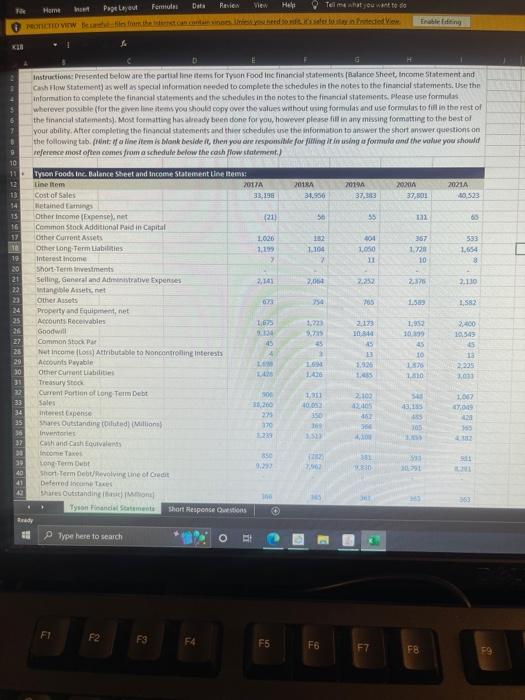

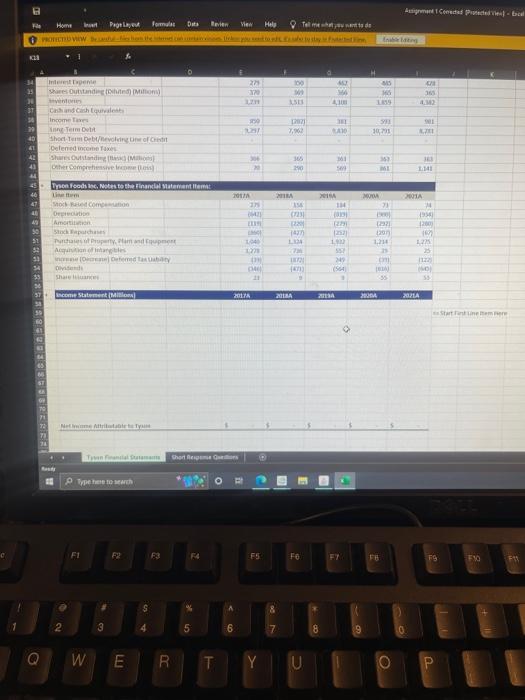

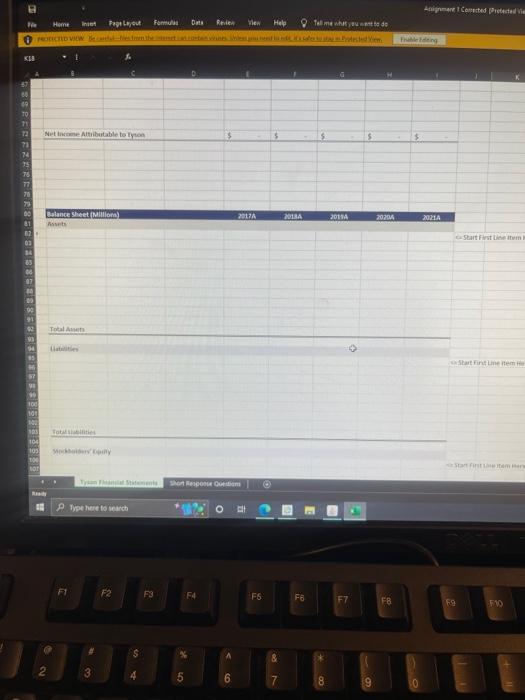

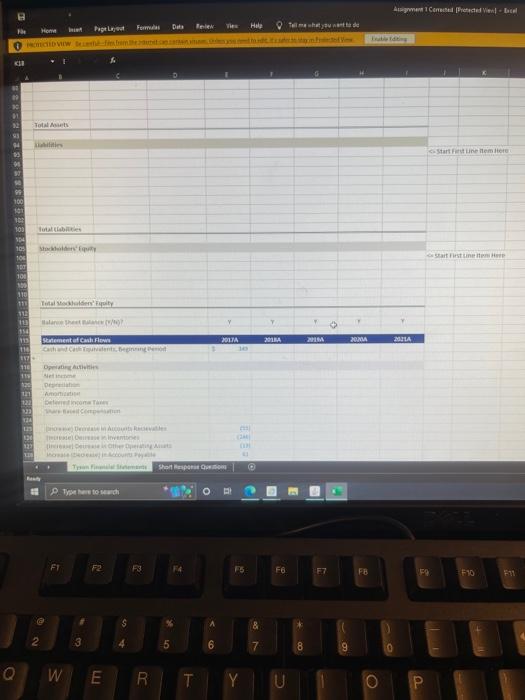

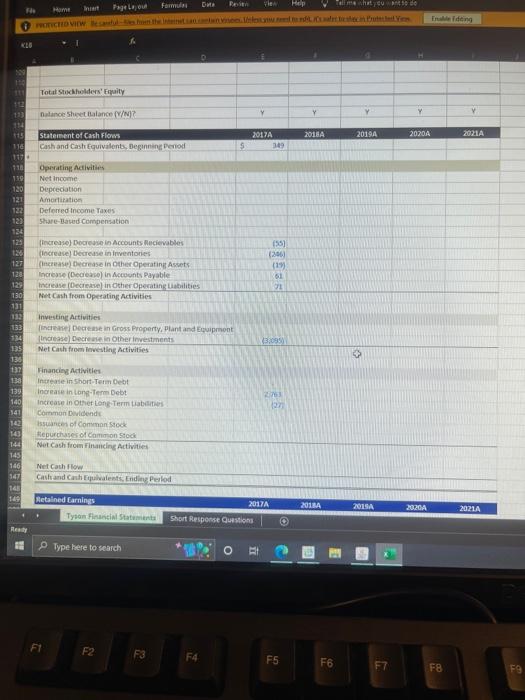

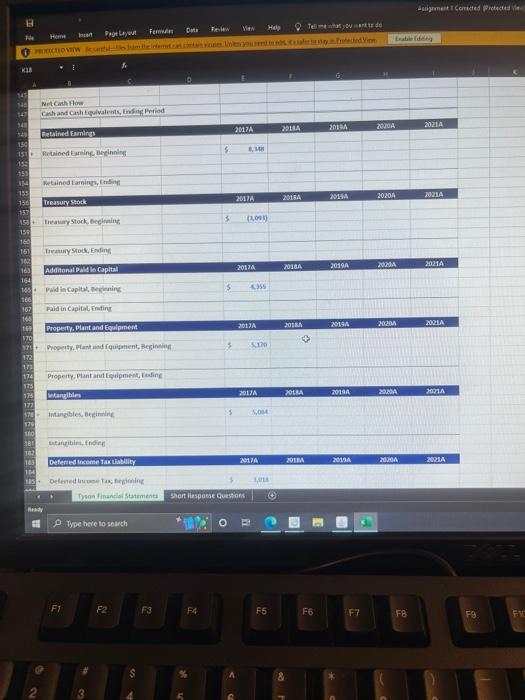

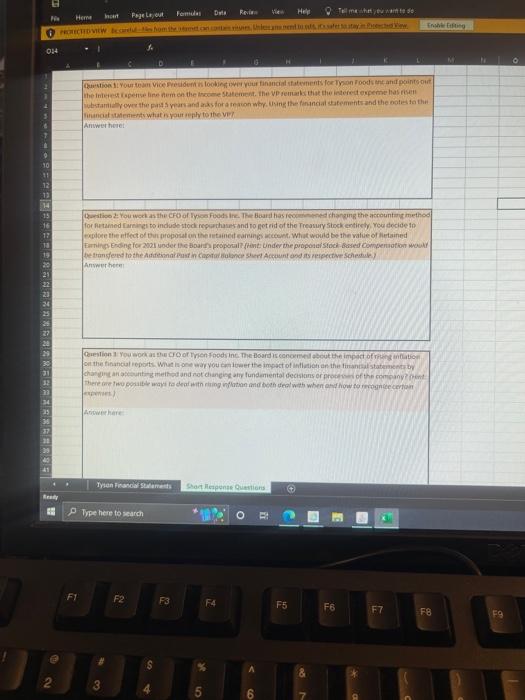

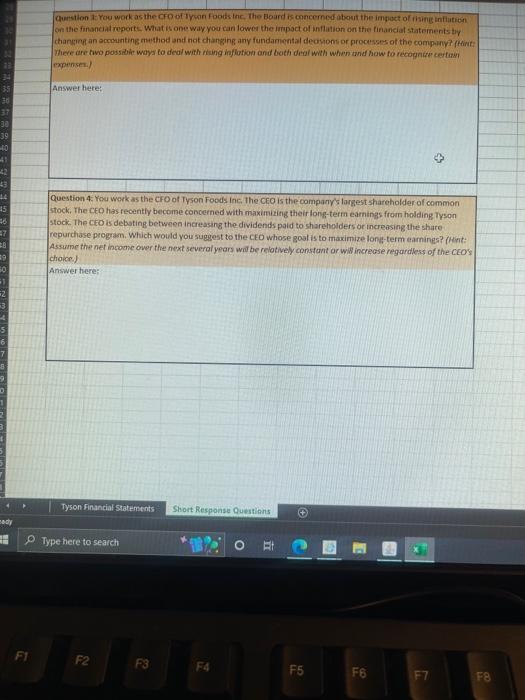

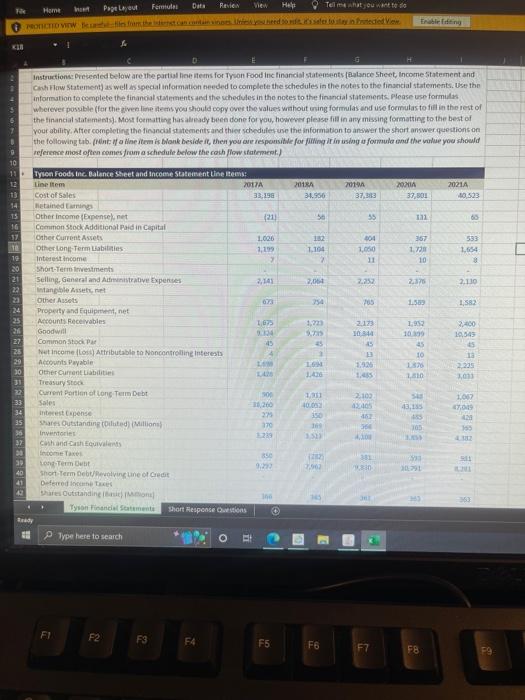

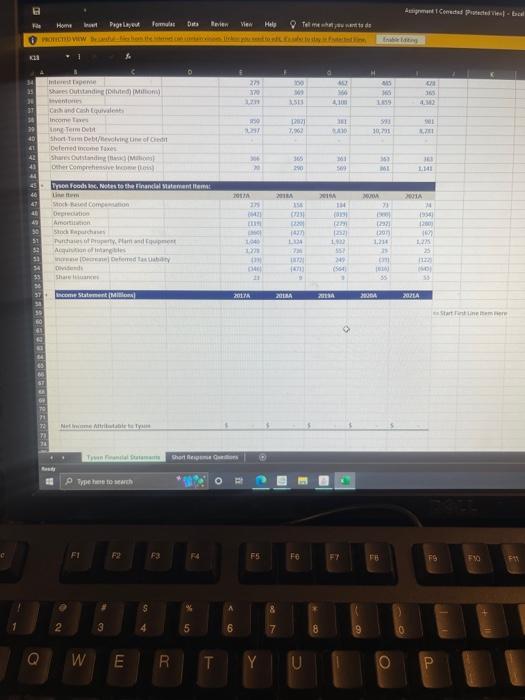

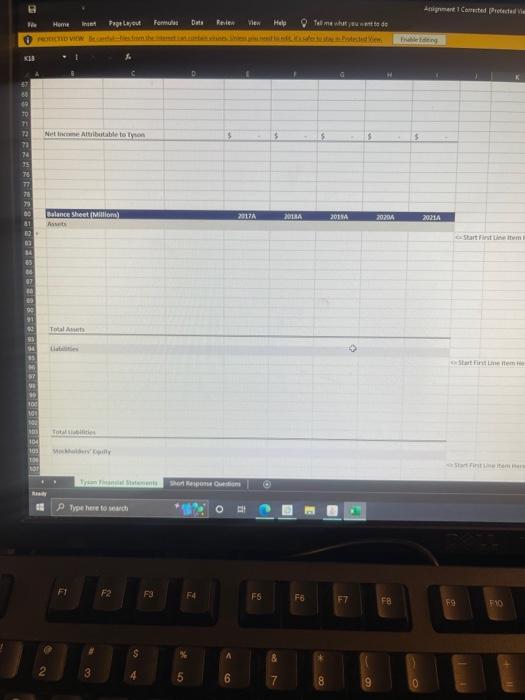

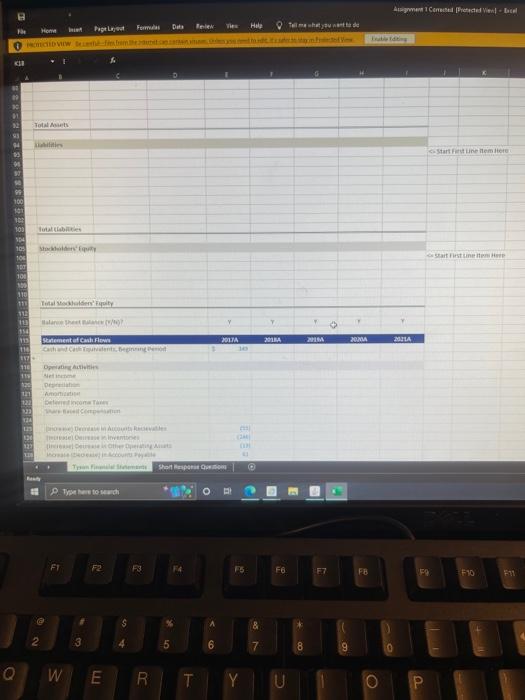

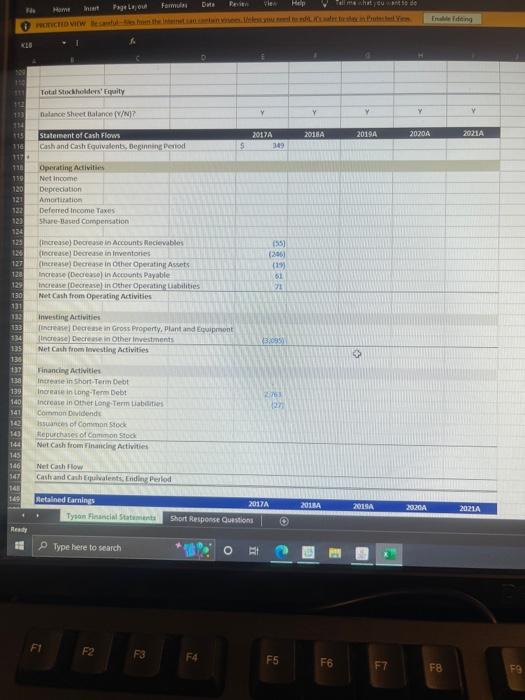

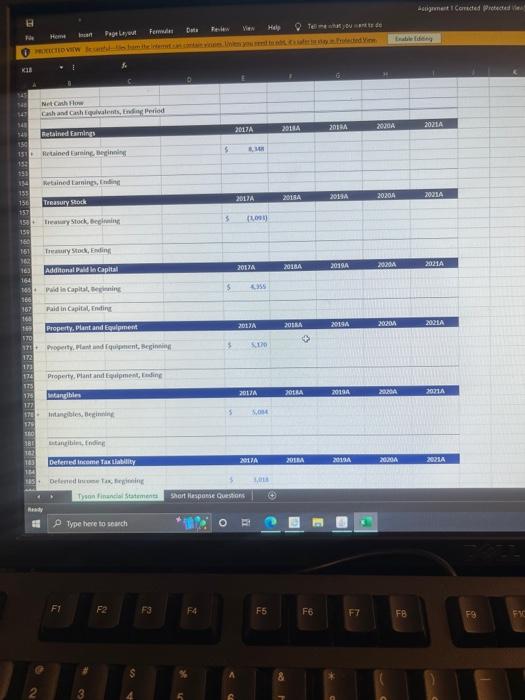

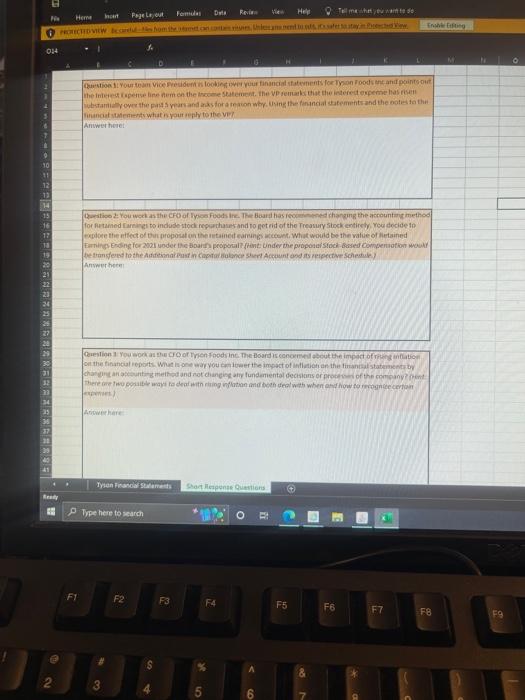

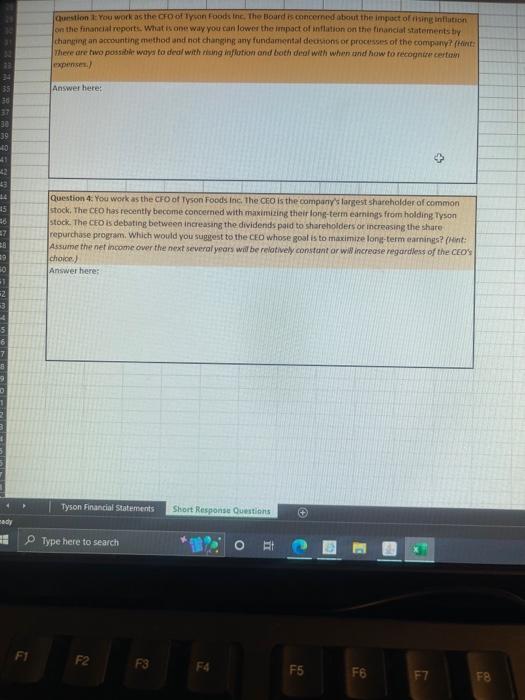

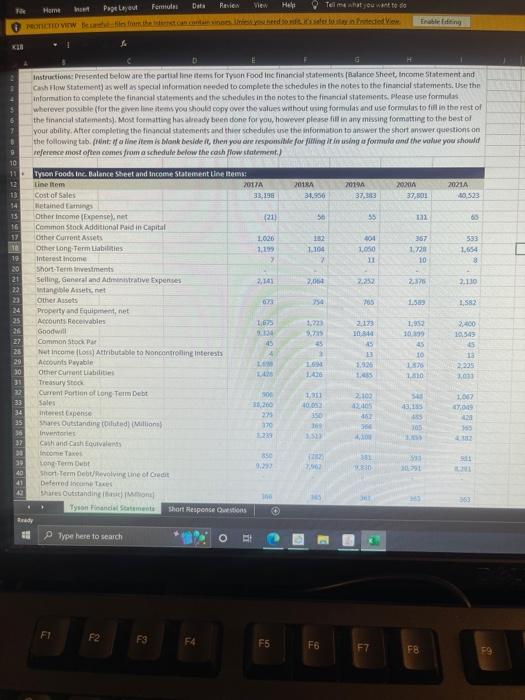

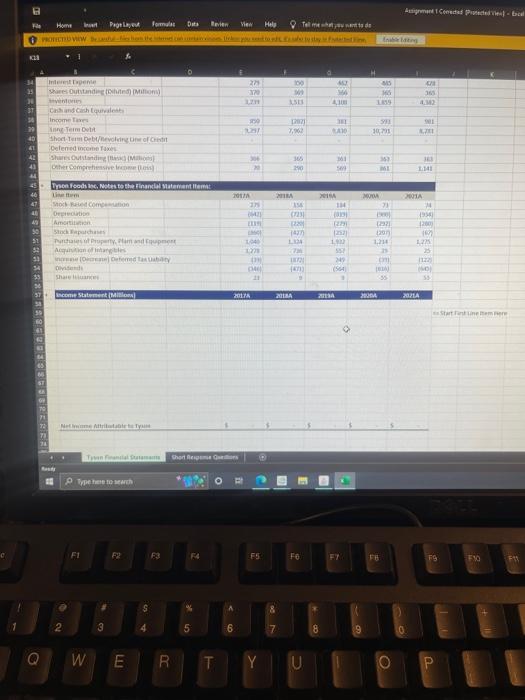

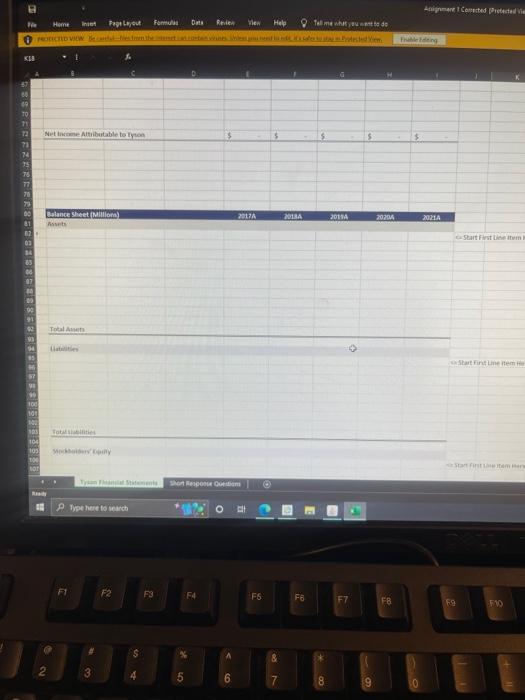

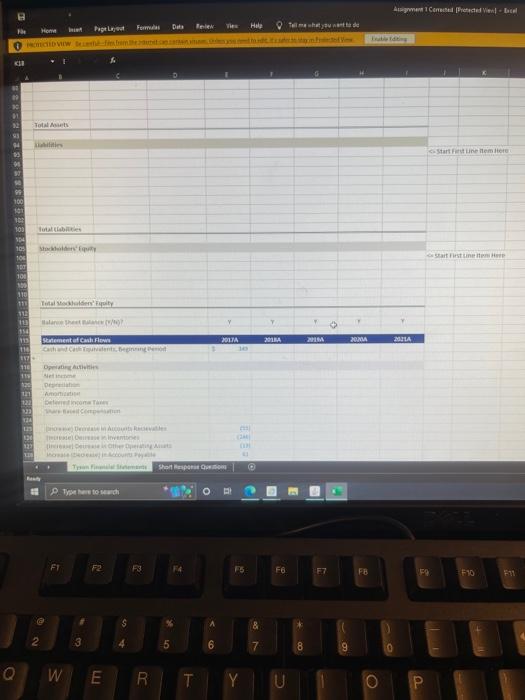

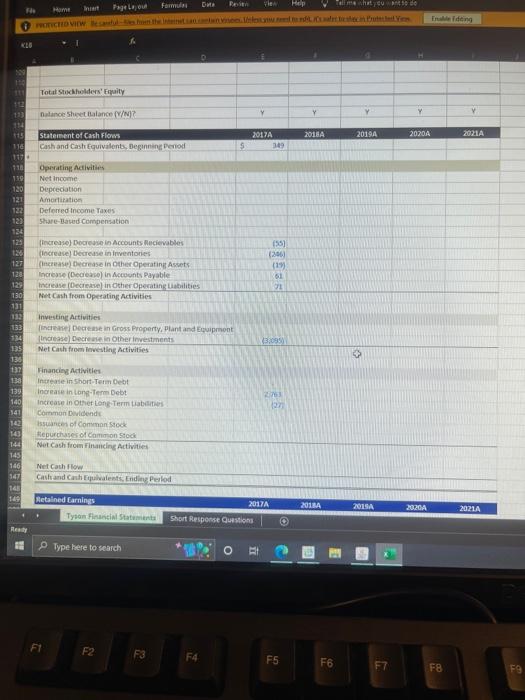

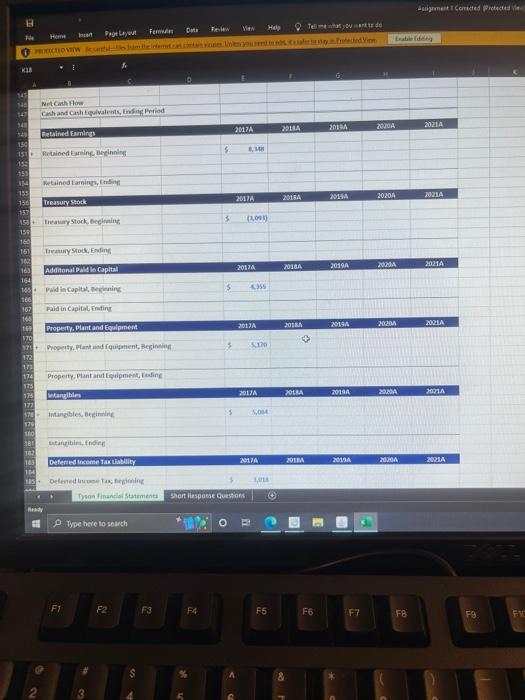

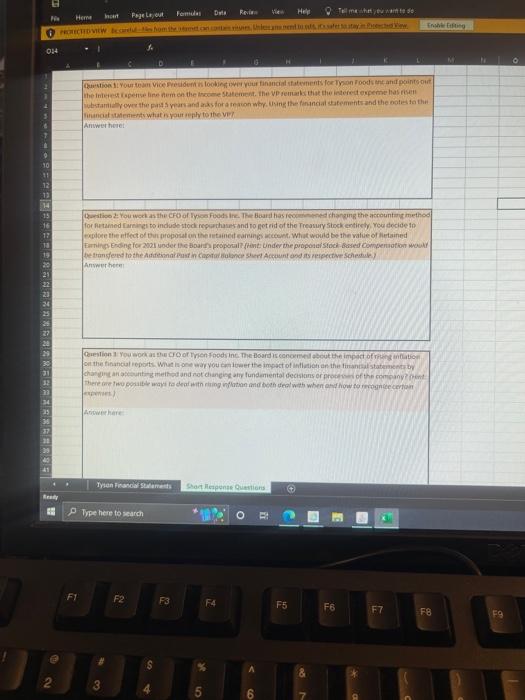

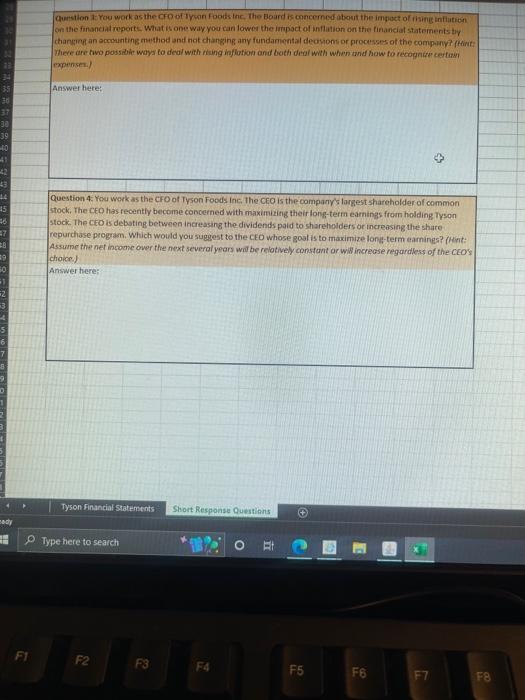

Femula Data Review View Help Page Layout Tell me what you want to do Fie Home host PROTECTED VITW Beacties from the dent can contain vinos Unies you need to det's safer to stay in Protected View f KIB G Instructions: Presented below are the partial line items for Tyson Food Inc financial statements (Balance Sheet, Income Statement and Cash Flow Statement) as well as special information needed to complete the schedules in the notes to the financial statements. Use the information to complete the financial statements and the schedules in the notes to the financial statements. Please use formulas wherever possible (for the given line items you should copy over the values without using formulas and use formulas to fill in the rest of the financial statements). Most formatting has already been done for you, however please fill in any missing formatting to the best of your ability. After completing the financial statements and thier schedules use the information to answer the short answer questions on the following tab. (Hint: if a line item is blank beside it, then you are responsible for filling it in using a formula and the value you should reference most often comes from a schedule below the cash flow statement.) 10 11 Tyson Foods Inc. Balance Sheet and Income Statement Line Items: 12 Line Item 2017A 2018A 2021A 70194 2021A 13 Cost of sales 14 Retained Earnings 15 Other Income (Expense), net 16 Common Stock Additional Paid in Capital 17 Other Current Assets 10 Other Long-Term Liabilities 19 Interest Income 20 Short-Term Investments 21 Selling, General and Administrative Expenses 22 Intangible Assets, net 23 Other Assets 24 Property and Equipment, net 25 Accounts Receivables 26 Goodwill 27 Common Stock Par 28 Net Income (Loss) Attributable to Noncontrolling Interests Accounts Payable Other Current Liabilities Treasury Stock Current Portion of Long Term Debt Sales Interest Expense Shares Outstanding (Diluted) (Millions) Inventories cash and Cash Equivalents Income Taxes Long-Term Debit Short-Term Debt/Revolving Line of Credit Deferred Income Taxes Shares Outstanding (Basic) (Mon) P1ype here to search F1 F2 30 32 33 34 35 36 37 39 41 Ready Tyson Financial Statements Short Response Questions O F3 F4 33,190 (21) 1,026 1,199 7 2,141 673 1,675 9.324 45 4 LEM 142 500 31,260 279 370 1.239 850 9,292 146 F5 34.956 56 182 1,104 2,064 354 1,223 9,735 45 D 3 16M 1,426 1,911 40.0052 350 369 1,519 2,902 345 F6 37,383 55 404 1,050 11 2.252 765 2,173 10,844 45 1.926 1,485 2,102 42405 462 366 4,300 381 9830 F7 37,801 111 367 1,728 10 2,376 1.589 1,952 10.399 45 10 1876 1,810 548 43,135 485 305 100 300 201791 363 FB 40,523 65 533 1,664 8 2.110 1,582 2,400 10,545 45 13 2,225 3,033 1,067 47,019 429 365 4.382 911 BUNL 363 F9 11 C F Home Int Page Layout PROTECTED VIEW eas 34 Interest Expense 25 Shares Outstanding (Dihited) (Million) H eventones ST Cash and Cash Equivalents 38 Income Taxes 29 Aong Term Debit 40 Short-Term Debt/Revolving Line of Credit Defened income Taxes 42 Shares Outstanding (M 43 Other Comprehensive Income (is) 44 45 Tyson Foods lec, Notes to the Financial Statement tem 46 Line fem 47 Stock-Based Compensation 40 Depreciation 49 Amortitution 50 Stock Expurchases Purchases of Property, Pam and Equipment ince (Deca) Deferred Tax ability Dividend Share Huances Income Statement (Millions) Netme Attrib K28 15 52 Acquisition of intangibles 15 34 $3 G Rady 2 F1 Del Tyven Financial Stat Type here to search F2 W 3 LU Formula Data View Help the cost O E F E S 4 F3 R Short Response Questions F4 % 5 T 275 370 3,211 200 2017A 6 30891 306 R 275 AZE me 20178 low 1040 1278 ko Ind IT D F5 Y & 7 100 3600 3,515 Tell me what you to de sayin (207) 7,962 165 290 IRA ASA (723) (220 (477) 2018A 1324 736 18721 9 FO D 8 XIMA H 462 4,300 301 995 20134 otv 361 509 114 (0) (279) (252) 1902 249 F7 415 166 1819 391 10,791 363 19 MODA 198 21 (292) (201) 1,214 25 com 2004 (yal 55% FB O Assignment Conected Protected Vie-bed 428 365 4.342 901 8,201 383 1:141 VEDIC 24 (954) (200) 0 Wal 1,275 25 (122) 2021A last 55 F9 P Start Fint nem 10 10 F11 8 Tell me what you want to do Fe Home Page Layout Formula Dat Review View Help PRODICTED VIEW Be carefules from the meat contenues les petits cafes started m KIB D Net Income Attributable to Tyson Balance Sheet (Millions) 2013A Assets 67 60 TO 71 72 74 75 76 77 76 00 81 82 03 14 85 06 97 44 00 90 91 92 Total Assets 100 101 100 103 Total abilities 104 105 100 ** 2 2017A Tyson Financial Statements Short Response Question Type here to search F2 F4 F1 3 $ 4 F3 5 A 6 F5 7 F6 8 2014 F7 9 2020A FB $ 0 Assignment 1 Corected Protected Vie 2021A Start First Line Item i Start First Line item Start First Line item Hers F9 F10 Form Data Fele Page Layout Fr Tell me what you want to de Home PROTECTED VIEW Dee from the V KIB D Total Assets kilities 99 100 101 100 100 Total abilities 104 105 Stockholder Eq 100 101 100 100 110 111 Total Mockholders' Fiquity 112 113 Balaron Sheet Balance (v/)? 