Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment Content Harvey Cook, 45, is a recently divorced father of two children, ages 10 and 7. He currently earns $95,000 a year as an

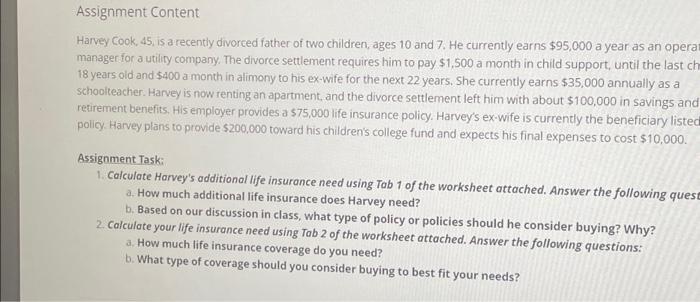

Assignment Content Harvey Cook, 45, is a recently divorced father of two children, ages 10 and 7. He currently earns $95,000 a year as an operat manager for a utility company. The divorce settlement requires him to pay $1,500 a month in child support, until the last ch 18 years old and $400 a month in alimony to his ex-wife for the next 22 years. She currently earns $35,000 annually as a schoolteacher. Harvey is now renting an apartment, and the divorce settlement left him with about $100,000 in savings and retirement benefits. His employer provides a $75,000 life insurance policy. Harvey's ex-wife is currently the beneficiary listed policy. Harvey plans to provide $200,000 toward his children's college fund and expects his final expenses to cost $10,000. Assignment Task: 1. Calculate Harvey's additional life insurance need using Tab 1 of the worksheet attached. Answer the following quest a. How much additional life insurance does Harvey need? b. Based on our discussion in class, what type of policy or policies should he consider buying? Why? 2. Calculate your life insurance need using Tab 2 of the worksheet attached. Answer the following questions: a. How much life insurance coverage do you need? b. What type of coverage should you consider buying to best fit your needs?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started