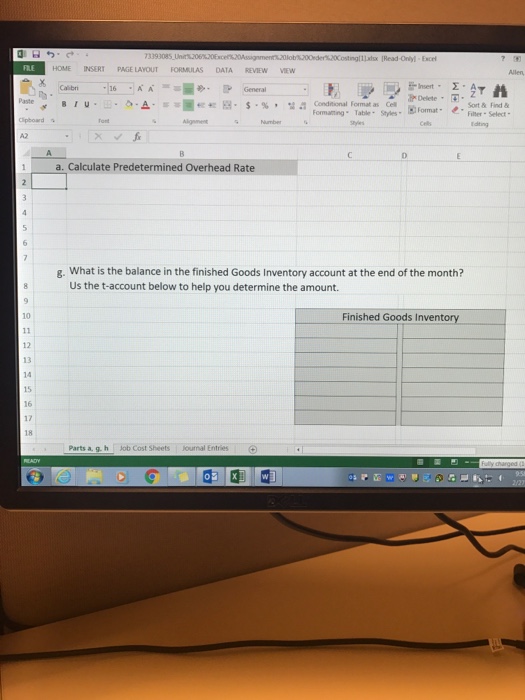

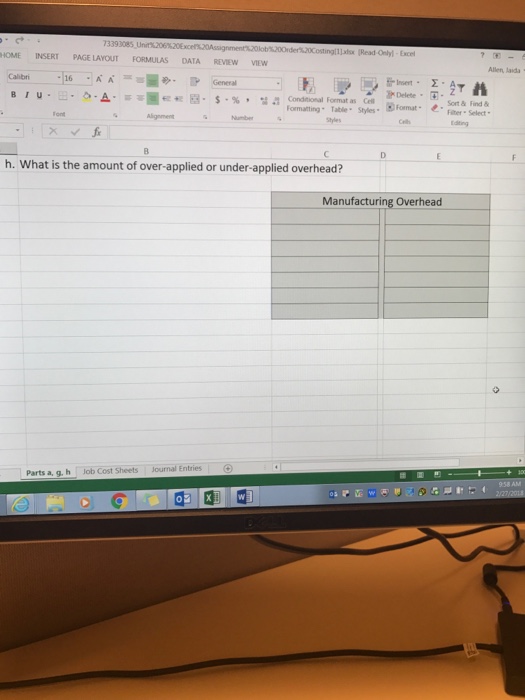

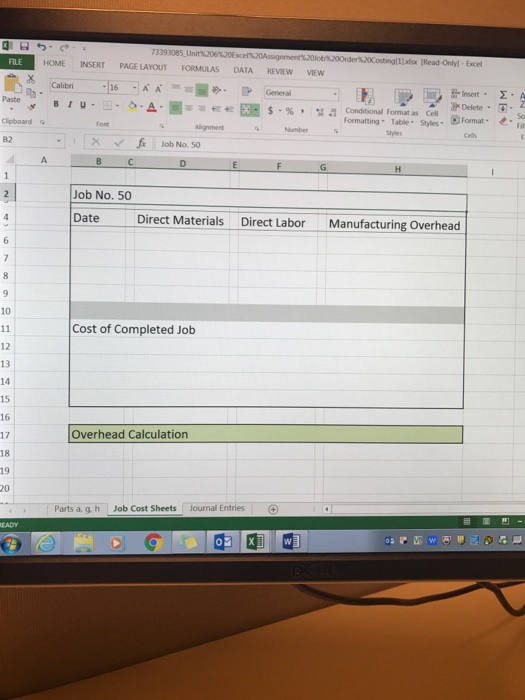

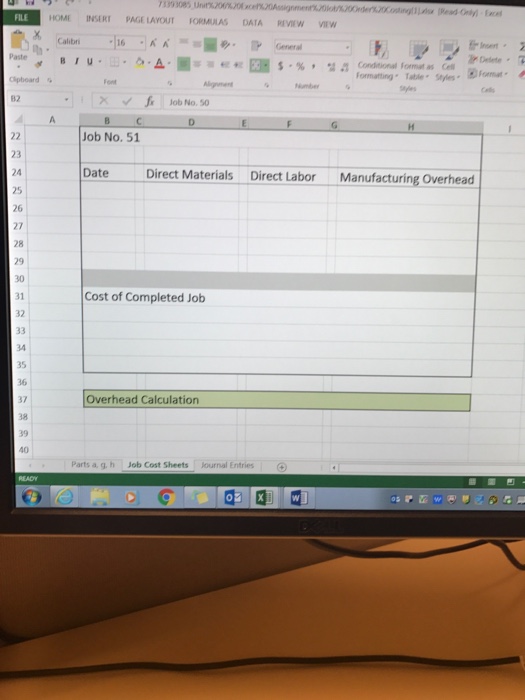

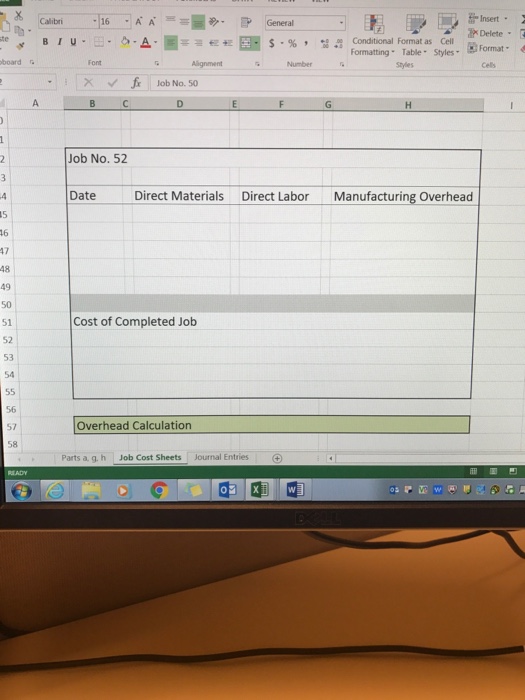

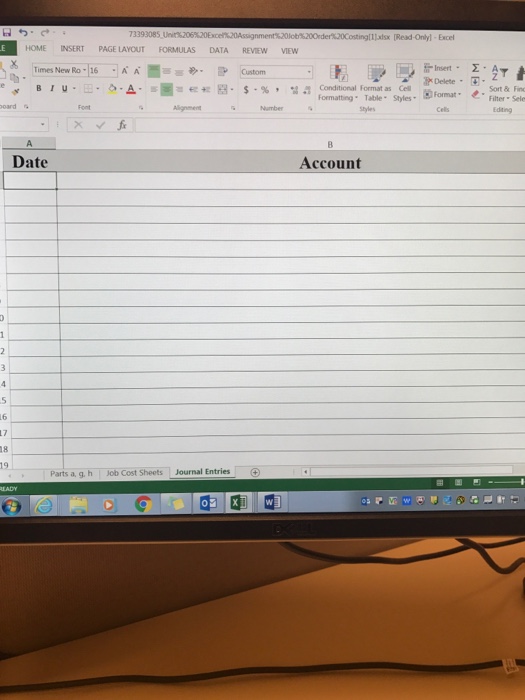

Assignment -Job Order Costing s. On January 1, 2014, Job No. 50 direct materials $20,000, direct labor $12,000, and AMBC Company uses a job order cost system and applies overbead to production on the basis of was the only job in process The costs incurred prior to January 1 on this job were as follows: manufacturing overhead $16,000. As of January 1, Job No.49 had been completed at a cost of $90,000 and was part of There was a $15,000 halance in the Raw Materials Inventory account During the month of January, ABC Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on accoust during the month for $122,000 and $158,000, respectively. The followin g additional events occurred during the month 1 Parchased additional raw materials of $90,000 on account 2. Incurred factory labor costs of $70,000. of this amount $16,000 related to employer payroll taxes 3. Incurred manufacturing overhead costs as follows indirect materials $17,000; indirect labor $20,000; depreciation expense on equipment $19,000, and various other manufacturing overhead costs on account $16,000 Assigned direct materials and direct labor to jobs as follows Nl answers will be eetered in the Excel Spreadsheet that you will download. The spreadsheet has tabs labeled for the different parts of the lem. 0ece you have compl esed the problem, you will upload the spreadsheet to the Uni16 Assignment #4 Drop hat You must upload the fie belore 1159 pm on Tuesday Calculate the predetermined overhead rate for 2014 assuming AIC Company estimates total manufacturing overhead costs of $980,000 direct lahor costs of $700,000; and direct labor hours of 20,000 for the year b. Open job