154 113 Statement of Cash Flows 116 Chandants, Beginning o 117 110 Operating Activities 119 Net 120 Depan 121 Amortizati 122 Deferred income Tax 323 124 125 o Decrease in Accounts Recevaller 320 Thereseleras invent 123 presel Cerase is Other Operating s Morate De X10 Type here to search F2 12 ST 50 O 2 FI W 3 F3 $ E R Short Response Quo F4 5 T 6 2017A E Help e) (244) 41 F5 Y & 2018A F6 U 8 T 201M F7 9 2020A FB O Assignment 1 Corrected Protected Vien-b Start First Line Item Here Start First Linete Here 2021A 0 F9 P F10 F11 Dat Formula glow Revi Help Tell me what you do Fa Home Intert Page Layout PROTECTED VIEW Be saful-es from the interesantnisees.estod af te shen Protsed Vi C 109 110 Total Stockholders' Equity Balance Sheet Balance (Y/N)? Y Statement of Cash Flows 2017A 2018A 2019A 2020A Cash and Cash Equivalents, Beginning Period Operating Activities Net Income Depreciation Amortization Deferred Income Taxes Share-Based Compensation (Increase) Decrease in Accounts Recievables (Increase) Decrease in Inventories (Increase) Decrease in Other Operating Assets Increase (Decrease) in Accounts Payable Increase (Decrease) in Other Operating Liabilities Net Cash from Operating Activities Investing Activities (increase) Decrease in Gross Property, Plant and Equipment (Increase) Decrease in Other Investments Net Cash from Investing Activities Financing Activities Increase in Short-Term Debt Increase in Long-Term Debt Increase in Other Long-Term Liabilities Common Dividends Issuances of Common Stock Repurchases of Common Stock Net Cash from Financing Activities Net Cash Flow Cash and Cash Equivalents, Ending Period Retained Earnings Tyson Financial Statements 113 114 115 116 117 118 159 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 341 142 143 144 145 146 147 148 149 Ready F1 Type here to search F2 F3 349 (55) (206) (19) (3,095) 2763 (27) 2017A O F5 Short Response Questions F4 2018A F6 2015A A F7 2020A Enable Editing F8 Y 2021A 2021A F9 B d View Help Da Ferm Page Layout I Tell me what you PROXECTED VIEW Bento humite internet.c.contres en you restos carotected in KIB E Net Cash Flow 147 Cash and Cash Equivalents, Ending Period 148 2017A 2018A 2014 2020A Retained Earnings 140 150 151 Retained Earning, Beginning $ 8,348 153 151 134 Retained Earnings, Ending 155 2017A 2018A 2019A 20204 156 Treasury Stock 157 158 Treasury Stock, Beginning $ (1,000) 159 160 161 Treasury Stock, Ending 162 Additonal Paid in Capital 2017A 163 2019A 2018A 2020A 164 165 Paid in Capital, Beginning 166 167 Paid in Capital, Ending 164 149 Property, Plant and Equipment 2018A 2019A 2020A 570 175+ Property, Plant and Equipment, Beginning 172 171 174 Property, Plant and Equipment, Ending 175 175 tangibles 2018A 2019A 2020A 177 178 Intangibles, Beginning 179 180 181 utiangibin, Ending 182 143 Deferred Income Tax Liability 2018A 2019A 2020A 184 185 Delened Income Tax Begining 2 Ready F1 Tyson Financial Statements Type here to search F2 F3 CISS 2017A SOM 2017A Short Response Questions F4 1,004 2017A 1,018 I B F5 & F6 F7 Assignment 1 Conected Protected lead Enable Edding FB 2021A 2021A 2021A 2021A 2021A 2021A F9 FIC Formas Rev View Help Page Layout t Heme N Tell meet you want to do safer so stay in Pow Enable Editing HORECTED VIEW Bccarell-hom the amcan.co.rs Unleament tots 014 M Question 1: Your team Vice President is looking over your financial statements for Tyson Foods tnc and points out the Interest Expense line them on the Income Statement. The VP remarks that the interest expeme has risen substantially over the past 5 years and anks for a reason why. Using the financial statements and the notes to the financial statements what is your reply to the VI Answer here: Question 2 You work as the CFO of Tyson Foods Inc. The Board has recommend changing the accounting method for Retamed Earnings to include stock repurchases and to get rid of the Treasury Stock entirely. You decide to explore the effect of this proposal on the retained earnings account. What would be the value of Retained Earnings Ending for 2023 under the Board's proposal? (Hint: Under the proposal Stock-Based Compensation would be transfered to the Additional Past in Capital Balance Sheet Account and its respective Schedule Answer here Question 3 You work as the CFO of Tyson Foods Inc. The Board is concermet about the impact of ring inflation on the financial reports. What is one way you can lower the impact of inflation on the financial statements by changing an accounting method and not changing any fundamental decisions or process of the company? There are two possible ways to deal with ring inflation and both deal with when and how to recognize certi expenses Answer here Tyson Financial Statements Short Response Questions F4 F7 FB 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 25 27 28 30 31 32 33 34 35 35 Ready 2 PType here to search F1 F2 3 $ F3 5 A 6 F5 7 F6 A N F9 O 32 13 34 35 30 37 30 39 40 41 -42 43 44 15 46 47 28 19 50 =1 2 mady F1 Question 1: You work as the CFO of Tyson Foods Inc. The Board is concerned about the impact of rising inflation on the financial reports. What is one way you can lower the impact of inflation on the financial statements by changing an accounting method and not changing any fundamental decisions or processes of the company? (Hint: There are two possible ways to deal with rising inflation and both deal with when and how to recognize certain expenses.) Answer here: Question 4: You work as the CFO of Tyson Foods Inc. The CEO is the company's largest shareholder of common stock. The CEO has recently become concerned with maximizing their long-term earnings from holding Tyson stock. The CEO is debating between increasing the dividends paid to shareholders or increasing the share repurchase program. Which would you suggest to the CEO whose goal is to maximize long-term earnings? (Hint: Assume the net income over the next several years will be relatively constant or will increase regardless of the CEO's choice.) Answer here: Tyson Financial Statements Short Response Questions Type here to search Et F2 F4 F8 F3 F5 F6 F7 Femula Data Review View Help Page Layout Tell me what you want to do Fie Home host PROTECTED VITW Beacties from the dent can contain vinos Unies you need to det's safer to stay in Protected View f KIB G Instructions: Presented below are the partial line items for Tyson Food Inc financial statements (Balance Sheet, Income Statement and Cash Flow Statement) as well as special information needed to complete the schedules in the notes to the financial statements. Use the information to complete the financial statements and the schedules in the notes to the financial statements. Please use formulas wherever possible (for the given line items you should copy over the values without using formulas and use formulas to fill in the rest of the financial statements). Most formatting has already been done for you, however please fill in any missing formatting to the best of your ability. After completing the financial statements and thier schedules use the information to answer the short answer questions on the following tab. (Hint: if a line item is blank beside it, then you are responsible for filling it in using a formula and the value you should reference most often comes from a schedule below the cash flow statement.) 10 11 Tyson Foods Inc. Balance Sheet and Income Statement Line Items: 12 Line Item 2017A 2018A 2021A 70194 2021A 13 Cost of sales 14 Retained Earnings 15 Other Income (Expense), net 16 Common Stock Additional Paid in Capital 17 Other Current Assets 10 Other Long-Term Liabilities 19 Interest Income 20 Short-Term Investments 21 Selling, General and Administrative Expenses 22 Intangible Assets, net 23 Other Assets 24 Property and Equipment, net 25 Accounts Receivables 26 Goodwill 27 Common Stock Par 28 Net Income (Loss) Attributable to Noncontrolling Interests Accounts Payable Other Current Liabilities Treasury Stock Current Portion of Long Term Debt Sales Interest Expense Shares Outstanding (Diluted) (Millions) Inventories cash and Cash Equivalents Income Taxes Long-Term Debit Short-Term Debt/Revolving Line of Credit Deferred Income Taxes Shares Outstanding (Basic) (Mon) P1ype here to search F1 F2 30 32 33 34 35 36 37 39 41 Ready Tyson Financial Statements Short Response Questions O F3 F4 33,190 (21) 1,026 1,199 7 2,141 673 1,675 9.324 45 4 LEM 142 500 31,260 279 370 1.239 850 9,292 146 F5 34.956 56 182 1,104 2,064 354 1,223 9,735 45 D 3 16M 1,426 1,911 40.0052 350 369 1,519 2,902 345 F6 37,383 55 404 1,050 11 2.252 765 2,173 10,844 45 1.926 1,485 2,102 42405 462 366 4,300 381 9830 F7 37,801 111 367 1,728 10 2,376 1.589 1,952 10.399 45 10 1876 1,810 548 43,135 485 305 100 300 201791 363 FB 40,523 65 533 1,664 8 2.110 1,582 2,400 10,545 45 13 2,225 3,033 1,067 47,019 429 365 4.382 911 BUNL 363 F9 11 C F Home Int Page Layout PROTECTED VIEW eas 34 Interest Expense 25 Shares Outstanding (Dihited) (Million) H eventones ST Cash and Cash Equivalents 38 Income Taxes 29 Aong Term Debit 40 Short-Term Debt/Revolving Line of Credit Defened income Taxes 42 Shares Outstanding (M 43 Other Comprehensive Income (is) 44 45 Tyson Foods lec, Notes to the Financial Statement tem 46 Line fem 47 Stock-Based Compensation 40 Depreciation 49 Amortitution 50 Stock Expurchases Purchases of Property, Pam and Equipment ince (Deca) Deferred Tax ability Dividend Share Huances Income Statement (Millions) Netme Attrib K28 15 52 Acquisition of intangibles 15 34 $3 G Rady 2 F1 Del Tyven Financial Stat Type here to search F2 W 3 LU Formula Data View Help the cost O E F E S 4 F3 R Short Response Questions F4 % 5 T 275 370 3,211 200 2017A 6 30891 306 R 275 AZE me 20178 low 1040 1278 ko Ind IT D F5 Y & 7 100 3600 3,515 Tell me what you to de sayin (207) 7,962 165 290 IRA ASA (723) (220 (477) 2018A 1324 736 18721 9 FO D 8 XIMA H 462 4,300 301 995 20134 otv 361 509 114 (0) (279) (252) 1902 249 F7 415 166 1819 391 10,791 363 19 MODA 198 21 (292) (201) 1,214 25 com 2004 (yal 55% FB O Assignment Conected Protected Vie-bed 428 365 4.342 901 8,201 383 1:141 VEDIC 24 (954) (200) 0 Wal 1,275 25 (122) 2021A last 55 F9 P Start Fint nem 10 10 F11 8 Tell me what you want to do Fe Home Page Layout Formula Dat Review View Help PRODICTED VIEW Be carefules from the meat contenues les petits cafes started m KIB D Net Income Attributable to Tyson Balance Sheet (Millions) 2013A Assets 67 60 TO 71 72 74 75 76 77 76 00 81 82 03 14 85 06 97 44 00 90 91 92 Total Assets 100 101 100 103 Total abilities 104 105 100 ** 2 2017A Tyson Financial Statements Short Response Question Type here to search F2 F4 F1 3 $ 4 F3 5 A 6 F5 7 F6 8 2014 F7 9 2020A FB $ 0 Assignment 1 Corected Protected Vie 2021A Start First Line Item i Start First Line item Start First Line item Hers F9 F10 Form Data Fele Page Layout Fr Tell me what you want to de Home PROTECTED VIEW Dee from the V KIB D Total Assets kilities 99 100 101 100 100 Total abilities 104 105 Stockholder Eq 100 101 100 100 110 111 Total Mockholders' Fiquity 112 113 Balaron Sheet Balance (v/)? 