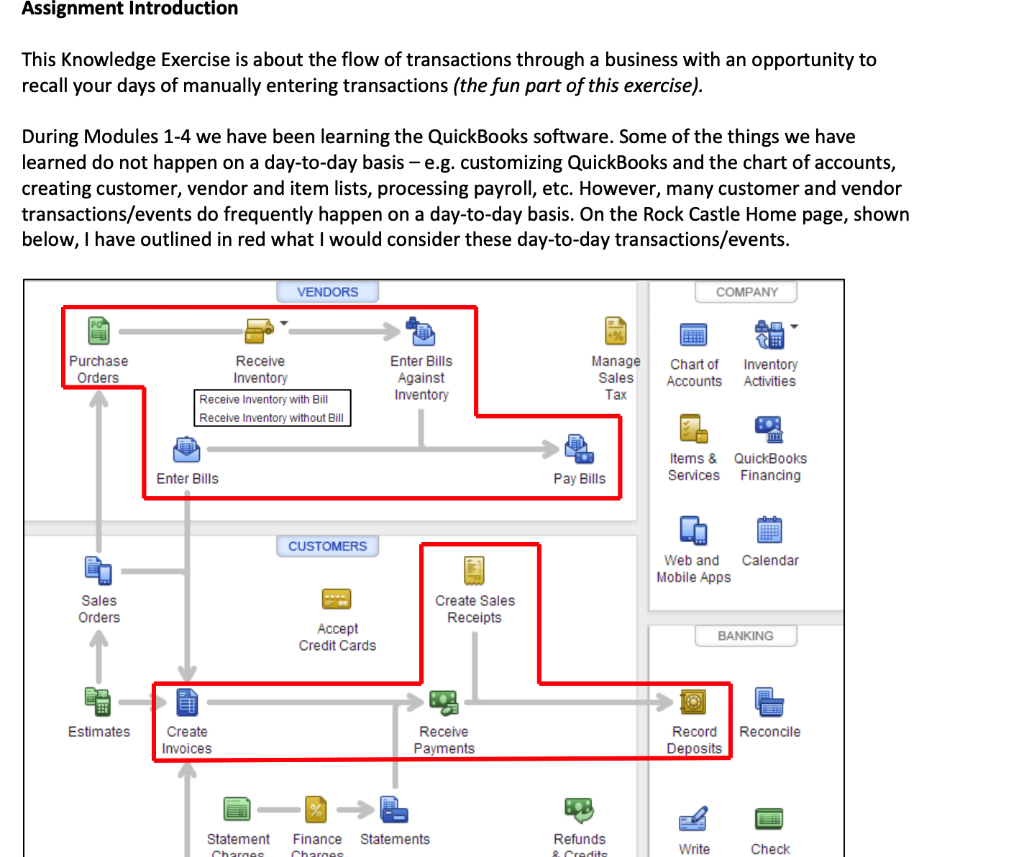

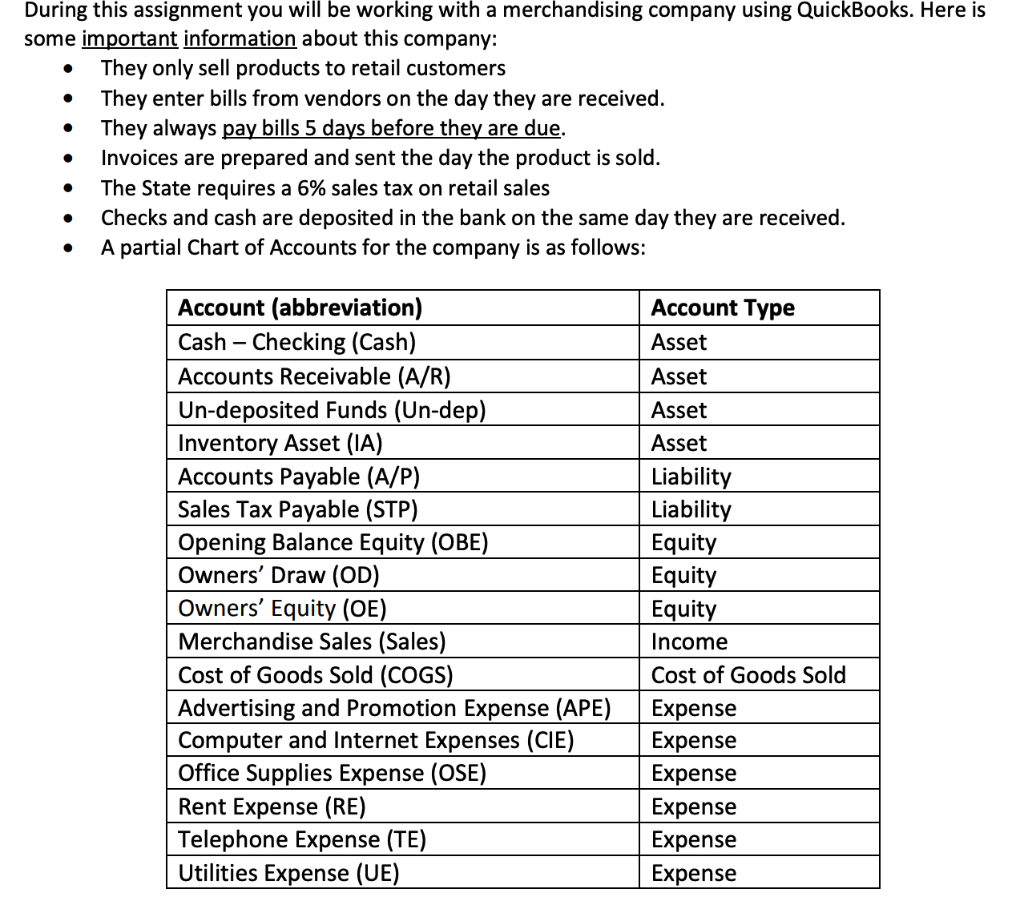

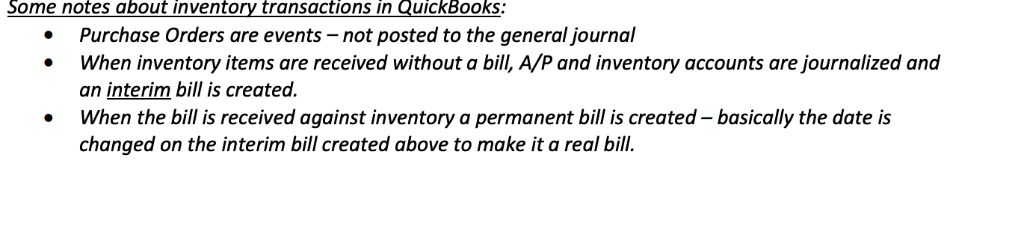

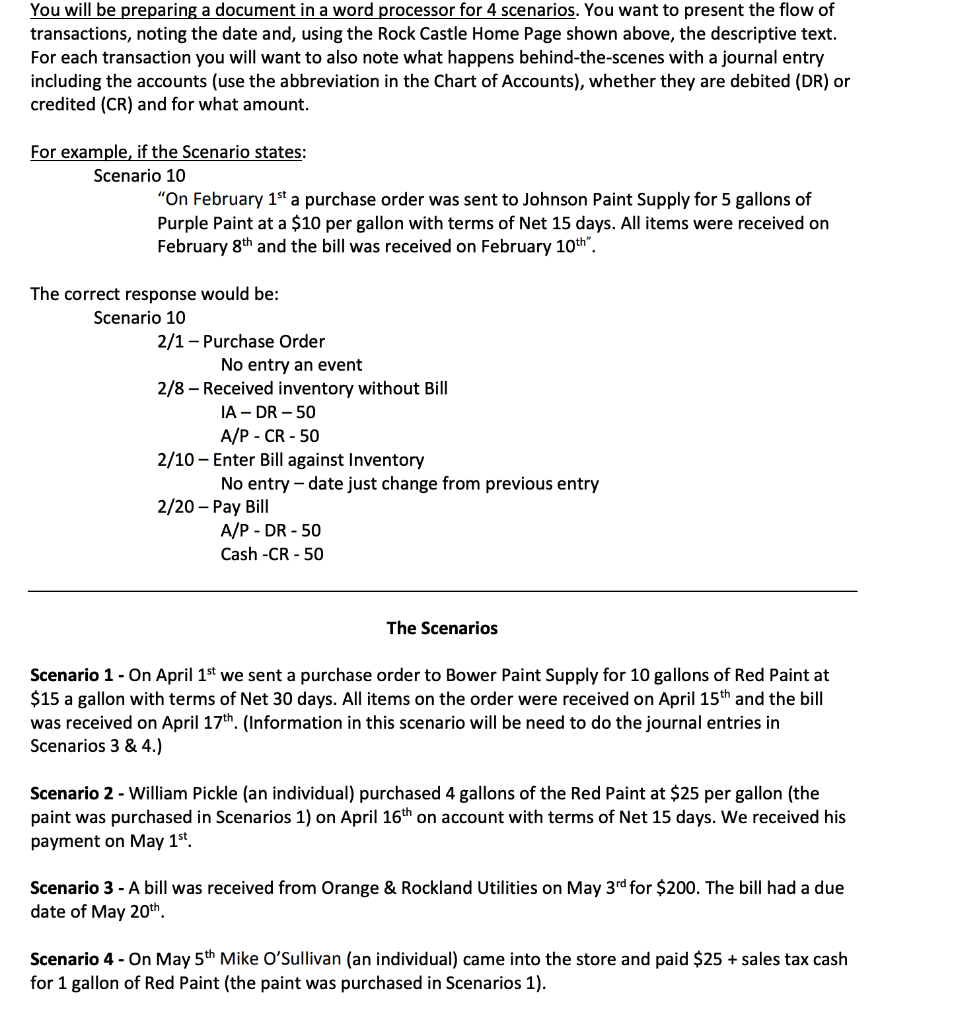

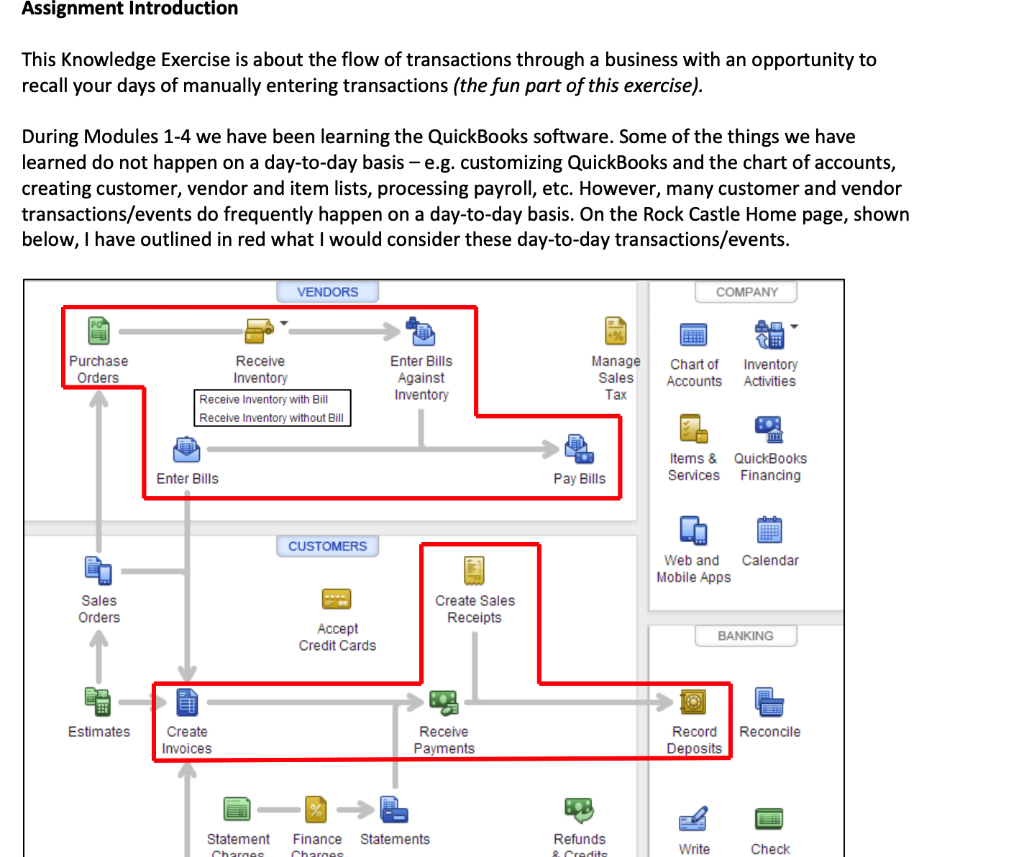

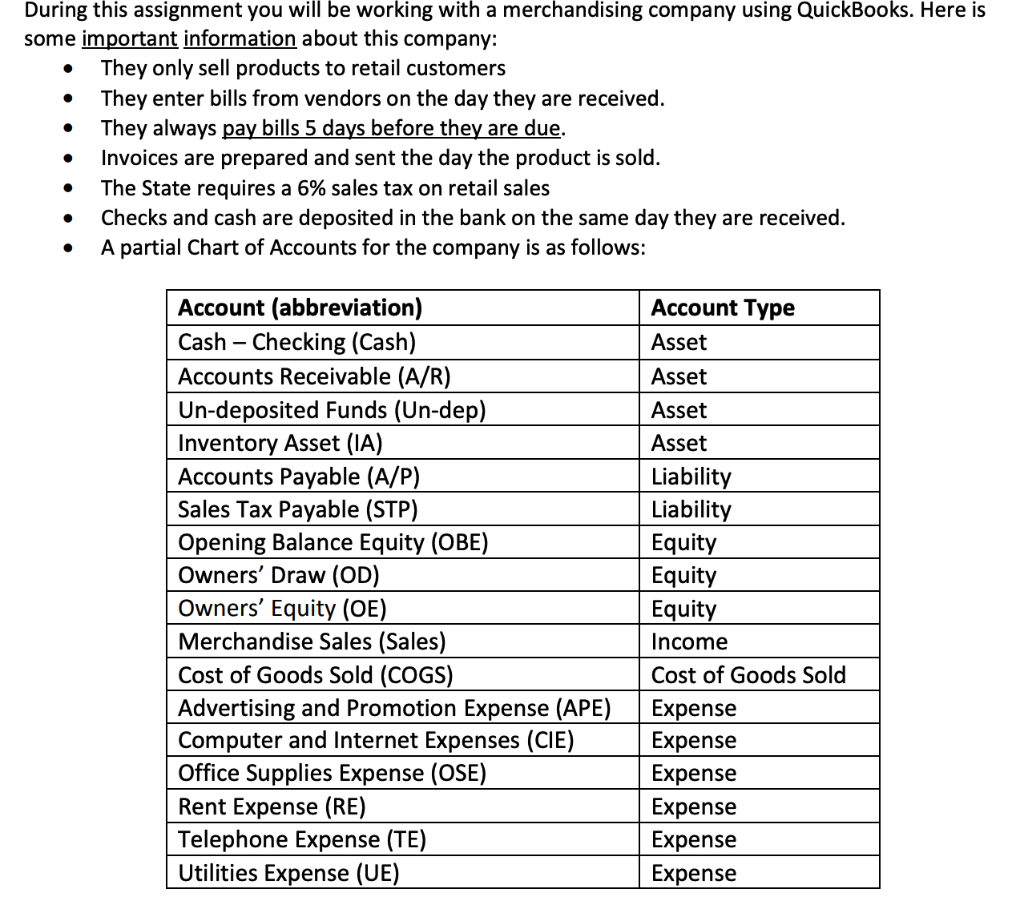

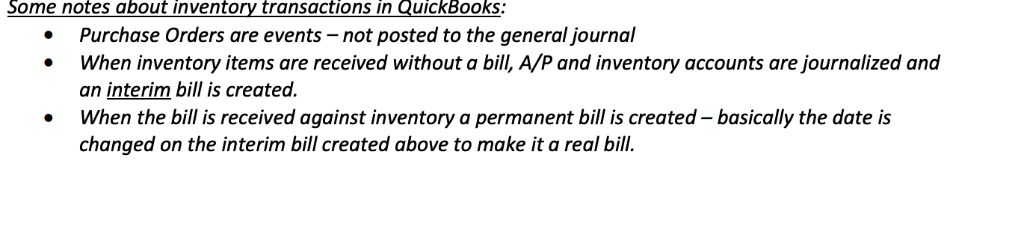

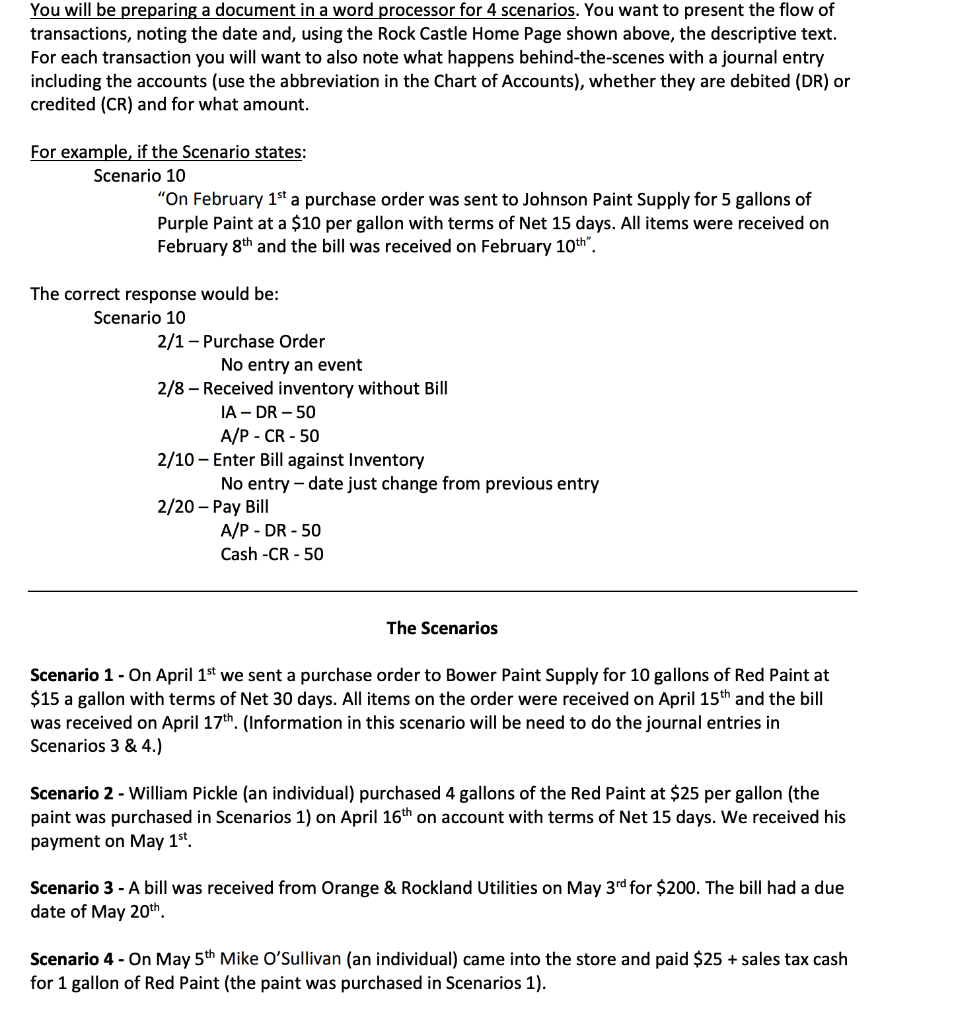

Assignment Introduction This Knowledge Exercise is about the flow of transactions through a business with an opportunity to recall your days of manually entering transactions (the fun part of this exercise) During Modules 1-4 we have been learning the QuickBooks software. Some of the things we have learned do not happen on a day-to-day basis e.g. customizing QuickBooks and the chart of accounts, creating customer, vendor and item lists, processing payroll, etc. However, many customer and vendor transactions/events do frequently happen on a day-to-day basis. On the Rock Castle Home page, shown below, I have outlined in red what I would consider these day-to-day transactions/events VENDORS COMPANY Purchase Orders Receive Inventory Receive Inventory with Bill ManageChart of Inventony Enter Bills Against Inventory Sales AccountsActivities Tax Receive Inventory without Bill tems & QuickBooks Services Financing Enter Bills Pay Bills CUSTOMERS Web and Calendar Mobile Apps Sales Orders Create Sales Receipts Accept Credit Cards BANKING Estimates Create Invoices Receive Payments RecordReconcile Deposits Statement Finance Statements Refunds Write Check During this assignment you will be working with a merchandising company using QuickBooks. Here is some important information about this company: . They only sell products to retail customers They enter bills from vendors on the day they are received. They always pay bills 5 days before they are due. Invoices are prepared and sent the day the product is sold. The State requires a 6% sales tax on retail sales Checks and cash are deposited in the bank on the same day they are received. A partial Chart of Accounts for the company is as follows: . . Account (abbreviation) Cash Checking (Cash) Accounts Receivable (A/R) Un-deposited Funds (Un-dep) Inventory Asset (IA) Accounts Payable (A/P) Sales Tax Payable (STP) Opening Balance Equity (OBE) Owners' Draw (OD) Owners' Equity (OE) Merchandise Sales (Sales) Cost of Goods Sold (COGS) Advertising and Promotion Expense (APE) xpense Computer and Internet Expenses (CIE) Office Supplies Expense (OSE) Rent