cont sheets for Jobs S0, 51, and 52. Enter the January 1 balances on the jolb cost sheet for Job No. 50o W E @. AIR Ctri Pae Assignment -Job Order Costing s. On January 1, 2014, Job No. 50 direct materials $20,000, direct labor $12,000, and AMBC Company uses a job order cost system and applies overbead to production on the basis of was the only job in process The costs incurred prior to January 1 on this job were as follows: manufacturing overhead $16,000. As of January 1, Job No.49 had been completed at a cost of $90,000 and was part of There was a $15,000 halance in the Raw Materials Inventory account During the month of January, ABC Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on accoust during the month for $122,000 and $158,000, respectively. The followin g additional events occurred during the month 1 Parchased additional raw materials of $90,000 on account 2. Incurred factory labor costs of $70,000. of this amount $16,000 related to employer payroll taxes 3. Incurred manufacturing overhead costs as follows indirect materials $17,000; indirect labor $20,000; depreciation expense on equipment $19,000, and various other manufacturing overhead costs on account $16,000 Assigned direct materials and direct labor to jobs as follows Nl answers will be eetered in the Excel Spreadsheet that you will download. The spreadsheet has tabs labeled for the different parts of the lem. 0ece you have compl esed the problem, you will upload the spreadsheet to the Uni16 Assignment #4 Drop hat You must upload the fie belore 1159 pm on Tuesday Calculate the predetermined overhead rate for 2014 assuming AIC Company estimates total manufacturing overhead costs of $980,000 direct lahor costs of $700,000; and direct labor hours of 20,000 for the year b. Open job cont sheets for Jobs S0, 51, and 52. Enter the January 1 balances on the jolb cost sheet for Job No. 50o W E @. AIR Ctri Pae