154 113 Statement of Cash Flows 116 Chandants, Beginning o 117 110 Operating Activities 119 Net 120 Depan 121 Amortizati 122 Deferred income Tax 323 124 125 o Decrease in Accounts Recevaller 320 Thereseleras invent 123 presel Cerase is Other Operating s Morate De X10 Type here to search F2 12 ST 50 O 2 FI W 3 F3 $ E R Short Response Quo F4 5 T 6 2017A E Help e) (244) 41 F5 Y & 2018A F6 U 8 T 201M F7 9 2020A FB O Assignment 1 Corrected Protected Vien-b Start First Line Item Here Start First Linete Here 2021A 0 F9 P F10 F11 Dat Formula glow Revi Help Tell me what you do Fa Home Intert Page Layout PROTECTED VIEW Be saful-es from the interesantnisees.estod af te shen Protsed Vi C 109 110 Total Stockholders' Equity Balance Sheet Balance (Y/N)? Y Statement of Cash Flows 2017A 2018A 2019A 2020A Cash and Cash Equivalents, Beginning Period Operating Activities Net Income Depreciation Amortization Deferred Income Taxes Share-Based Compensation (Increase) Decrease in Accounts Recievables (Increase) Decrease in Inventories (Increase) Decrease in Other Operating Assets Increase (Decrease) in Accounts Payable Increase (Decrease) in Other Operating Liabilities Net Cash from Operating Activities Investing Activities (increase) Decrease in Gross Property, Plant and Equipment (Increase) Decrease in Other Investments Net Cash from Investing Activities Financing Activities Increase in Short-Term Debt Increase in Long-Term Debt Increase in Other Long-Term Liabilities Common Dividends Issuances of Common Stock Repurchases of Common Stock Net Cash from Financing Activities Net Cash Flow Cash and Cash Equivalents, Ending Period Retained Earnings Tyson Financial Statements 113 114 115 116 117 118 159 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 341 142 143 144 145 146 147 148 149 Ready F1 Type here to search F2 F3 349 (55) (206) (19) (3,095) 2763 (27) 2017A O F5 Short Response Questions F4 2018A F6 2015A A F7 2020A Enable Editing F8 Y 2021A 2021A F9 B d View Help Da Ferm Page Layout I Tell me what you PROXECTED VIEW Bento humite internet.c.contres en you restos carotected in KIB E Net Cash Flow 147 Cash and Cash Equivalents, Ending Period 148 2017A 2018A 2014 2020A Retained Earnings 140 150 151 Retained Earning, Beginning $ 8,348 153 151 134 Retained Earnings, Ending 155 2017A 2018A 2019A 20204 156 Treasury Stock 157 158 Treasury Stock, Beginning $ (1,000) 159 160 161 Treasury Stock, Ending 162 Additonal Paid in Capital 2017A 163 2019A 2018A 2020A 164 165 Paid in Capital, Beginning 166 167 Paid in Capital, Ending 164 149 Property, Plant and Equipment 2018A 2019A 2020A 570 175+ Property, Plant and Equipment, Beginning 172 171 174 Property, Plant and Equipment, Ending 175 175 tangibles 2018A 2019A 2020A 177 178 Intangibles, Beginning 179 180 181 utiangibin, Ending 182 143 Deferred Income Tax Liability 2018A 2019A 2020A 184 185 Delened Income Tax Begining 2 Ready F1 Tyson Financial Statements Type here to search F2 F3 CISS 2017A SOM 2017A Short Response Questions F4 1,004 2017A 1,018 I B F5 & F6 F7 Assignment 1 Conected Protected lead Enable Edding FB 2021A 2021A 2021A 2021A 2021A 2021A F9 FIC Formas Rev View Help Page Layout t Heme N Tell meet you want to do safer so stay in Pow Enable Editing HORECTED VIEW Bccarell-hom the amcan.co.rs Unleament tots 014 M Question 1: Your team Vice President is looking over your financial statements for Tyson Foods tnc and points out the Interest Expense line them on the Income Statement. The VP remarks that the interest expeme has risen substantially over the past 5 years and anks for a reason why. Using the financial statements and the notes to the financial statements what is your reply to the VI Answer here: Question 2 You work as the CFO of Tyson Foods Inc. The Board has recommend changing the accounting method for Retamed Earnings to include stock repurchases and to get rid of the Treasury Stock entirely. You decide to explore the effect of this proposal on the retained earnings account. What would be the value of Retained Earnings Ending for 2023 under the Board's proposal? (Hint: Under the proposal Stock-Based Compensation would be transfered to the Additional Past in Capital Balance Sheet Account and its respective Schedule Answer here Question 3 You work as the CFO of Tyson Foods Inc. The Board is concermet about the impact of ring inflation on the financial reports. What is one way you can lower the impact of inflation on the financial statements by changing an accounting method and not changing any fundamental decisions or process of the company? There are two possible ways to deal with ring inflation and both deal with when and how to recognize certi expenses Answer here Tyson Financial Statements Short Response Questions F4 F7 FB 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 25 27 28 30 31 32 33 34 35 35 Ready 2 PType here to search F1 F2 3 $ F3 5 A 6 F5 7 F6 A N F9 O 32 13 34 35 30 37 30 39 40 41 -42 43 44 15 46 47 28 19 50 =1 2 mady F1 Question 1: You work as the CFO of Tyson Foods Inc. The Board is concerned about the impact of rising inflation on the financial reports. What is one way you can lower the impact of inflation on the financial statements by changing an accounting method and not changing any fundamental decisions or processes of the company? (Hint: There are two possible ways to deal with rising inflation and both deal with when and how to recognize certain expenses.) Answer here: Question 4: You work as the CFO of Tyson Foods Inc. The CEO is the company's largest shareholder of common stock. The CEO has recently become concerned with