Question: Assignment #5 Work this problem out using an Excel spreadsheet. Short answer questions can be answered right in a cell in the spreadsheet so you

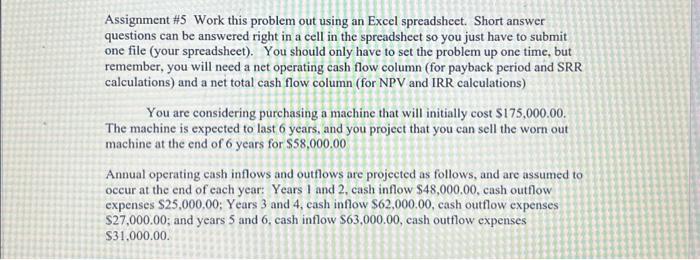

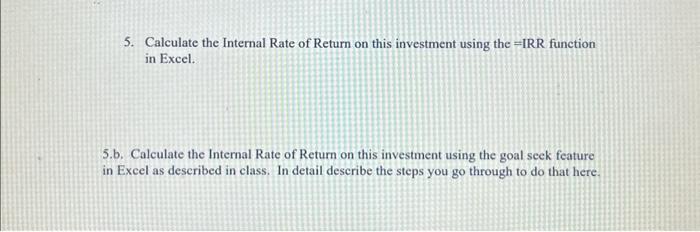

Assignment \#5 Work this problem out using an Excel spreadsheet. Short answer questions can be answered right in a cell in the spreadsheet so you just have to submit one file (your spreadsheet). You should only have to set the problem up one time, but remember, you will need a net operating cash flow column (for payback period and SRR calculations) and a net total cash flow column (for NPV and IRR calculations) You are considering purchasing a machine that will initially cost $175,000.00. The machine is expected to last 6 years, and you project that you can sell the worn out machine at the end of 6 years for $58,000.00 Annual operating cash inflows and outflows are projected as follows, and are assumed to occur at the end of each year: Years 1 and 2, cash inflow $48,000.00, cash outflow expenses $25,000,00; Years 3 and 4 , cash inflow $62,000,00, cash outflow expenses $27,000.00; and years 5 and 6 , cash inflow $63,000.00, cash outflow expenses $31,000.00. 5. Calculate the Internal Rate of Return on this investment using the =IRR function in Excel. 5.b. Calculate the Internal Rate of Return on this investment using the goal seek feature in Excel as described in class. In detail describe the steps you go through to do that here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts