Answered step by step

Verified Expert Solution

Question

1 Approved Answer

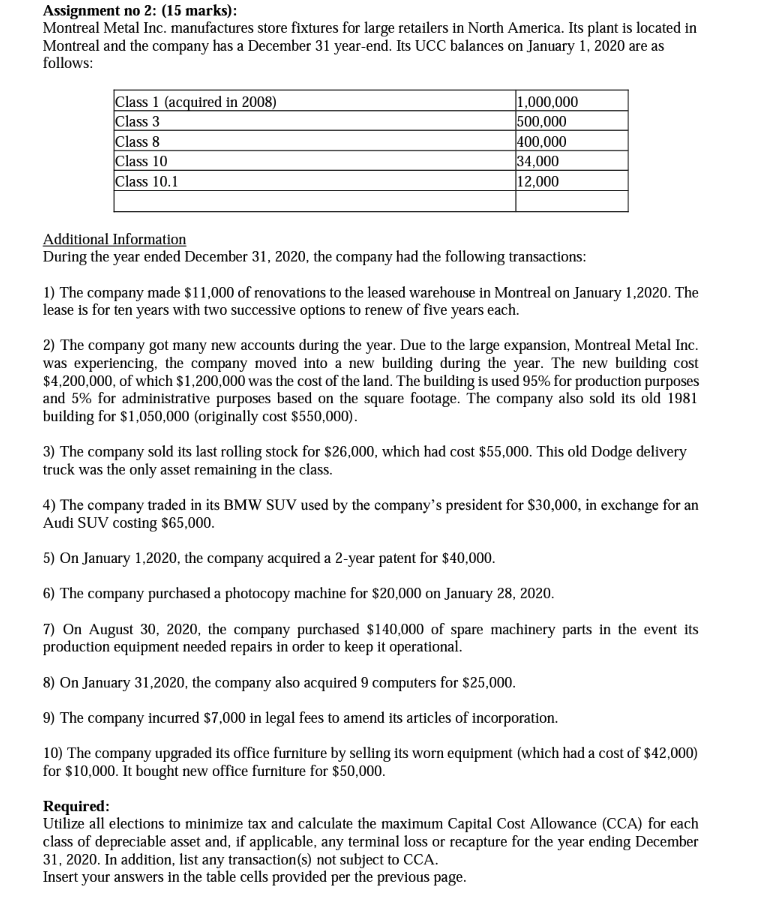

Assignment no 2: (15 marks): Montreal Metal Inc. manufactures store fixtures for large retailers in North America. Its plant is located in Montreal and the

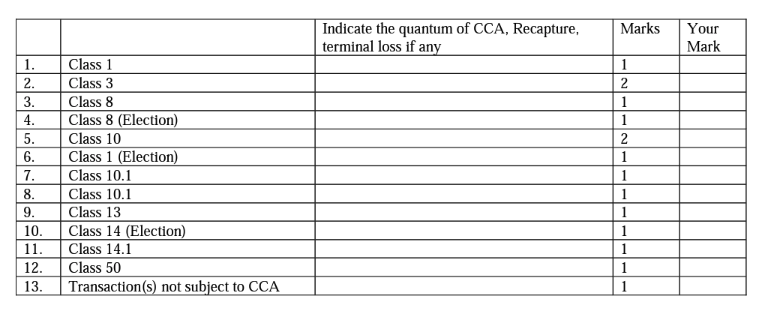

Assignment no 2: (15 marks): Montreal Metal Inc. manufactures store fixtures for large retailers in North America. Its plant is located in Montreal and the company has a December 31 year-end. Its UCC balances on January 1,2020 are as follows: Additional Information During the year ended December 31, 2020, the company had the following transactions: 1) The company made $11,000 of renovations to the leased warehouse in Montreal on January 1,2020 . The lease is for ten years with two successive options to renew of five years each. 2) The company got many new accounts during the year. Due to the large expansion, Montreal Metal Inc. was experiencing, the company moved into a new building during the year. The new building cost $4,200,000, of which $1,200,000 was the cost of the land. The building is used 95% for production purposes and 5% for administrative purposes based on the square footage. The company also sold its old 1981 building for $1,050,000 (originally cost $550,000 ). 3) The company sold its last rolling stock for $26,000, which had cost $55,000. This old Dodge delivery truck was the only asset remaining in the class. 4) The company traded in its BMW SUV used by the company's president for $30,000, in exchange for an Audi SUV costing $65,000. 5) On January 1,2020 , the company acquired a 2-year patent for $40,000. 6) The company purchased a photocopy machine for $20,000 on January 28, 2020. 7) On August 30, 2020, the company purchased $140,000 of spare machinery parts in the event its production equipment needed repairs in order to keep it operational. 8) On January 31,2020 , the company also acquired 9 computers for $25,000. 9) The company incurred $7,000 in legal fees to amend its articles of incorporation. 10) The company upgraded its office furniture by selling its worn equipment (which had a cost of $42,000 ) for $10,000. It bought new office furniture for $50,000. Required: Utilize all elections to minimize tax and calculate the maximum Capital Cost Allowance (CCA) for each class of depreciable asset and, if applicable, any terminal loss or recapture for the year ending December 31,2020 . In addition, list any transaction(s) not subject to CCA. \begin{tabular}{|l|l|l|l|l|} \hline & & \begin{tabular}{l} Indicate the quantum of CCA, Recapture, \\ terminal loss if any \end{tabular} & Marks & \begin{tabular}{l} Your \\ Mark \end{tabular} \\ \hline 1. & Class 1 & & 1 & \\ \hline 2. & Class 3 & & 2 & \\ \hline 3. & Class 8 & & 1 & \\ \hline 4. & Class 8 (Election) & & 1 & \\ \hline 5. & Class 10 & & 2 & \\ \hline 6. & Class 1 (Election) & & 1 & \\ \hline 7. & Class 10.1 & & 1 & \\ \hline 8. & Class 10.1 & & 1 & \\ \hline 9. & Class 13 & & 1 & \\ \hline 10. & Class 14 (Election) & & 1 & \\ \hline 11. & Class 14.1 & 1 & \\ \hline 12. & Class 50 & 1 & \\ \hline 13. & Transaction(s) not subject to CCA & & 1 & \\ \hline \end{tabular}

Assignment no 2: (15 marks): Montreal Metal Inc. manufactures store fixtures for large retailers in North America. Its plant is located in Montreal and the company has a December 31 year-end. Its UCC balances on January 1,2020 are as follows: Additional Information During the year ended December 31, 2020, the company had the following transactions: 1) The company made $11,000 of renovations to the leased warehouse in Montreal on January 1,2020 . The lease is for ten years with two successive options to renew of five years each. 2) The company got many new accounts during the year. Due to the large expansion, Montreal Metal Inc. was experiencing, the company moved into a new building during the year. The new building cost $4,200,000, of which $1,200,000 was the cost of the land. The building is used 95% for production purposes and 5% for administrative purposes based on the square footage. The company also sold its old 1981 building for $1,050,000 (originally cost $550,000 ). 3) The company sold its last rolling stock for $26,000, which had cost $55,000. This old Dodge delivery truck was the only asset remaining in the class. 4) The company traded in its BMW SUV used by the company's president for $30,000, in exchange for an Audi SUV costing $65,000. 5) On January 1,2020 , the company acquired a 2-year patent for $40,000. 6) The company purchased a photocopy machine for $20,000 on January 28, 2020. 7) On August 30, 2020, the company purchased $140,000 of spare machinery parts in the event its production equipment needed repairs in order to keep it operational. 8) On January 31,2020 , the company also acquired 9 computers for $25,000. 9) The company incurred $7,000 in legal fees to amend its articles of incorporation. 10) The company upgraded its office furniture by selling its worn equipment (which had a cost of $42,000 ) for $10,000. It bought new office furniture for $50,000. Required: Utilize all elections to minimize tax and calculate the maximum Capital Cost Allowance (CCA) for each class of depreciable asset and, if applicable, any terminal loss or recapture for the year ending December 31,2020 . In addition, list any transaction(s) not subject to CCA. \begin{tabular}{|l|l|l|l|l|} \hline & & \begin{tabular}{l} Indicate the quantum of CCA, Recapture, \\ terminal loss if any \end{tabular} & Marks & \begin{tabular}{l} Your \\ Mark \end{tabular} \\ \hline 1. & Class 1 & & 1 & \\ \hline 2. & Class 3 & & 2 & \\ \hline 3. & Class 8 & & 1 & \\ \hline 4. & Class 8 (Election) & & 1 & \\ \hline 5. & Class 10 & & 2 & \\ \hline 6. & Class 1 (Election) & & 1 & \\ \hline 7. & Class 10.1 & & 1 & \\ \hline 8. & Class 10.1 & & 1 & \\ \hline 9. & Class 13 & & 1 & \\ \hline 10. & Class 14 (Election) & & 1 & \\ \hline 11. & Class 14.1 & 1 & \\ \hline 12. & Class 50 & 1 & \\ \hline 13. & Transaction(s) not subject to CCA & & 1 & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started