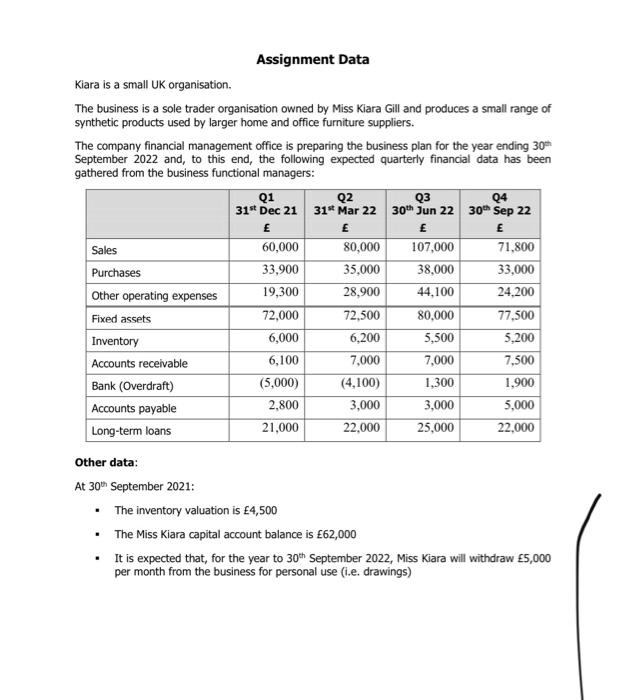

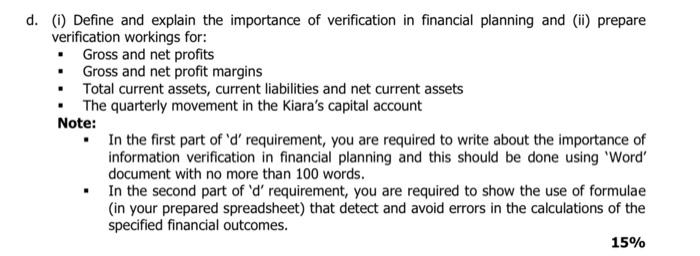

Assignment Data Kiara is a small UK organisation. The business is a sole trader organisation owned by Miss Kiara Gill and produces a small range of synthetic products used by larger home and office furniture suppliers. The company financial management office is preparing the business plan for the year ending 30* September 2022 and, to this end, the following expected quarterly financial data has been gathered from the business functional managers: Q1 Q2 Q3 04 31st Dec 21 31* Mar 22 30th Jun 22 30 Sep 22 E Sales 60,000 80,000 107,000 71,800 Purchases 33,900 35,000 38,000 33,000 Other operating expenses 19,300 28,900 44,100 24,200 Fixed assets 72,000 72,500 80,000 77,500 Inventory 6,000 6,200 5,500 5,200 Accounts receivable 6,100 7,000 7,000 7,500 Bank (Overdraft) (5,000) (4.100) 1,300 1,900 Accounts payable 2,800 3,000 3,000 5,000 Long-term loans 21,000 22,000 25,000 22.000 Other data: At 30th September 2021: The inventory valuation is 4,500 The Miss Kiara capital account balance is 62,000 It is expected that, for the year to 30th September 2022, Miss Kiara will withdraw 5,000 per month from the business for personal use (i.e. drawings) d. (1) Define and explain the importance of verification in financial planning and (ii) prepare verification workings for: Gross and net profits Gross and net profit margins Total current assets, current liabilities and net current assets The quarterly movement in the Kiara's capital account Note: . In the first part of 'd' requirement, you are required to write about the importance of information verification in financial planning and this should be done using 'Word' document with no more than 100 words. In the second part of 'd' requirement, you are required to show the use of formulae (in your prepared spreadsheet) that detect and avoid errors in the calculations of the specified financial outcomes. 15% Assignment Data Kiara is a small UK organisation. The business is a sole trader organisation owned by Miss Kiara Gill and produces a small range of synthetic products used by larger home and office furniture suppliers. The company financial management office is preparing the business plan for the year ending 30* September 2022 and, to this end, the following expected quarterly financial data has been gathered from the business functional managers: Q1 Q2 Q3 04 31st Dec 21 31* Mar 22 30th Jun 22 30 Sep 22 E Sales 60,000 80,000 107,000 71,800 Purchases 33,900 35,000 38,000 33,000 Other operating expenses 19,300 28,900 44,100 24,200 Fixed assets 72,000 72,500 80,000 77,500 Inventory 6,000 6,200 5,500 5,200 Accounts receivable 6,100 7,000 7,000 7,500 Bank (Overdraft) (5,000) (4.100) 1,300 1,900 Accounts payable 2,800 3,000 3,000 5,000 Long-term loans 21,000 22,000 25,000 22.000 Other data: At 30th September 2021: The inventory valuation is 4,500 The Miss Kiara capital account balance is 62,000 It is expected that, for the year to 30th September 2022, Miss Kiara will withdraw 5,000 per month from the business for personal use (i.e. drawings) d. (1) Define and explain the importance of verification in financial planning and (ii) prepare verification workings for: Gross and net profits Gross and net profit margins Total current assets, current liabilities and net current assets The quarterly movement in the Kiara's capital account Note: . In the first part of 'd' requirement, you are required to write about the importance of information verification in financial planning and this should be done using 'Word' document with no more than 100 words. In the second part of 'd' requirement, you are required to show the use of formulae (in your prepared spreadsheet) that detect and avoid errors in the calculations of the specified financial outcomes. 15%