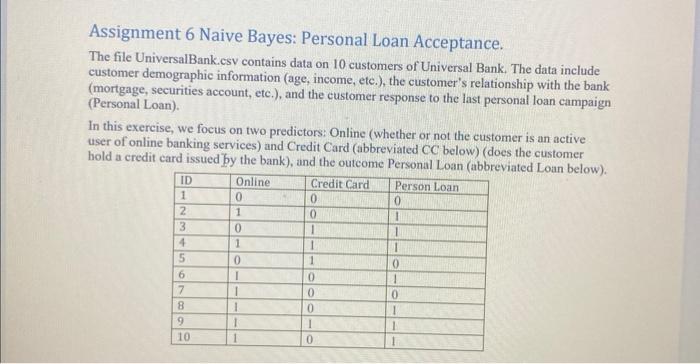

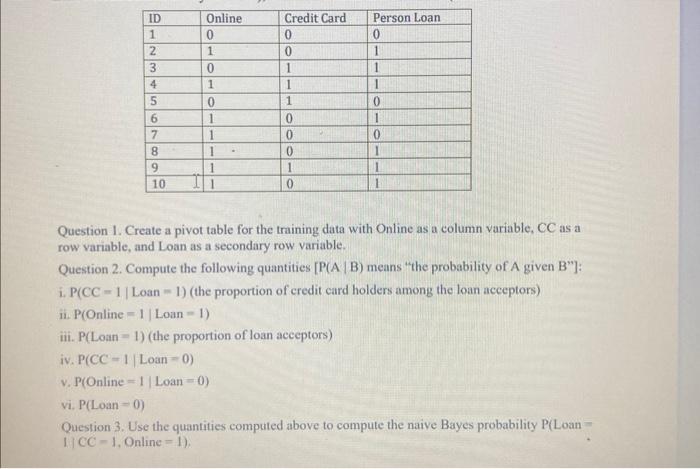

Assignment 6 Naive Bayes: Personal Loan Acceptance. The file UniversalBank.csv contains data on 10 customers of Universal Bank. The data include customer demographic information (age, income, etc.), the customer's relationship with the bank (mortgage, securities account, ete.), and the customer response to the last personal loan campaign (Personal Loan). In this exercise, we focus on two predictors: Online (whether or not the customer is an active user of online banking services) and Credit Card (abbreviated CC below) (does the customer hold a credit card issued by the bank), and the outcome Personal Loan (abbreviated Loan below) Question 1. Create a pivot table for the training data with Online as a column variable, CC as a row variable, and Loan as a secondary row variable. Question 2. Compute the following quantities [P(A|B) means "the probability of A given B"]: i. P(CC=1 Loan =1) (the proportion of credit card holders among the loan acceptors) ii. P( Online =1 Loan =1) iii. P( Loan =1) (the proportion of loan aceeptors) iv. P(CC=1 Loan =0) v. P( Online =1 Loan =0) vi. P(Loan=0) Question 3 . Use the quantities computed above to compute the naive Bayes probability P( Loan = 1. CC=1, Online = 1). Assignment 6 Naive Bayes: Personal Loan Acceptance. The file UniversalBank.csv contains data on 10 customers of Universal Bank. The data include customer demographic information (age, income, etc.), the customer's relationship with the bank (mortgage, securities account, ete.), and the customer response to the last personal loan campaign (Personal Loan). In this exercise, we focus on two predictors: Online (whether or not the customer is an active user of online banking services) and Credit Card (abbreviated CC below) (does the customer hold a credit card issued by the bank), and the outcome Personal Loan (abbreviated Loan below) Question 1. Create a pivot table for the training data with Online as a column variable, CC as a row variable, and Loan as a secondary row variable. Question 2. Compute the following quantities [P(A|B) means "the probability of A given B"]: i. P(CC=1 Loan =1) (the proportion of credit card holders among the loan acceptors) ii. P( Online =1 Loan =1) iii. P( Loan =1) (the proportion of loan aceeptors) iv. P(CC=1 Loan =0) v. P( Online =1 Loan =0) vi. P(Loan=0) Question 3 . Use the quantities computed above to compute the naive Bayes probability P( Loan = 1. CC=1, Online = 1)