Question

Assignment Description and Instructions In this scenario, you are presented with the companys financial records and are required to use the principles learned in units

Assignment Description and Instructions

In this scenario, you are presented with the companys financial records and are required to use the principles learned in units 7 to assist you in presenting the required answers. This is an individual activity which requires vigilance and a keen eye for details will be crucial as the information presented will challenge your ability to use good reasoning and critical thinking to analyze the financial data presented. There should be absolutely no sharing of answers as this carries a penalty to include forfeiture of marks for the guilty parties if this is identified. You are required to only use the figures in line with your first name initial as any other info used will result in the loss of marks.

All submission should be typed in an excel or word document and should include a cover page to show the students name, Course name/code, table of contents, number of pages, and date. Marks will be lost if the established rules are not adhered.

Scenario:

Ben and Eric are opening a comic bookstore to be registered as E&B Comic Bookstore Co. There is no other competing comic bookstore in the area. Their fundamental decision is how to organize the business and they anticipate a substantial profit in the first year, with the ability to sell franchises in the future. Although they have enough to start the business now as a partnership, cash flow will be an issue as they grow. They feel the corporate form of operation will be best for the long term. They seek your advice.

Requirements

1. What is the main advantage they gain by selecting a corporate form of business now?

2. Distinguish between par value and issue price.

3. If they decide to issue $1 par common stock and anticipate an initial market price of $80 per share, how many shares will they need to issue to raise $4,000,000?

4. The owners are desirous of comparing serval financial transactions and possible outcomes to assist in guiding their decision-making process. They assume that the company will be formed on January 1, 2020. In addition, E&B Comic Bookstore Companys charter will authorize 1,200,000 shares of common stock (to be divided into two classes (700,000 shares class A -voting rights and 500,000 shares class B -nonvoting rights) and 400,000, $X par value (see info below), 5% cumulative preferred stock. They have asked each student from your accounting course to prepare the companys journal entries and statement of owners equity based on the following information which is grouped according to your first name initial. (Hint!!!! Example first Manuel will use the initial M and that person should only use the info presented in line with the heading with their first name initial. You are not allowed to use info associated other initials other than that of your own as this will result in the forfeiture of the grade.)

Please note that my first name initial is S.

