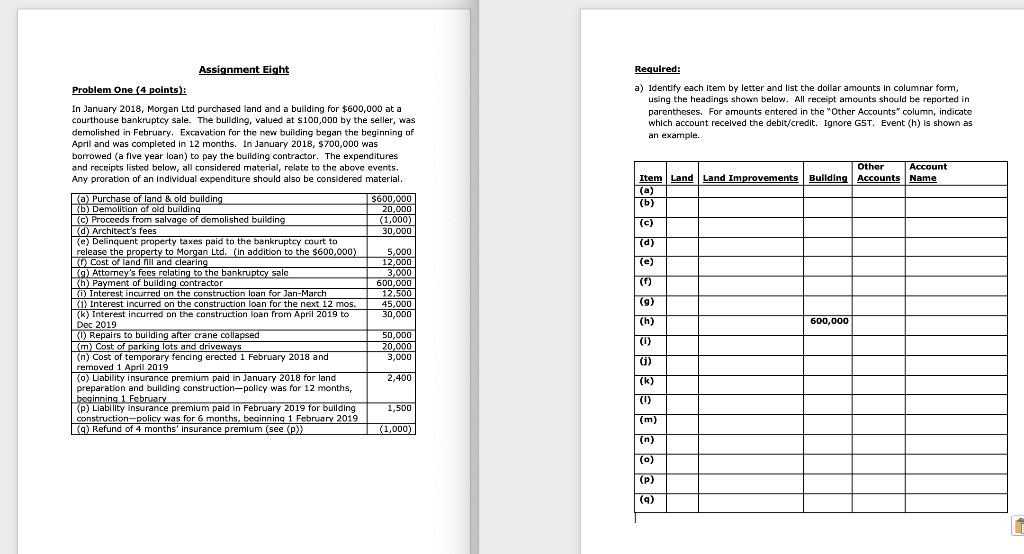

Assignment Eight Required: Problem One (4 points): In January 2018, Morgan Ltd purchased land and a building for $600,000 at a courthouse bankruptcy sale. The building, valued at $100,000 by the seller, was demolished in February. Excavation for the new building began the beginning of April and was completed in 12 months. In January 2018, $700,000 was borrowed (a five year loan) to pay the building contractor. The expenditures and receipts listed below, all considered material, relate to the above events. Any proration of an individual expenditure should also be considered material. a) Identify each item by letter and list the dollar amounts in columnar form, using the headings shown below. All receipt amounts should be reported in parentheses. For amounts entered in the Other Accounts" column, indicate which account received the debit/credit. Ignore GST. Event (h) is shown as an example. Other Account Item Land Land Improvements Building Accounts Name $600,000 20.000 (1,000) 30,000 (a) Purchase of land & old building (b) Demolition of old building (c) Proceeds from salvage of demolished building d) Architect's fees (e) Delinquent property taxes paid to the bankruptcy court to release the property to Morgan Ltd. (In addition to the $600,000) Cost of land fill and clearing (g) Attorney's focs relating to the bankruptcy sale (h) Payment of building contractor (0) Interest incurred on the construction loan for Jan-March (1) Interest incurred on the construction loan for the next 12 mos. (k) Interest incurred on the construction loan from April 2019 to Dec 2019 (0) Repairs to building after crane collapsed m) Cost of parking lots and driveways (n) Cost of temporary fencing erected 1 February 2018 and removed 1 April 2019 (0) Liability insurance premium paid in January 2018 for land preparation and building construction policy was for 12 months, beginning 1 February (p) Liability insurance premium paid in February 2019 for building construction-policy was for 6 months, beginning 1 February 2019 (a) Refund of 4 months' insurance premium (see (p) 5,000 12,000 3,000 600,000 12.500 45,000 30,000 600,000 50,000 20,000 3,000 2,400 1,500 (1,000) Assignment Eight Required: Problem One (4 points): In January 2018, Morgan Ltd purchased land and a building for $600,000 at a courthouse bankruptcy sale. The building, valued at $100,000 by the seller, was demolished in February. Excavation for the new building began the beginning of April and was completed in 12 months. In January 2018, $700,000 was borrowed (a five year loan) to pay the building contractor. The expenditures and receipts listed below, all considered material, relate to the above events. Any proration of an individual expenditure should also be considered material. a) Identify each item by letter and list the dollar amounts in columnar form, using the headings shown below. All receipt amounts should be reported in parentheses. For amounts entered in the Other Accounts" column, indicate which account received the debit/credit. Ignore GST. Event (h) is shown as an example. Other Account Item Land Land Improvements Building Accounts Name $600,000 20.000 (1,000) 30,000 (a) Purchase of land & old building (b) Demolition of old building (c) Proceeds from salvage of demolished building d) Architect's fees (e) Delinquent property taxes paid to the bankruptcy court to release the property to Morgan Ltd. (In addition to the $600,000) Cost of land fill and clearing (g) Attorney's focs relating to the bankruptcy sale (h) Payment of building contractor (0) Interest incurred on the construction loan for Jan-March (1) Interest incurred on the construction loan for the next 12 mos. (k) Interest incurred on the construction loan from April 2019 to Dec 2019 (0) Repairs to building after crane collapsed m) Cost of parking lots and driveways (n) Cost of temporary fencing erected 1 February 2018 and removed 1 April 2019 (0) Liability insurance premium paid in January 2018 for land preparation and building construction policy was for 12 months, beginning 1 February (p) Liability insurance premium paid in February 2019 for building construction-policy was for 6 months, beginning 1 February 2019 (a) Refund of 4 months' insurance premium (see (p) 5,000 12,000 3,000 600,000 12.500 45,000 30,000 600,000 50,000 20,000 3,000 2,400 1,500 (1,000)