You have three investment options*: Option I Option II Option III Initial Cost $400 $1,300 $825 Uniform Annual Benefit $120 $200 $190 Useful Life,

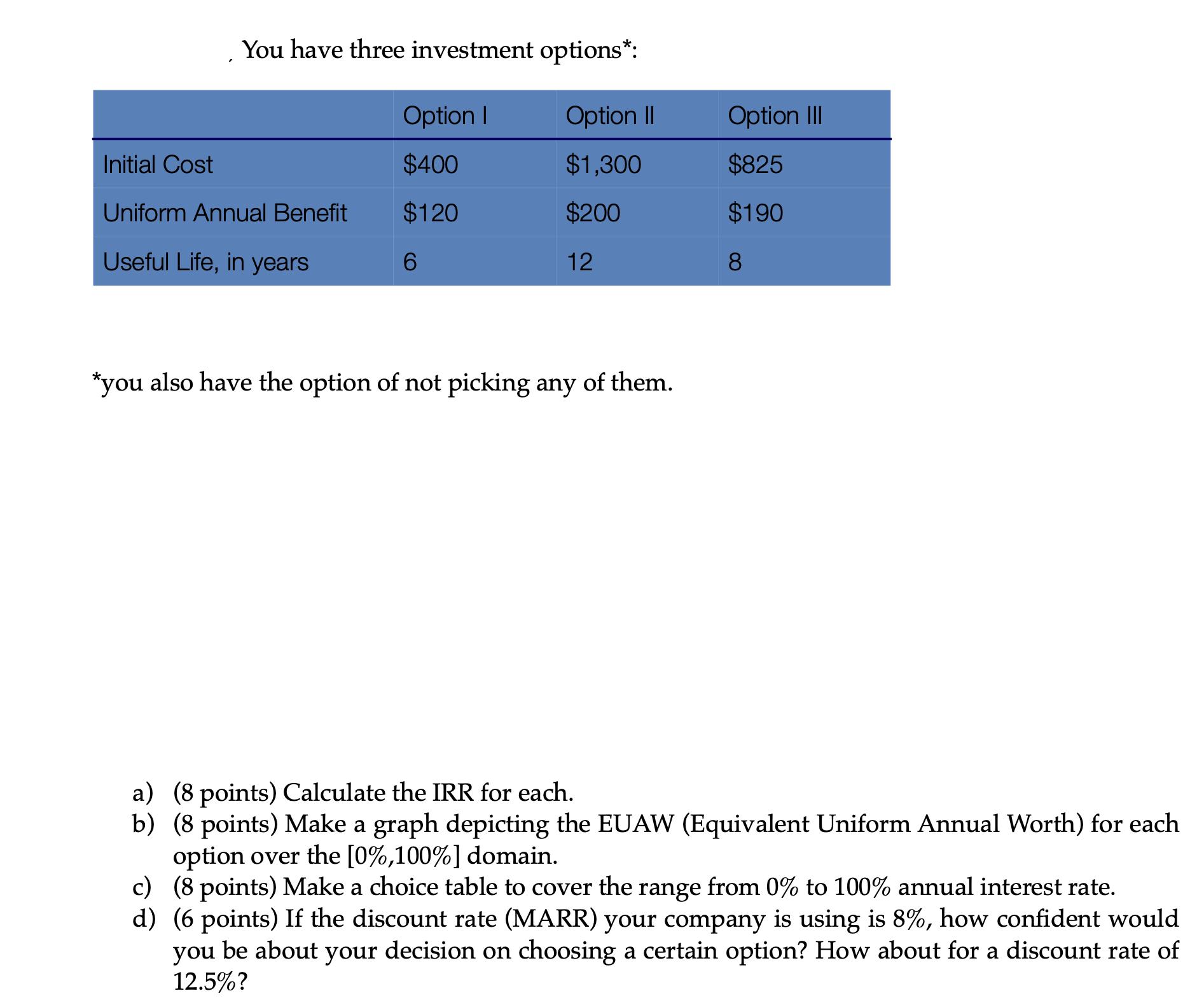

You have three investment options*: Option I Option II Option III Initial Cost $400 $1,300 $825 Uniform Annual Benefit $120 $200 $190 Useful Life, in years 6 12 8 *you also have the option of not picking any of them. a) (8 points) Calculate the IRR for each. b) (8 points) Make a graph depicting the EUAW (Equivalent Uniform Annual Worth) for each option over the [0%,100%] domain. c) (8 points) Make a choice table to cover the range from 0% to 100% annual interest rate. d) (6 points) If the discount rate (MARR) your company is using is 8%, how confident would you be about your decision on choosing a certain option? How about for a discount rate of 12.5%?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculate the IRR Internal Rate of Return for each option The IRR is the interest rate that sets the net present value NPV of all cash flows to zero ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started