Expense (RE) Telephone Expense (TE) Utilities Expense (UE) Account Type Asset Asset Asset Asset Liability Liability Equity Equity Equity Income Cost of Goods Sold Expense Expense Expense Expense Expense Some notes about inventory transactions in QuickBooks Purchase Orders are events -not posted to the general journal an interim bill is created. changed on the interim bill created above to make it a real bill. .When inventory items are received without a bill, A/P and inventory accounts are journalized and . When the bill is received against inventory a permanent bill is created - basically the date is You will be preparing a document in a word processor for 4 scenarios. You want to present the flow of transactions, noting the date and, using the Rock Castle Home Page shown above, the descriptive text For each transaction you will want to also note what happens behind-the-scenes with a journal entry including the accounts (use the abbreviation in the Chart of Accounts), whether they are debited (DR) or credited (CR) and for what amount For example, if the Scenario states: Scenario 10 "On February 15t a purchase order was sent to Johnson Paint Supply for 5 gallons of Purple Paint at a $10 per gallon with terms of Net 15 days. All items were received on February 8th and the bill was received on February 10h The correct response would be Scenario 10 2/1- Purchase Order No entry an event 2/8 - Received inventory without Bill IA - DR -50 A/P - CR - 50 No entry -date just change from previous entry A/P - DR - 50 2/10 - Enter Bill against Inventory 2/20- Pay Bill Cash -CR- 50 The Scenarios Scenario 1- On April 1st we sent a purchase order to Bower Paint Supply for 10 gallons of Red Paint at $15 a gallon with terms of Net 30 days. All items on the order were received on April 15th and the bill was received on April 17th. (Information in this scenario will be need to do the journal entries in Scenarios 3 & 4.) Scenario 2 - William Pickle (an individual) purchased 4 gallons of the Red Paint at $25 per gallon (the paint was purchased in Scenarios 1) on April 16th on account with terms of Net 15 days. We received his payment on May 1st. Scenario 3 - A bill was received from Orange & Rockland Utilities on May 3rd for $200. The bill had a due date of May 20th, Scenario 4 - On May 5th Mike O'Sullivan (an individual) came into the store and paid $25+sales tax cash for 1 gallon of Red Paint (the paint was purchased in Scenarios 1)