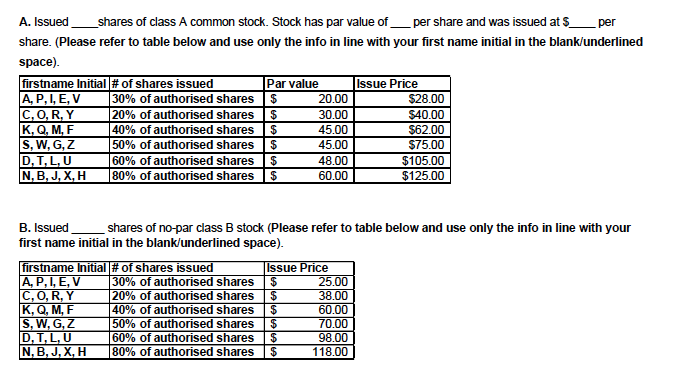

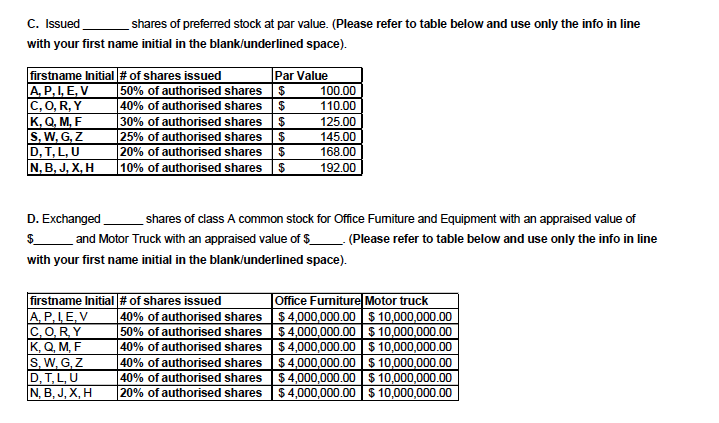

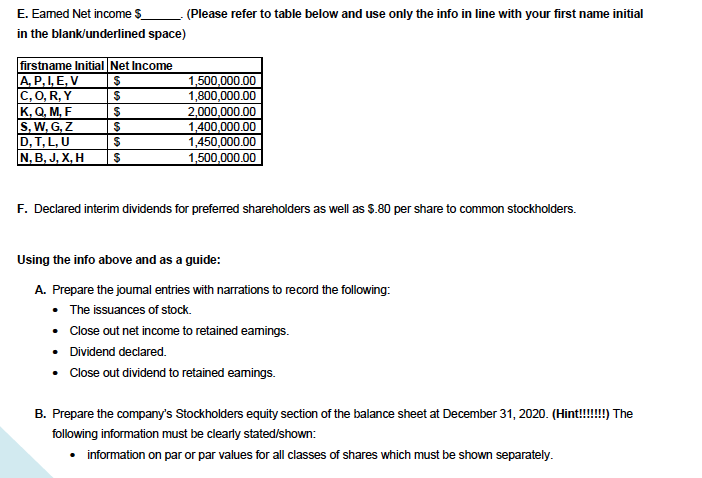

A. Issued shares of class A common stock. Stock has par value of _per share and was issued at $_per share. (Please refer to table below and use only the info in line with your first name initial in the blank/underlined space) firstname Initial # of shares issued Par value Issue Price A, P, I, E, V 30% of authorised shares $ 20.00 $28.00 C,O,R, Y 20% of authorised shares $ 30.00 $40.00 K, Q, M, F 40% of authorised shares $ 45.00 $62.00 S,W,G,Z 50% of authorised shares $ 45.00 $75.00 DT.LU 60% of authorised shares $ 48.00 $105.00 N,B,J,X,H 80% of authorised shares $ 60.00 $125.00 B. Issued shares of no-par class B stock (Please refer to table below and use only the info in line with your first name initial in the blank/underlined space). firstname Initial # of shares issued Issue Price A,P, I, E, V 30% of authorised shares $ 25.00 C,O,R, Y 20% of authorised shares $ 38.00 K, Q, M, F 40% of authorised shares $ 60.00 S,W,G,Z 50% of authorised shares $ 70.00 DT,L,U 60% of authorised shares $ 98.00 N,B, J.XH 80% of authorised shares $ 118.00 C. Issued shares of preferred stock at par value. (Please refer to table below and use only the info in line with your first name initial in the blank/underlined space). firstname Initial # of shares issued A.P.I.E. V 50% of authorised shares C,O,R,Y 40% of authorised shares K,Q, M, F 30% of authorised shares S,W,G,Z 25% of authorised shares DT,LU 20% of authorised shares N, B, J, X,H 10% of authorised shares Par Value $ 100.00 $ 110.00 $ 125.00 $ 145.00 $ 168.00 $ 192.00 D. Exchanged shares of class A common stock for Office Fumiture and Equipment with an appraised value of $__ and Motor Truck with an appraised value of $_(Please refer to table below and use only the info in line with your first name initial in the blank/underlined space). firstname Initial # of shares issued Office Furniture Motor truck A.P.IE, V 40% of authorised shares $4,000,000.00 $ 10,000,000.00 CORY 50% of authorised shares $4,000,000.00 $ 10,000,000.00 KQ, M, F 40% of authorised shares $4,000,000.00 $ 10,000,000.00 S, W.GZ 40% of authorised shares $4,000,000.00 $ 10,000,000.00 D,T,L,U 40% of authorised shares $4,000,000.00 $10,000,000.00 NB, J, XH 20% of authorised shares $4,000,000.00 $ 10,000,000.00 E. Eamed Net income $ (Please refer to table below and use only the info in line with your first name initial in the blank/underlined space) firstname Initial Net Income A.P.LE, V $ 1,500,000.00 C,O,R,Y $ 1,800,000.00 K,Q, M, F S 2,000,000.00 S,W,G,Z $ 1,400,000.00 DT,LU $ 1,450,000.00 N,B, J.XH S 1,500,000.00 F. Declared interim dividends for preferred shareholders as well as 5.80 per share to common stockholders. Using the info above and as a guide: A. Prepare the joumal entries with narrations to record the following: The issuances of stock Close out net income to retained eamings. Dividend declared. Close out dividend to retained eamings. B. Prepare the company's Stockholders equity section of the balance sheet at December 31, 2020. (Hint!!!!!!!) The following information must be clearly stated/shown: information on par or par values for all classes of shares which must be shown separately. ACCT1002 Introduction to Financial Accounting . the number of shares authorized and issued where necessary. the sub total for the total paid in capital. Retained