Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment: Create a Financial Report for Mr. & Mrs. Austin For this assignment, imagine you are a Financial Planner. You met with the Austin's

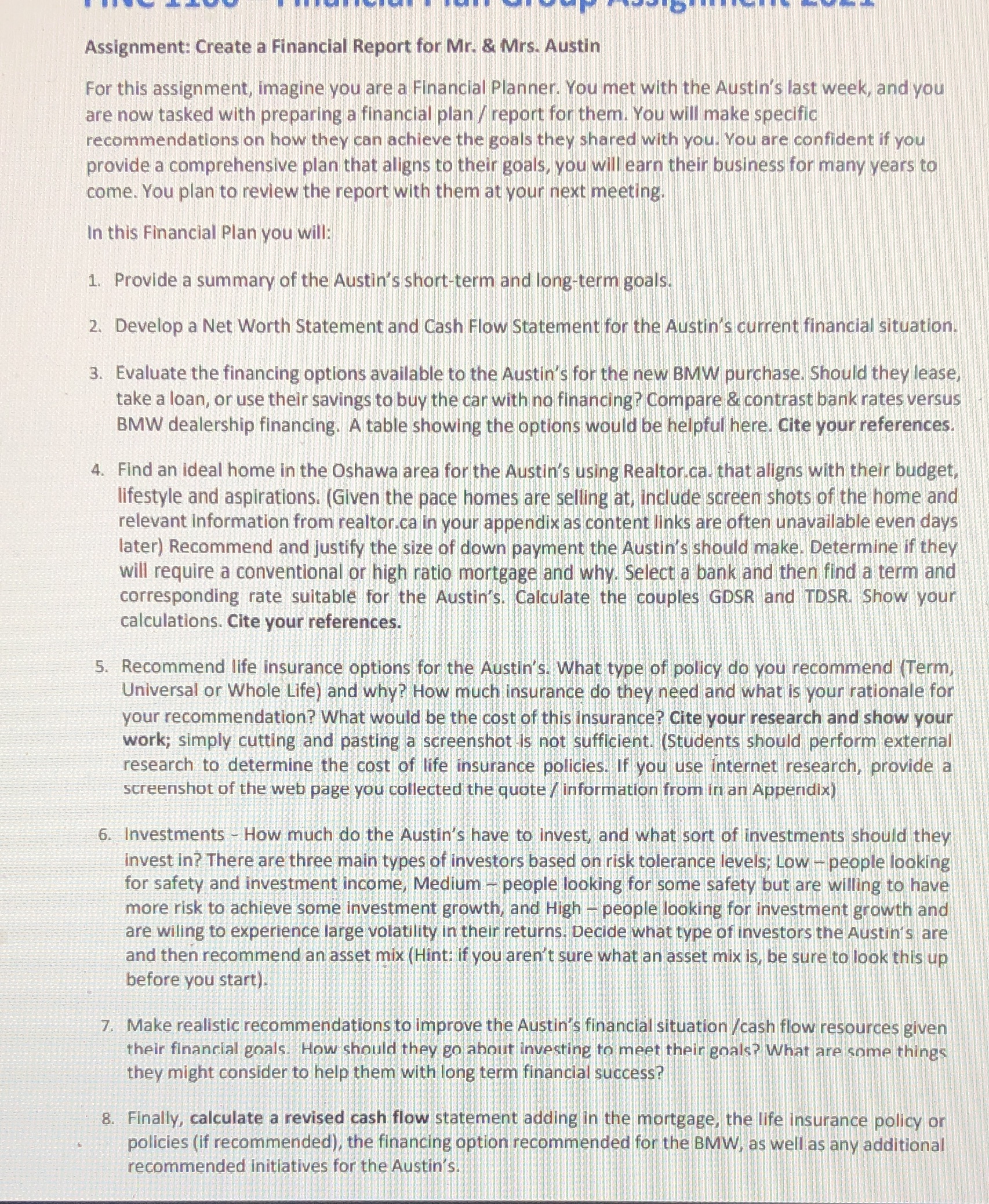

Assignment: Create a Financial Report for Mr. & Mrs. Austin For this assignment, imagine you are a Financial Planner. You met with the Austin's last week, and you are now tasked with preparing a financial plan / report for them. You will make specific recommendations on how they can achieve the goals they shared with you. You are confident if you provide a comprehensive plan that aligns to their goals, you will earn their business for many years to come. You plan to review the report with them at your next meeting. In this Financial Plan you will: 1. Provide a summary of the Austin's short-term and long-term goals. 2. Develop a Net Worth Statement and Cash Flow Statement for the Austin's current financial situation. 3. Evaluate the financing options available to the Austin's for the new BMW purchase. Should they lease, take a loan, or use their savings to buy the car with no financing? Compare & contrast bank rates versus BMW dealership financing. A table showing the options would be helpful here. Cite your references. 4. Find an ideal home in the Oshawa area for the Austin's using Realtor.ca. that aligns with their budget, lifestyle and aspirations. (Given the pace homes are selling at, include screen shots of the home and relevant information from realtor.ca in your appendix as content links are often unavailable even days later) Recommend and justify the size of down payment the Austin's should make. Determine if they will require a conventional or high ratio mortgage and why. Select a bank and then find a term and corresponding rate suitable for the Austin's. Calculate the couples GDSR and TDSR. Show your calculations. Cite your references. 5. Recommend life insurance options for the Austin's. What type of policy do you recommend (Term, Universal or Whole Life) and why? How much insurance do they need and what is your rationale for your recommendation? What would be the cost of this insurance? Cite your research and show your work; simply cutting and pasting a screenshot is not sufficient. (Students should perform external research to determine the cost of life insurance policies. If you use internet research, provide a screenshot of the web page you collected the quote/information from in an Appendix) 6. Investments - How much do the Austin's have to invest, and what sort of investments should they invest in? There are three main types of investors based on risk tolerance levels; Low - people looking for safety and investment income, Medium - people looking for some safety but are willing to have more risk to achieve some investment growth, and High - people looking for investment growth and are wiling to experience large volatility in their returns. Decide what type of investors the Austin's are and then recommend an asset mix (Hint: if you aren't sure what an asset mix is, be sure to look this up before you start). 7. Make realistic recommendations to improve the Austin's financial situation/cash flow resources given their financial goals. How should they go about investing to meet their goals? What are some things they might consider to help them with long term financial success? 8. Finally, calculate a revised cash flow statement adding in the mortgage, the life insurance policy or policies (if recommended), the financing option recommended for the BMW, as well as any additional recommended initiatives for the Austin's.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started