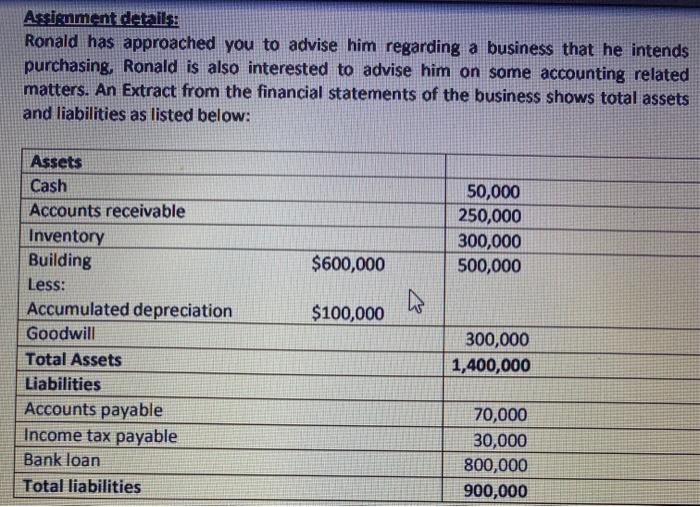

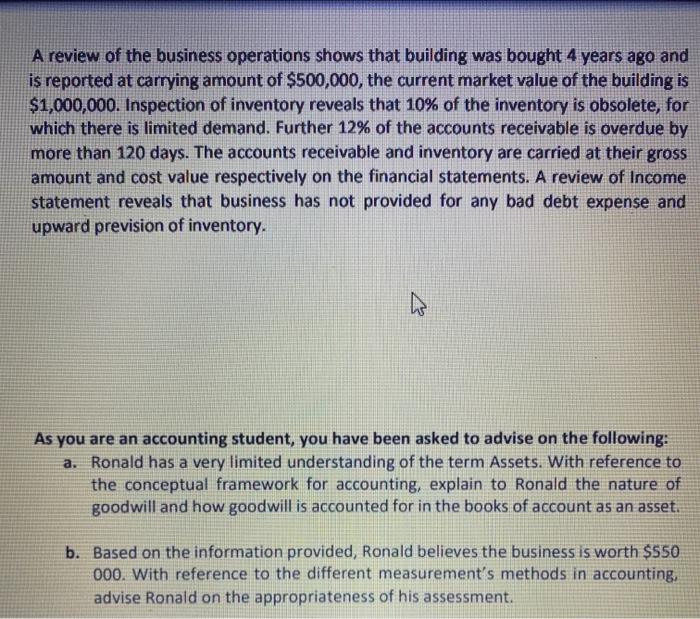

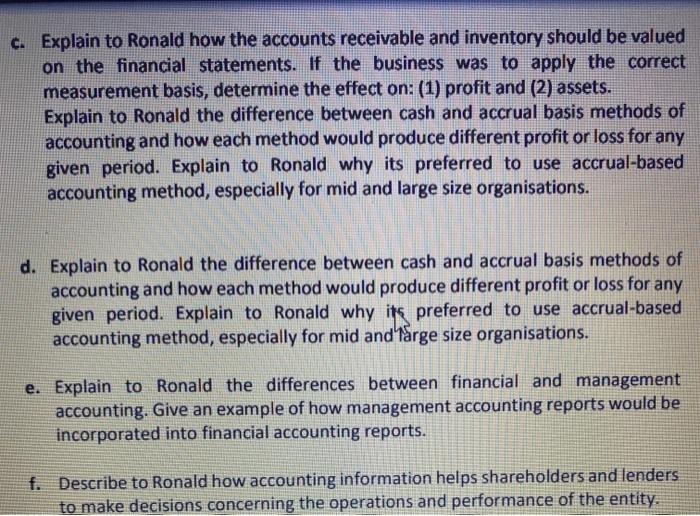

Assignment details: Ronald has approached you to advise him regarding a business that he intends purchasing, Ronald is also interested to advise him on some accounting related matters. An Extract from the financial statements of the business shows total assets and liabilities as listed below: 50,000 250,000 300,000 500,000 $600,000 w $100,000 Assets Cash Accounts receivable Inventory Building Less: Accumulated depreciation Goodwill Total Assets Liabilities Accounts payable Income tax payable Bank loan Total liabilities 300,000 1,400,000 70,000 30,000 800,000 900,000 A review of the business operations shows that building was bought 4 years ago and is reported at carrying amount of $500,000, the current market value of the building is $1,000,000. Inspection of inventory reveals that 10% of the inventory is obsolete, for which there is limited demand. Further 12% of the accounts receivable is overdue by more than 120 days. The accounts receivable and inventory are carried at their gross amount and cost value respectively on the financial statements. A review of Income statement reveals that business has not provided for any bad debt expense and upward prevision of inventory. As you are an accounting student, you have been asked to advise on the following: a. Ronald has a very limited understanding of the term Assets. With reference to the conceptual framework for accounting, explain to Ronald the nature of goodwill and how goodwill is accounted for in the books of account as an asset. b. Based on the information provided, Ronald believes the business is worth $550 000. With reference to the different measurement's methods in accounting, advise Ronald on the appropriateness of his assessment. c. Explain to Ronald how the accounts receivable and inventory should be valued on the financial statements. If the business was to apply the correct measurement basis, determine the effect on: (1) profit and (2) assets. Explain to Ronald the difference between cash and accrual basis methods of accounting and how each method would produce different profit or loss for any given period. Explain to Ronald why its preferred to use accrual-based accounting method, especially for mid and large size organisations. d. Explain to Ronald the difference between cash and accrual basis methods of accounting and how each method would produce different profit or loss for any given period. Explain to Ronald why its preferred to use accrual-based accounting method, especially for mid and large size organisations. e. Explain to Ronald the differences between financial and management accounting. Give an example of how management accounting reports would be incorporated into financial accounting reports. f. Describe to Ronald how accounting information helps shareholders and lenders to make decisions concerning the operations and performance of the entity