Answered step by step

Verified Expert Solution

Question

1 Approved Answer

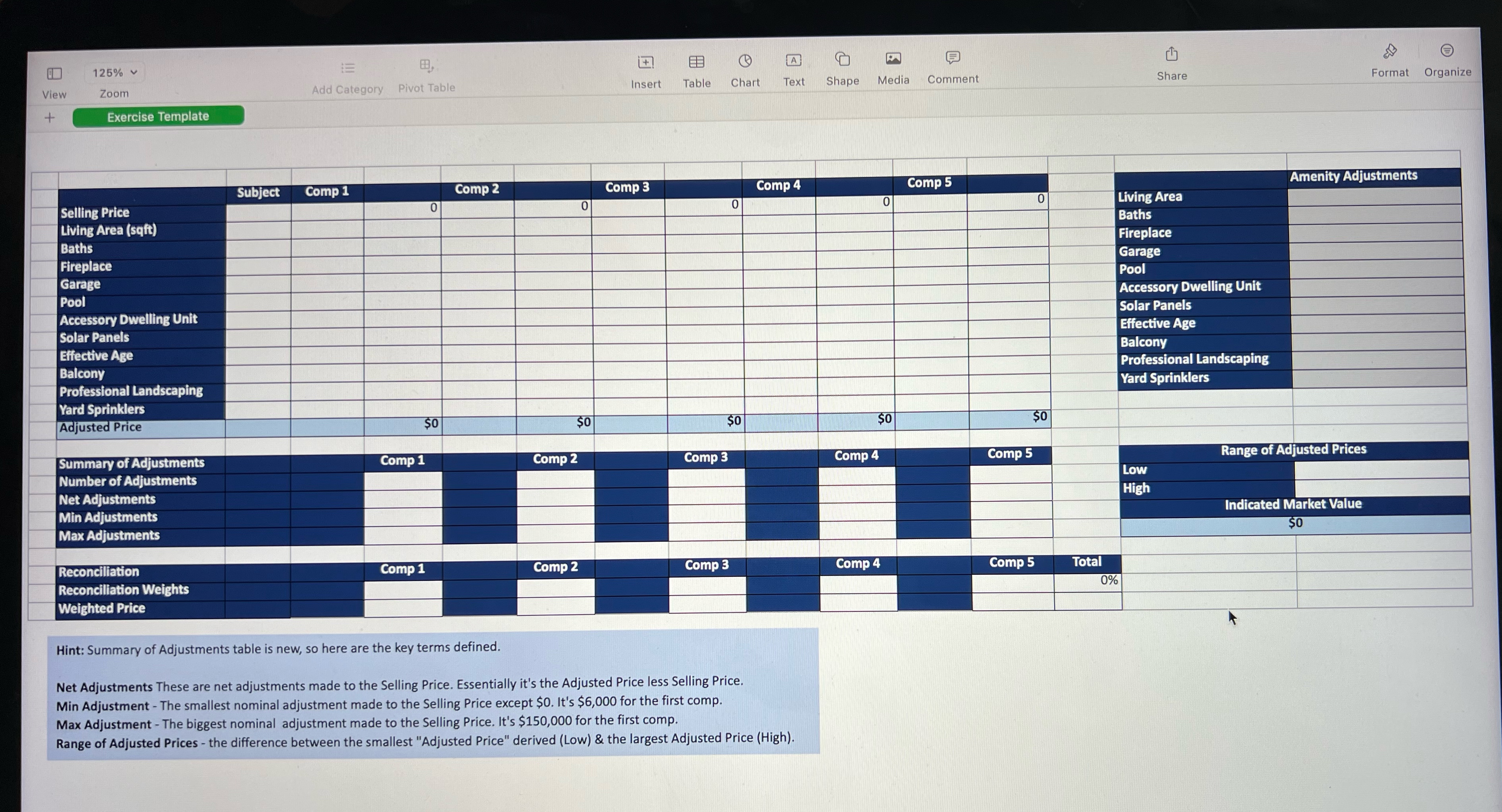

Assignment Instructions 1 . Your TaskWelcome to this single - family home valuation assignment! Here you will build your skills in valuing single - family

Assignment Instructions Your TaskWelcome to this singlefamily home valuation assignment! Here you will build your skills in valuing singlefamily homes using the sales comparison approach.Imagine you are working as an appraiser and have been asked by your client the lender to complete an appraisal for a getaway house called Valley Views shown belowYou have done your own indepth market research and gathered five comparable properties to determine afair price for the house.Your task: Calculate the subject property's market value using the sales comparison method AssumptionsGeneral assumptions: All properties are located in the same neighborhood. Comparable properties were sold in the last six months. Comparable transactions are feesimple and use conventional financing.Valueadded assumptions: Living area: $sf Bathrooms: $ Effective Age: $ The effective age of the subject property and comparables is years. The effective age of comparable is years. The market indicates an age adjustment is necessary for years of $ Fireplace: $ Garage: $ Pool: $ Accessory Dwelling Unit: $ Solar Panels: $ Balcony: $ Professional Landscaping: $ Yard Sprinklers: $Reconciliation Weights: Comparable : Comparable : Comparable : Comparable : Comparable : Instructions Download the Valuation Template, Comparable Properties, and Subject Property files. Review the information provided and find the indicated market value of the subject property using the sales comparison approach. Fill in the given information for the comparable and subject properties in the corresponding columns. For example, the information for the subject property would go under the "Subject" column in the table. In the Amenity Adjustments table to the right, fill in the given valueadded assumptions. Using the information in the Amenity Adjustments table calculate the adjustments for each comparable next to the corresponding amenity. The table will automatically calculate the sum of your adjustments. After you calculate the adjusted price of each comparable fill in the remaining tables. In the reconciliation table fill in the given reconciliation weights for each comparable. Hint: multiply the weight by the adjusted value for each comp to calculate indicated market value of the subject property Calculate the indicated market value of the subject property. Once you complete the Valuation Template, complete the Tell Us Your Answers". This is a series of multiplechoice questions about the Valuation Template you've just completed along with theoretical questions about the sales comparison approach to valuation Upload your completed Valuation Template in Upload Your Work Here" If you get stuck, take a look at the video content & practice problems in the following module: Valuation Approach Sales Cost & IncomeHint: Summary of Adjustments table is new, so here are the key terms defined.

Net Adjustments These are net adjustments made to the Selling Price. Essentially it's the Adjusted Price less Selling Price.

Min Adjustment The smallest nominal adjustment made to the Selling Price except $ It's $ for the first comp.

Max Adjustment The biggest nominal adjustment made to the Selling Price. It's $ for the first comp.

Range of Adjusted Prices the difference between the smallest "Adjusted Price" derived Low & the largest Adjusted Price High

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started