maximizing their long-term earnings from holding Tyson stock. The CEO is debating between increasing the dividends paid to shareholders or increasing the share repurchase program. Which would you suggest to the CEO whose goal is to maximize long-term earnings? (Hint: Assume the net income over the next several years will be relatively constant or will increase regardless of the CEO's choice.) Answer here: Tyson Financial Statements Short Response Questions Type here to search Et F2 F4 F8 F3 F5 F6 F7 Femula Data Review View Help Page Layout Tell me what you want to do Fie Home host PROTECTED VITW Beacties from the dent can contain vinos Unies you need to det's safer to stay in Protected View f KIB G Instructions: Presented below are the partial line items for Tyson Food Inc financial statements (Balance Sheet, Income Statement and Cash Flow Statement) as well as special information needed to complete the schedules in the notes to the financial statements. Use the information to complete the financial statements and the schedules in the notes to the financial statements. Please use formulas wherever possible (for the given line items you should copy over the values without using formulas and use formulas to fill in the rest of the financial statements). Most formatting has already been done for you, however please fill in any missing formatting to the best of your ability. After completing the financial statements and thier schedules use the information to answer the short answer questions on the following tab. (Hint: if a line item is blank beside it, then you are responsible for filling it in using a formula and the value you should reference most often comes from a schedule below the cash flow statement.) 10 11 Tyson Foods Inc. Balance Sheet and Income Statement Line Items: 12 Line Item 2017A 2018A 2021A 70194 2021A 13 Cost of sales 14 Retained Earnings 15 Other Income (Expense), net 16 Common Stock Additional Paid in Capital 17 Other Current Assets 10 Other Long-Term Liabilities 19 Interest Income 20 Short-Term Investments 21 Selling, General and Administrative Expenses 22 Intangible Assets, net 23 Other Assets 24 Property and Equipment, net 25 Accounts Receivables 26 Goodwill 27 Common Stock Par 28 Net Income (Loss) Attributable to Noncontrolling Interests Accounts Payable Other Current Liabilities Treasury Stock Current Portion of Long Term Debt Sales Interest Expense Shares Outstanding (Diluted) (Millions) Inventories cash and Cash Equivalents Income Taxes Long-Term Debit Short-Term Debt/Revolving Line of Credit Deferred Income Taxes Shares Outstanding (Basic) (Mon) P1ype here to search F1 F2 30 32 33 34 35 36 37 39 41 Ready Tyson Financial Statements Short Response Questions O F3 F4 33,190 (21) 1,026 1,199 7 2,141 673 1,675 9.324 45 4 LEM 142 500 31,260 279 370 1.239 850 9,292 146 F5 34.956 56 182 1,104 2,064 354 1,223 9,735 45 D 3 16M 1,426 1,911 40.0052 350 369 1,519 2,902 345 F6 37,383 55 404 1,050 11 2.252 765 2,173 10,844 45 1.926 1,485 2,102 42405 462 366 4,300 381 9830 F7 37,801 111 367 1,728 10 2,376 1.589 1,952 10.399 45 10 1876 1,810 548 43,135 485 305 100 300 201791 363 FB 40,523 65 533 1,664 8 2.110 1,582 2,400 10,545 45 13 2,225 3,033 1,067 47,019 429 365 4.382 911 BUNL 363 F9 11 C F Home Int Page Layout PROTECTED VIEW eas 34 Interest Expense 25 Shares Outstanding (Dihited) (Million) H eventones ST Cash and Cash Equivalents 38 Income Taxes 29 Aong Term Debit 40 Short-Term Debt/Revolving Line of Credit Defened income Taxes 42 Shares Outstanding (M 43 Other Comprehensive Income (is) 44 45 Tyson Foods lec, Notes to the Financial Statement tem 46 Line fem 47 Stock-Based Compensation 40 Depreciation 49 Amortitution 50 Stock Expurchases Purchases of Property, Pam and Equipment ince (Deca) Deferred Tax ability Dividend Share Huances Income Statement (Millions) Netme Attrib K28 15 52 Acquisition of intangibles 15 34 $3 G Rady 2 F1 Del Tyven Financial Stat Type here to search F2 W 3 LU Formula Data View Help the cost O E F E S 4 F3 R Short Response Questions F4 % 5 T 275 370 3,211 200 2017A 6 30891 306 R 275 AZE me 20178 low 1040 1278 ko Ind IT D F5 Y & 7 100 3600 3,515 Tell me what you to de sayin (207) 7,962 165 290 IRA ASA (723) (220 (477) 2018A 1324 736 18721 9 FO D 8 XIMA H 462 4,300 301 995 20134 otv 361 509 114 (0) (279) (252) 1902 249 F7 415 166 1819 391 10,791 363 19 MODA 198 21 (292) (201) 1,214 25 com 2004 (yal 55% FB O Assignment Conected Protected Vie-bed 428 365 4.342 901 8,201 383 1:141 VEDIC 24 (954) (200) 0 Wal 1,275 25 (122) 2021A last 55 F9 P Start Fint nem 10 10 F11 8 Tell me what you want to do Fe Home Page Layout Formula Dat Review View Help PRODICTED VIEW Be carefules from the meat contenues les petits cafes started m KIB D Net Income Attributable to Tyson Balance Sheet (Millions) 2013A Assets 67 60 TO 71 72 74 75 76 77 76 00 81 82 03 14 85 06 97 44 00 90 91 92 Total Assets 100 101 100 103 Total abilities 104 105 100 ** 2 2017A Tyson Financial Statements Short Response Question Type here to search F2 F4 F1 3 $ 4 F3 5 A 6 F5 7 F6 8 2014 F7 9 2020A FB $ 0 Assignment 1 Corected Protected Vie 2021A Start First Line Item i Start First Line item Start First Line item Hers F9 F10 Form Data Fele Page Layout Fr Tell me what you want to de Home PROTECTED VIEW Dee from the V KIB D Total Assets kilities 99 100 101 100 100 Total abilities 104 105 Stockholder Eq 100 101 100 100 110 111 Total Mockholders' Fiquity 112 113 Balaron Sheet Balance (v/)? 