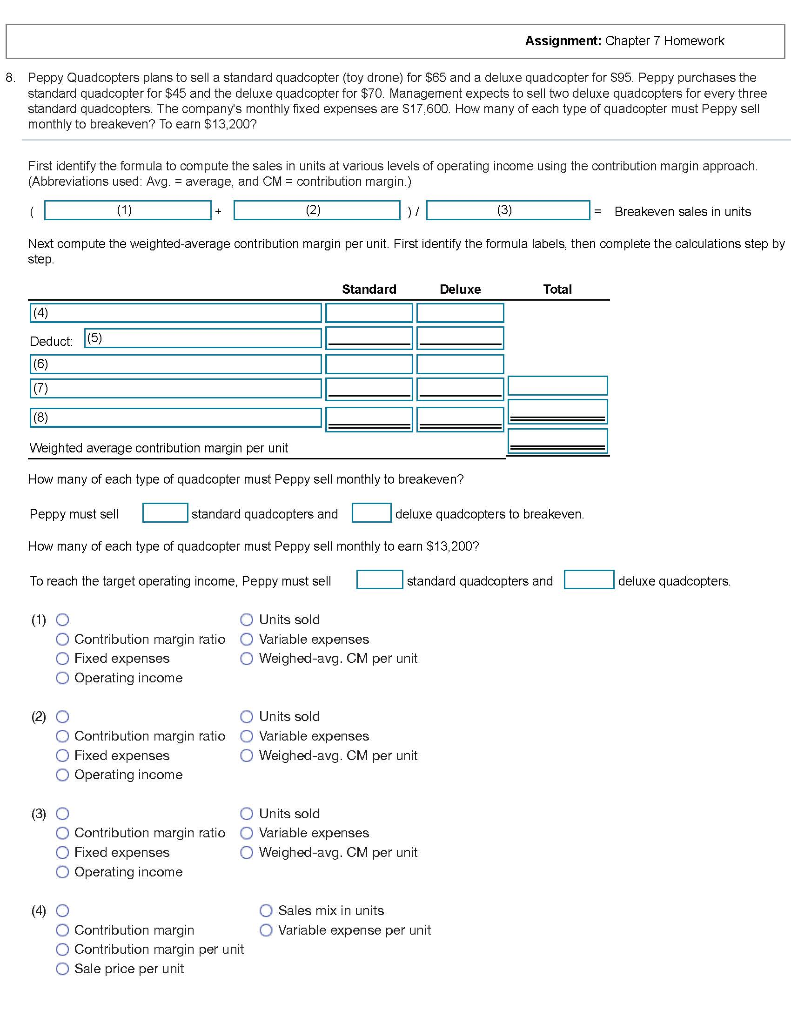

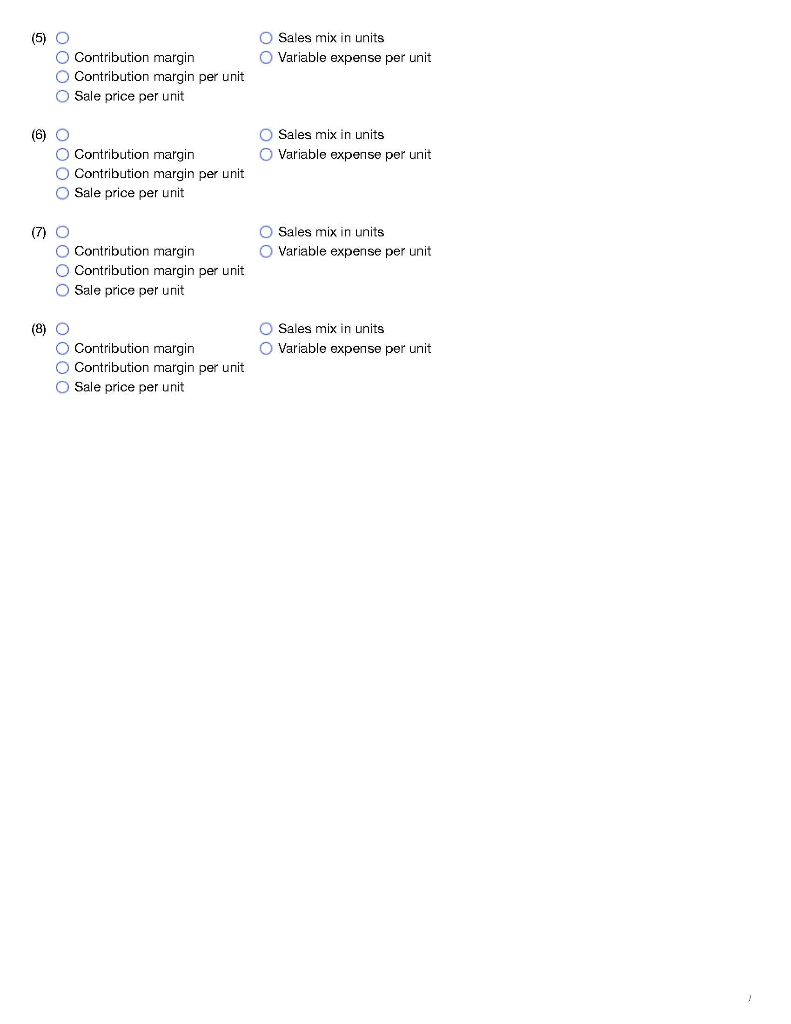

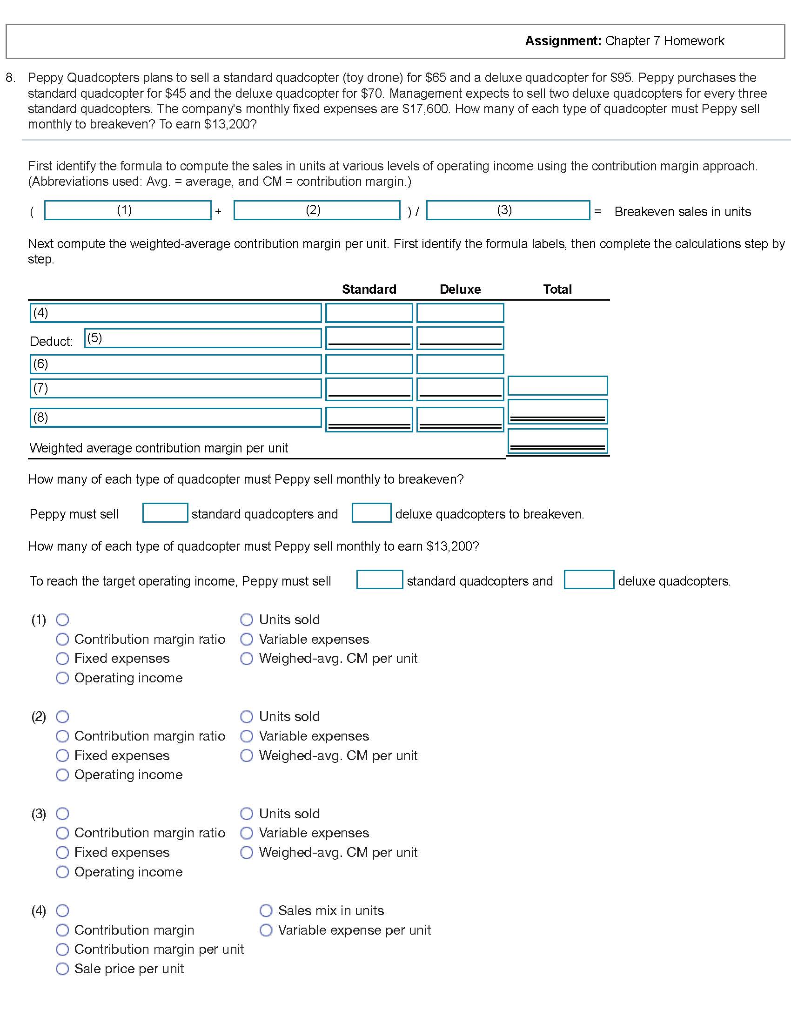

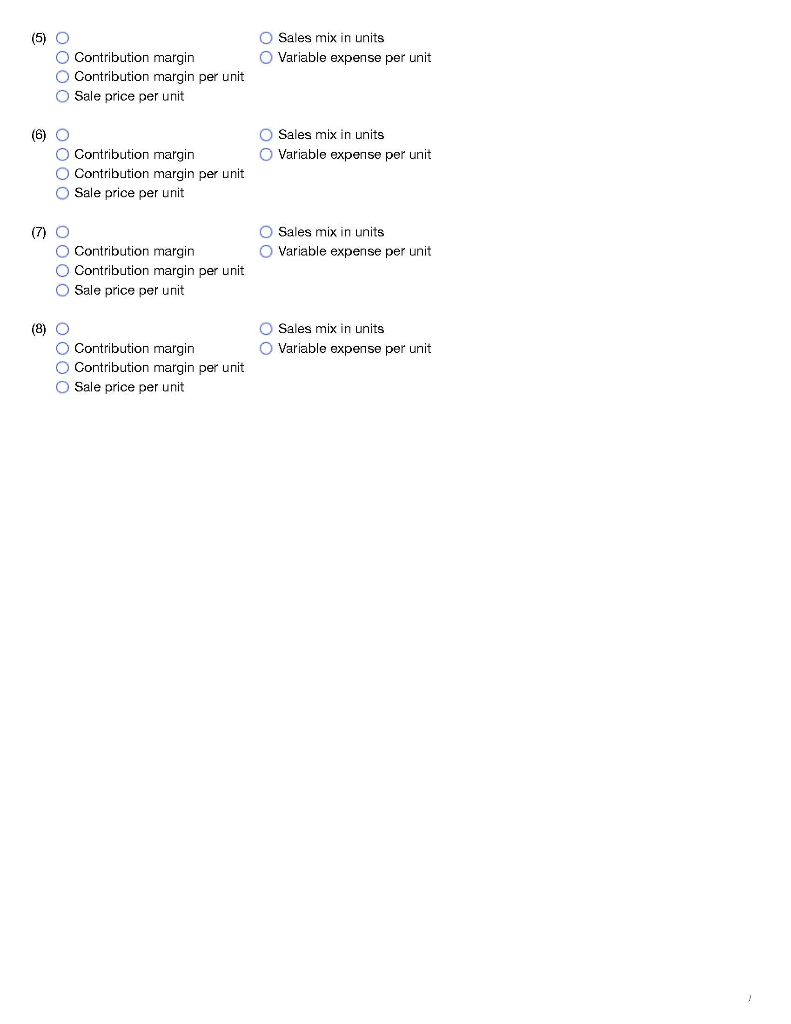

Assignment: Chapter 7 Homework 8. Peppy Quadcopters plans to sell a standard quadcopter (toy drone) for $65 and a deluxe quadcopter for $95. Peppy purchases the standard quadcopter for $45 and the deluxe quadcopter for $70. Management expects to sell two deluxe quadcopters for every three standard quadcopters. The company's monthly fixed expenses are $17.600. How many of each type of quadcopter must Peppy sell monthly to breakeven? To earn $13,200? First identify the formula to compute the sales in units at various levels of operating income using the contribution margin approach (Abbreviations used: Avg. = average, and CM = contribution margin.) (2) (3) = Breakeven sales in units Next compute the weighted average contribution margin per unit. First identify the formula labels.then complete the calculations step by step Standard Deluxe Total Deduct (5) (8) Weighted average contribution margin per unit How many of each type of quadcopter must Peppy sell monthly to breakeven? Peppy must sell standard quadcopters and deluxe quadcopters to breakeven. How many of each type of quadcopter must Peppy sell monthly to earn $13,200? To reach the target operating income, Peppy must sell standard quadcopters and deluxe quadcopters. (1) O O Contribution margin ratio Fixed expenses Operating income Units sold Variable expenses Weighed-avg. CM per unit (2) O Contribution margin ratio O Fixed expenses Operating income Units sold O Variable expenses Weighed-avg. CM per unit (3) O Contribution margin ratio O Fixed expenses Operating income Units sold Variable expenses O Weighed-avg. CM per unit (4) O Sales mix in units O Variable expense per unit O O Contribution margin O Contribution margin per unit Sale price per unit Sales mix in units O Variable expense per unit (5) O O Contribution margin Contribution margin per unit O Sale price per unit O Sales mix in units Variable expense per unit (6) O Contribution margin Contribution margin per unit O Sale price per unit (7) O O Contribution margin Contribution margin per unit O Sale price per unit O Sales mix in units Variable expense per unit Sales mix in units O Variable expense per unit (8) O O Contribution margin Contribution margin per unit O Sale price per unit