earnings. total stockholders' equity. A. Issued shares of class A common stock. Stock has par value of _per share and was issued at $_per share. (Please refer to table below and use only the info in line with your first name initial in the blank/underlined space) firstname Initial # of shares issued Par value Issue Price A, P, I, E, V 30% of authorised shares $ 20.00 $28.00 C,O,R, Y 20% of authorised shares $ 30.00 $40.00 K, Q, M, F 40% of authorised shares $ 45.00 $62.00 S,W,G,Z 50% of authorised shares $ 45.00 $75.00 DT.LU 60% of authorised shares $ 48.00 $105.00 N,B,J,X,H 80% of authorised shares $ 60.00 $125.00 B. Issued shares of no-par class B stock (Please refer to table below and use only the info in line with your first name initial in the blank/underlined space). firstname Initial # of shares issued Issue Price A,P, I, E, V 30% of authorised shares $ 25.00 C,O,R, Y 20% of authorised shares $ 38.00 K, Q, M, F 40% of authorised shares $ 60.00 S,W,G,Z 50% of authorised shares $ 70.00 DT,L,U 60% of authorised shares $ 98.00 N,B, J.XH 80% of authorised shares $ 118.00 C. Issued shares of preferred stock at par value. (Please refer to table below and use only the info in line with your first name initial in the blank/underlined space). firstname Initial # of shares issued A.P.I.E. V 50% of authorised shares C,O,R,Y 40% of authorised shares K,Q, M, F 30% of authorised shares S,W,G,Z 25% of authorised shares DT,LU 20% of authorised shares N, B, J, X,H 10% of authorised shares Par Value $ 100.00 $ 110.00 $ 125.00 $ 145.00 $ 168.00 $ 192.00 D. Exchanged shares of class A common stock for Office Fumiture and Equipment with an appraised value of $__ and Motor Truck with an appraised value of $_(Please refer to table below and use only the info in line with your first name initial in the blank/underlined space). firstname Initial # of shares issued Office Furniture Motor truck A.P.IE, V 40% of authorised shares $4,000,000.00 $ 10,000,000.00 CORY 50% of authorised shares $4,000,000.00 $ 10,000,000.00 KQ, M, F 40% of authorised shares $4,000,000.00 $ 10,000,000.00 S, W.GZ 40% of authorised shares $4,000,000.00 $ 10,000,000.00 D,T,L,U 40% of authorised shares $4,000,000.00 $10,000,000.00 NB, J, XH 20% of authorised shares $4,000,000.00 $ 10,000,000.00 E. Eamed Net income $ (Please refer to table below and use only the info in line with your first name initial in the blank/underlined space) firstname Initial Net Income A.P.LE, V $ 1,500,000.00 C,O,R,Y $ 1,800,000.00 K,Q, M, F S 2,000,000.00 S,W,G,Z $ 1,400,000.00 DT,LU $ 1,450,000.00 N,B, J.XH S 1,500,000.00 F. Declared interim dividends for preferred shareholders as well as 5.80 per share to common stockholders. Using the info above and as a guide: A. Prepare the joumal entries with narrations to record the following: The issuances of stock Close out net income to retained eamings. Dividend declared. Close out dividend to retained eamings. B. Prepare the company's Stockholders equity section of the balance sheet at December 31, 2020. (Hint!!!!!!!) The following information must be clearly stated/shown: information on par or par values for all classes of shares which must be shown separately. ACCT1002 Introduction to Financial Accounting . the number of shares authorized and issued where necessary. the sub total for the total paid in capital. Retained earnings. total stockholders' equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started