154 113 Statement of Cash Flows 116 Chandants, Beginning o 117 110 Operating Activities 119 Net 120 Depan 121 Amortizati 122 Deferred income Tax 323 124 125 o Decrease in Accounts Recevaller 320 Thereseleras invent 123 presel Cerase is Other Operating s Morate De X10 Type here to search F2 12 ST 50 O 2 FI W 3 F3 $ E R Short Response Quo F4 5 T 6 2017A E Help e) (244) 41 F5 Y & 2018A F6 U 8 T 201M F7 9 2020A FB O Assignment 1 Corrected Protected Vien-b Start First Line Item Here Start First Linete Here 2021A 0 F9 P F10 F11 Dat Formula glow Revi Help Tell me what you do Fa Home Intert Page Layout PROTECTED VIEW Be saful-es from the interesantnisees.estod af te shen Protsed Vi C 109 110 Total Stockholders' Equity Balance Sheet Balance (Y/N)? Y Statement of Cash Flows 2017A 2018A 2019A 2020A Cash and Cash Equivalents, Beginning Period Operating Activities Net Income Depreciation Amortization Deferred Income Taxes Share-Based Compensation (Increase) Decrease in Accounts Recievables (Increase) Decrease in Inventories (Increase) Decrease in Other Operating Assets Increase (Decrease) in Accounts Payable Increase (Decrease) in Other Operating Liabilities Net Cash from Operating Activities Investing Activities (increase) Decrease in Gross Property, Plant and Equipment (Increase) Decrease in Other Investments Net Cash from Investing Activities Financing Activities Increase in Short-Term Debt Increase in Long-Term Debt Increase in Other Long-Term Liabilities Common Dividends Issuances of Common Stock Repurchases of Common Stock Net Cash from Financing Activities Net Cash Flow Cash and Cash Equivalents, Ending Period Retained Earnings Tyson Financial Statements 113 114 115 116 117 118 159 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 341 142 143 144 145 146 147 148 149 Ready F1 Type here to search F2 F3 349 (55) (206) (19) (3,095) 2763 (27) 2017A O F5 Short Response Questions F4 2018A F6 2015A A F7 2020A Enable Editing F8 Y 2021A 2021A F9 B d View Help Da Ferm Page Layout I Tell me what you PROXECTED VIEW Bento humite internet.c.contres en you restos carotected in KIB E Net Cash Flow 147 Cash and Cash Equivalents, Ending Period 148 2017A 2018A 2014 2020A Retained Earnings 140 150 151 Retained Earning, Beginning $ 8,348 153 151 134 Retained Earnings, Ending 155 2017A 2018A 2019A 20204 156 Treasury Stock 157 158 Treasury Stock, Beginning $ (1,000) 159 160 161 Treasury Stock, Ending 162 Additonal Paid in Capital 2017A 163 2019A 2018A 2020A 164 165 Paid in Capital, Beginning 166 167 Paid in Capital, Ending 164 149 Property, Plant and Equipment 2018A 2019A 2020A 570 175+ Property, Plant and Equipment, Beginning 172 171 174 Property, Plant and Equipment, Ending 175 175 tangibles 2018A 2019A 2020A 177 178 Intangibles, Beginning 179 180 181 utiangibin, Ending 182 143 Deferred Income Tax Liability 2018A 2019A 2020A 184 185 Delened Income Tax Begining 2 Ready F1 Tyson Financial Statements Type here to search F2 F3 CISS 2017A SOM 2017A Short Response Questions F4 1,004 2017A 1,018 I B F5 & F6 F7 Assignment 1 Conected Protected lead Enable Edding FB 2021A 2021A 2021A 2021A 2021A 2021A F9 FIC Formas Rev View Help Page Layout t Heme N Tell meet you want to do safer so stay in Pow Enable Editing HORECTED VIEW Bccarell-hom the amcan.co.rs Unleament tots 014 M Question 1: Your team Vice President is looking over your financial statements for Tyson Foods tnc and points out the Interest Expense line them on the Income Statement. The VP remarks that the interest expeme has risen substantially over the past 5 years and anks for a reason why. Using the financial statements and the notes to the financial statements what is your reply to the VI Answer here: Question 2 You work as the CFO of Tyson Foods Inc. The Board has recommend changing the accounting method for Retamed Earnings to include stock repurchases and to get rid of the Treasury Stock entirely. You decide to explore the effect of this proposal on the retained earnings account. What would be the value of Retained Earnings Ending for 2023 under the Board's proposal? (Hint: Under the proposal Stock-Based Compensation would be transfered to the Additional Past in Capital Balance Sheet Account and its respective Schedule Answer here Question 3 You work as the CFO of Tyson Foods Inc. The Board is concermet about the impact of ring inflation on the financial reports. What is one way you can lower the impact of inflation on the financial statements by changing an accounting method and not changing any fundamental decisions or process of the company? There are two possible ways to deal with ring inflation and both deal with when and how to recognize certi expenses Answer here Tyson Financial Statements Short Response Questions F4 F7 FB 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 25 27 28 30 31 32 33 34 35 35 Ready 2 PType here to search F1 F2 3 $ F3 5 A 6 F5 7 F6 A N F9 O 32 13 34 35 30 37 30 39 40 41 -42 43 44 15 46 47 28 19 50 =1 2 mady F1 Question 1: You work as the CFO of Tyson Foods Inc. The Board is concerned about the impact of rising inflation on the financial reports. What is one way you can lower the impact of inflation on the financial statements by changing an accounting method and not changing any fundamental decisions or processes of the company? (Hint: There are two possible ways to deal with rising inflation and both deal with when and how to recognize certain expenses.) Answer here: Question 4: You work as the CFO of Tyson Foods Inc. The CEO is the company's largest shareholder of common stock. The CEO has recently become concerned with maximizing their long-term earnings from holding Tyson stock. The CEO is debating between increasing the dividends paid to shareholders or increasing the share repurchase program. Which would you suggest to the CEO whose goal is to maximize long-term