Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment - Global Financial Management- Due Oct 2 - Microsoft Word The following companies' shares and options trade at the identified prices. The options have

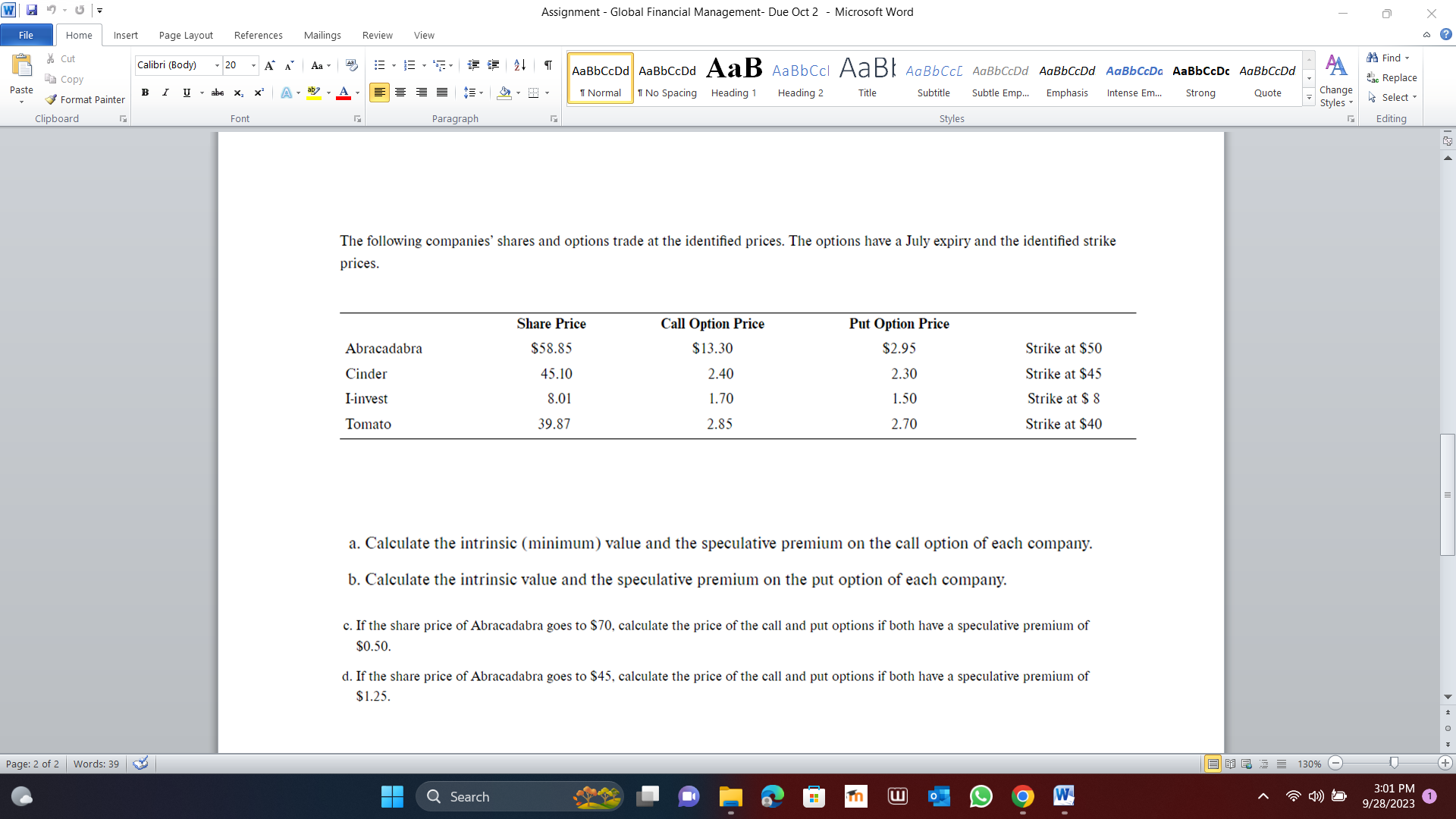

Assignment - Global Financial Management- Due Oct 2 - Microsoft Word The following companies' shares and options trade at the identified prices. The options have a July expiry and the identified strike prices. a. Calculate the intrinsic (minimum) value and the speculative premium on the call option of each company. b. Calculate the intrinsic value and the speculative premium on the put option of each company. c. If the share price of Abracadabra goes to $70, calculate the price of the call and put options if both have a speculative premium of $0.50. d. If the share price of Abracadabra goes to $45, calculate the price of the call and put options if both have a speculative premium of $1.25

Assignment - Global Financial Management- Due Oct 2 - Microsoft Word The following companies' shares and options trade at the identified prices. The options have a July expiry and the identified strike prices. a. Calculate the intrinsic (minimum) value and the speculative premium on the call option of each company. b. Calculate the intrinsic value and the speculative premium on the put option of each company. c. If the share price of Abracadabra goes to $70, calculate the price of the call and put options if both have a speculative premium of $0.50. d. If the share price of Abracadabra goes to $45, calculate the price of the call and put options if both have a speculative premium of $1.25 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started