Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment 5.3: Investment Decisions (continued) 15. You are comparing offers from a dealership to either buy or lease a car. The price to purchase is

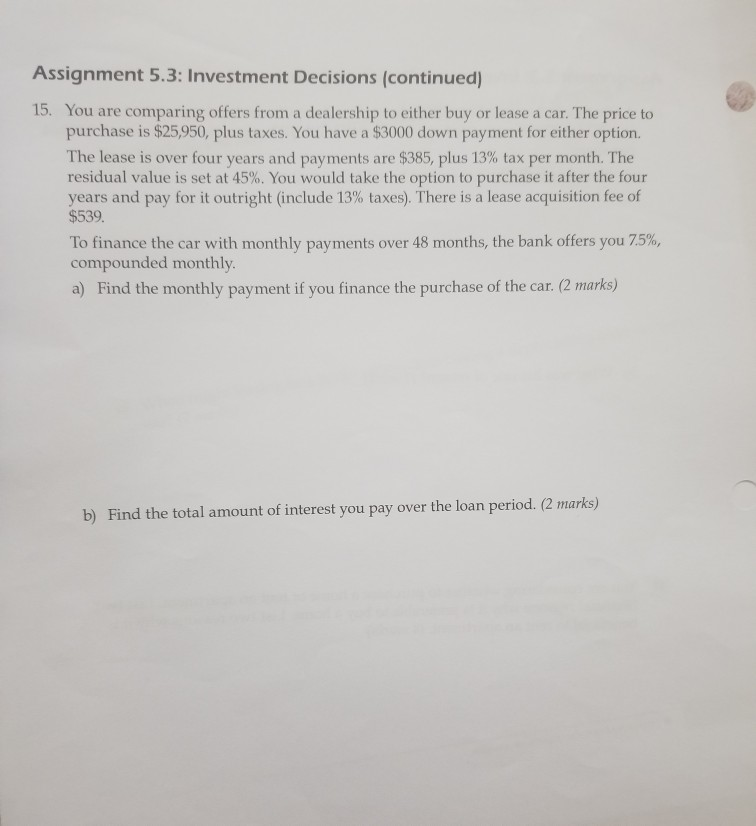

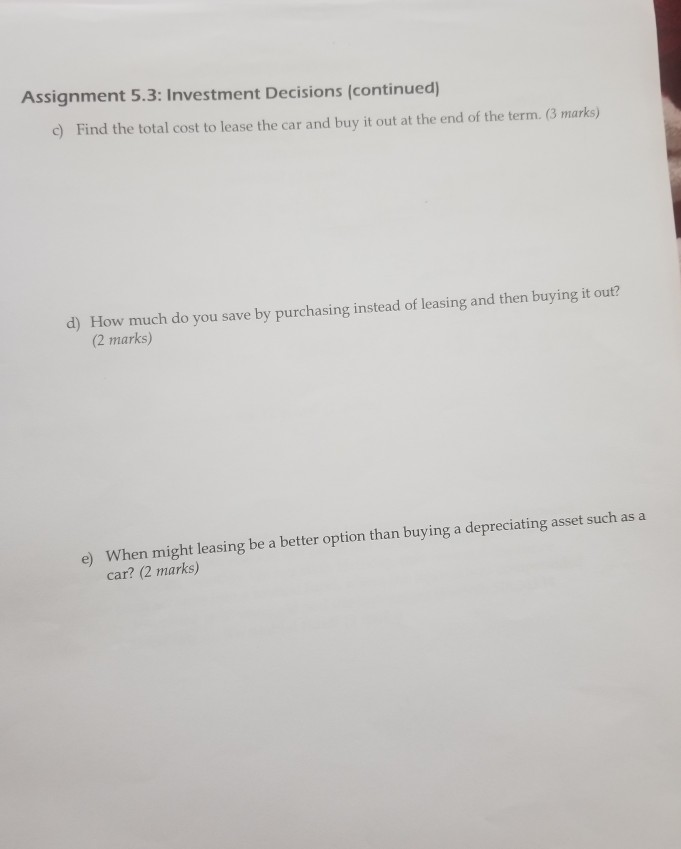

Assignment 5.3: Investment Decisions (continued) 15. You are comparing offers from a dealership to either buy or lease a car. The price to purchase is $25,950, plus taxes. You have a $3000 down payment for either option. The lease is over four years and payments residual value is set at 45%. You would take the option to purchase it after the four years and pay for it outright (include 13% taxes ). There is a lease acquisition fee of $539. $385, plus 13% tax per month. The are To finance the car with monthly payments compounded monthly over 48 months, the bank offers you 7.5%, a) Find the monthly payment if you finance the purchase of the car. (2 marks) b) Find the total amount of interest you pay over the loan period. (2 marks) Assignment 5.3: Investment Decisions (continued) c) Find the total cost to lease the car and buy it out at the end of the term. (3 marks) d) How much do you save (2 marks) by purchasing instead of leasing and then buying it out? e) When might leasing be a better option than buying a depreciating car? (2 marks) asset such as a Assignment 5.3: Investment Decisions (continued) 15. You are comparing offers from a dealership to either buy or lease a car. The price to purchase is $25,950, plus taxes. You have a $3000 down payment for either option. The lease is over four years and payments residual value is set at 45%. You would take the option to purchase it after the four years and pay for it outright (include 13% taxes ). There is a lease acquisition fee of $539. $385, plus 13% tax per month. The are To finance the car with monthly payments compounded monthly over 48 months, the bank offers you 7.5%, a) Find the monthly payment if you finance the purchase of the car. (2 marks) b) Find the total amount of interest you pay over the loan period. (2 marks) Assignment 5.3: Investment Decisions (continued) c) Find the total cost to lease the car and buy it out at the end of the term. (3 marks) d) How much do you save (2 marks) by purchasing instead of leasing and then buying it out? e) When might leasing be a better option than buying a depreciating car? (2 marks) asset such as a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started