earnings? (Hint: Assume the net income over the next several years will be relatively constant or will increase regardless of the CEO's choice.) Answer here: Tyson Financial Statements Short Response Questions Type here to search Et F2 F4 F8 F3 F5 F6 F7 Femula Data Review View Help Page Layout Tell me what you want to do Fie Home host PROTECTED VITW Beacties from the dent can contain vinos Unies you need to det's safer to stay in Protected View f KIB G Instructions: Presented below are the partial line items for Tyson Food Inc financial statements (Balance Sheet, Income Statement and Cash Flow Statement) as well as special information needed to complete the schedules in the notes to the financial statements. Use the information to complete the financial statements and the schedules in the notes to the financial statements. Please use formulas wherever possible (for the given line items you should copy over the values without using formulas and use formulas to fill in the rest of the financial statements). Most formatting has already been done for you, however please fill in any missing formatting to the best of your ability. After completing the financial statements and thier schedules use the information to answer the short answer questions on the following tab. (Hint: if a line item is blank beside it, then you are responsible for filling it in using a formula and the value you should reference most often comes from a schedule below the cash flow statement.) 10 11 Tyson Foods Inc. Balance Sheet and Income Statement Line Items: 12 Line Item 2017A 2018A 2021A 70194 2021A 13 Cost of sales 14 Retained Earnings 15 Other Income (Expense), net 16 Common Stock Additional Paid in Capital 17 Other Current Assets 10 Other Long-Term Liabilities 19 Interest Income 20 Short-Term Investments 21 Selling, General and Administrative Expenses 22 Intangible Assets, net 23 Other Assets 24 Property and Equipment, net 25 Accounts Receivables 26 Goodwill 27 Common Stock Par 28 Net Income (Loss) Attributable to Noncontrolling Interests Accounts Payable Other Current Liabilities Treasury Stock Current Portion of Long Term Debt Sales Interest Expense Shares Outstanding (Diluted) (Millions) Inventories cash and Cash Equivalents Income Taxes Long-Term Debit Short-Term Debt/Revolving Line of Credit Deferred Income Taxes Shares Outstanding (Basic) (Mon) P1ype here to search F1 F2 30 32 33 34 35 36 37 39 41 Ready Tyson Financial Statements Short Response Questions O F3 F4 33,190 (21) 1,026 1,199 7 2,141 673 1,675 9.324 45 4 LEM 142 500 31,260 279 370 1.239 850 9,292 146 F5 34.956 56 182 1,104 2,064 354 1,223 9,735 45 D 3 16M 1,426 1,911 40.0052 350 369 1,519 2,902 345 F6 37,383 55 404 1,050 11 2.252 765 2,173 10,844 45 1.926 1,485 2,102 42405 462 366 4,300 381 9830 F7 37,801 111 367 1,728 10 2,376 1.589 1,952 10.399 45 10 1876 1,810 548 43,135 485 305 100 300 201791 363 FB 40,523 65 533 1,664 8 2.110 1,582 2,400 10,545 45 13 2,225 3,033 1,067 47,019 429 365 4.382 911 BUNL 363 F9 11 C F Home Int Page Layout PROTECTED VIEW eas 34 Interest Expense 25 Shares Outstanding (Dihited) (Million) H eventones ST Cash and Cash Equivalents 38 Income Taxes 29 Aong Term Debit 40 Short-Term Debt/Revolving Line of Credit Defened income Taxes 42 Shares Outstanding (M 43 Other Comprehensive Income (is) 44 45 Tyson Foods lec, Notes to the Financial Statement tem 46 Line fem 47 Stock-Based Compensation 40 Depreciation 49 Amortitution 50 Stock Expurchases Purchases of Property, Pam and Equipment ince (Deca) Deferred Tax ability Dividend Share Huances Income Statement (Millions) Netme Attrib K28 15 52 Acquisition of intangibles 15 34 $3 G Rady 2 F1 Del Tyven Financial Stat Type here to search F2 W 3 LU Formula Data View Help the cost O E F E S 4 F3 R Short Response Questions F4 % 5 T 275 370 3,211 200 2017A 6 30891 306 R 275 AZE me 20178 low 1040 1278 ko Ind IT D F5 Y & 7 100 3600 3,515 Tell me what you to de sayin (207) 7,962 165 290 IRA ASA (723) (220 (477) 2018A 1324 736 18721 9 FO D 8 XIMA H 462 4,300 301 995 20134 otv 361 509 114 (0) (279) (252) 1902 249 F7 415 166 1819 391 10,791 363 19 MODA 198 21 (292) (201) 1,214 25 com 2004 (yal 55% FB O Assignment Conected Protected Vie-bed 428 365 4.342 901 8,201 383 1:141 VEDIC 24 (954) (200) 0 Wal 1,275 25 (122) 2021A last 55 F9 P Start Fint nem 10 10 F11 8 Tell me what you want to do Fe Home Page Layout Formula Dat Review View Help PRODICTED VIEW Be carefules from the meat contenues les petits cafes started m KIB D Net Income Attributable to Tyson Balance Sheet (Millions) 2013A Assets 67 60 TO 71 72 74 75 76 77 76 00 81 82 03 14 85 06 97 44 00 90 91 92 Total Assets 100 101 100 103 Total abilities 104 105 100 ** 2 2017A Tyson Financial Statements Short Response Question Type here to search F2 F4 F1 3 $ 4 F3 5 A 6 F5 7 F6 8 2014 F7 9 2020A FB $ 0 Assignment 1 Corected Protected Vie 2021A Start First Line Item i Start First Line item Start First Line item Hers F9 F10 Form Data Fele Page Layout Fr Tell me what you want to de Home PROTECTED VIEW Dee from the V KIB D Total Assets kilities 99 100 101 100 100 Total abilities 104 105 Stockholder Eq 100 101 100 100 110 111 Total Mockholders' Fiquity 112 113 Balaron Sheet Balance (v/)? 154 113 Statement of Cash Flows 116 Chandants, Beginning o 117 110 Operating Activities 119 Net 120 Depan 121 Amortizati 122 Deferred income Tax 323 124 125 o Decrease in Accounts Recevaller 320 Thereseleras invent 123 presel Cerase is Other Operating s Morate De X10 Type here to search F2 12 ST 50 O 2 FI W 3 F3 $ E R Short Response Quo F4 5 T 6 2017A E Help e) (244) 41 F5 Y & 2018A F6 U 8 T 201M F7 9 2020A FB O Assignment 1 Corrected Protected Vien-b Start First Line Item Here Start First Linete Here 2021A 0 F9 P F10 F11 Dat Formula glow Revi Help Tell me what you do Fa Home Intert Page Layout PROTECTED VIEW Be saful-es from the interesantnisees.estod af te shen Protsed Vi C 109 110 Total Stockholders' Equity Balance Sheet Balance (Y/N)? Y Statement of Cash Flows 2017A 2018A 2019A 2020A Cash and Cash Equivalents, Beginning Period Operating Activities Net Income Depreciation Amortization Deferred Income Taxes Share-Based Compensation (Increase) Decrease in Accounts Recievables (Increase) Decrease in Inventories (Increase) Decrease in Other Operating Assets Increase (Decrease) in Accounts Payable Increase (Decrease) in Other Operating Liabilities Net Cash from Operating Activities Investing Activities (increase) Decrease in Gross Property, Plant and Equipment (Increase) Decrease in Other Investments Net Cash from Investing Activities Financing Activities Increase in Short-Term Debt Increase in Long-Term Debt Increase in Other Long-Term Liabilities Common Dividends Issuances of Common Stock Repurchases of Common Stock Net Cash from Financing Activities Net Cash Flow Cash and Cash Equivalents, Ending Period Retained Earnings Tyson Financial Statements 113 114 115 116 117 118 159 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 341 142 143 144 145 146 147 148 149 Ready F1 Type here to search F2 F3 349 (55) (206) (19) (3,095) 2763 (27) 2017A O F5 Short Response Questions F4 2018A F6 2015A A F7 2020A Enable Editing F8 Y 2021A 2021A F9 B d View Help Da Ferm Page Layout I Tell me what you PROXECTED VIEW Bento humite internet.c.contres en you restos carotected in KIB E Net Cash Flow 147 Cash and Cash Equivalents, Ending Period 148 2017A 2018A 2014 2020A Retained Earnings 140 150 151 Retained Earning, Beginning $ 8,348 153 151 134 Retained Earnings, Ending 155 2017A 2018A 2019A 20204 156 Treasury Stock 157 158 Treasury Stock, Beginning $ (1,000) 159 160 161 Treasury Stock, Ending 162 Additonal Paid in Capital 2017A 163 2019A 2018A 2020A 164 165 Paid in Capital, Beginning 166 167 Paid in Capital, Ending 164 149 Property, Plant and Equipment 2018A 2019A 2020A 570 175+ Property, Plant and Equipment, Beginning 172 171 174 Property, Plant and Equipment, Ending 175 175 tangibles 2018A 2019A 2020A 177 178 Intangibles, Beginning 179 180 181 utiangibin, Ending 182 143 Deferred Income Tax Liability 2018A 2019A 2020A 184 185 Delened Income Tax Begining 2 Ready F1 Tyson Financial Statements Type here to search F2 F3 CISS 2017A SOM 2017A Short Response Questions F4 1,004 2017A 1,018 I B F5 & F6 F7 Assignment 1 Conected Protected lead Enable Edding FB 2021A 2021A 2021A 2021A 2021A 2021A F9 FIC Formas Rev View Help Page Layout t Heme N Tell meet you want to do safer so stay in Pow Enable Editing HORECTED VIEW Bccarell-hom the amcan.co.rs Unleament tots 014 M Question 1: Your team Vice President is looking over your financial statements for Tyson Foods tnc and points out the Interest Expense line them on the Income Statement. The VP remarks that the interest expeme has risen substantially over the past 5 years and anks for a reason why. Using the financial statements and the notes to the financial statements what is your reply to the VI Answer here: Question 2 You work as the CFO of Tyson Foods Inc. The Board has recommend changing the accounting method for Retamed Earnings to include stock repurchases and to get rid of the Treasury Stock entirely. You decide to explore the effect of this proposal on the retained earnings account. What would be the value of Retained Earnings Ending for 2023 under the Board's proposal? (Hint: Under the proposal Stock-Based Compensation would be transfered to the Additional Past in Capital Balance Sheet Account and its respective Schedule Answer here Question 3 You work as the CFO of Tyson Foods Inc. The Board is concermet about the impact of ring inflation on the financial reports. What is one way you can lower the impact of inflation on the financial statements by changing an accounting method and not changing any fundamental decisions or process of the company? There are two possible ways to deal with ring inflation and both deal with when and how to recognize certi expenses Answer here Tyson Financial Statements Short Response Questions F4 F7 FB 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 25 27 28 30 31 32 33 34 35 35 Ready 2 PType here to search F1 F2 3 $ F3 5 A 6 F5 7 F6 A N F9 O 32 13 34 35 30 37 30 39 40 41 -42 43 44 15 46 47 28 19 50 =1 2 mady F1 Question 1: You work as the CFO of Tyson Foods Inc. The Board is concerned about the impact of rising inflation on the financial reports. What is one way you can lower the impact of inflation on the financial statements by changing an accounting method and not changing any fundamental decisions or processes of the company? (Hint: There are two possible ways to deal with rising inflation and both deal with when and how to recognize certain expenses.) Answer here: Question 4: You work as the CFO of Tyson Foods Inc. The CEO is the company's largest shareholder of common stock. The CEO has recently become concerned with maximizing their long-term earnings from holding Tyson stock. The CEO is debating between increasing the dividends paid to shareholders or increasing the share repurchase program. Which would you suggest to the CEO whose goal is to maximize long-term earnings? (Hint: Assume the net income over the next several years will be relatively constant or will increase regardless of the CEO's choice.) Answer here: Tyson Financial Statements Short Response Questions Type here to search Et F2 F4 F8 F3 F5 F6 F7