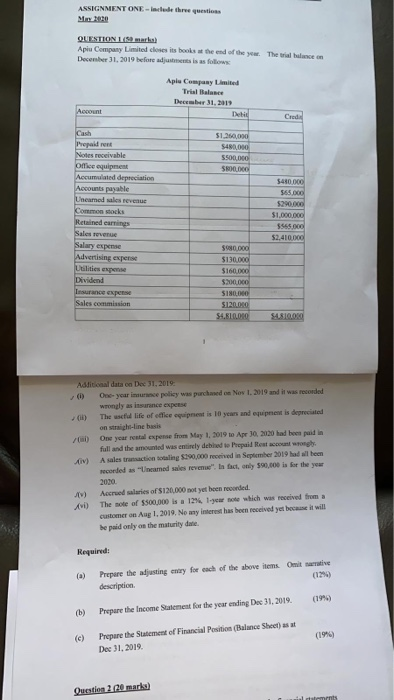

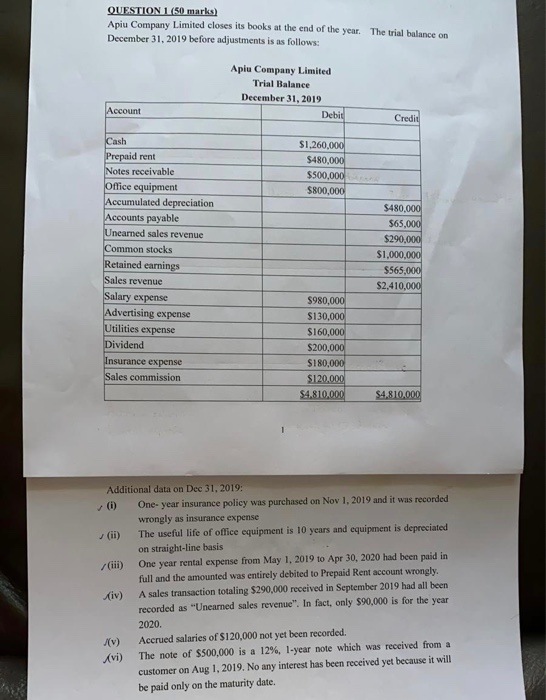

ASSIGNMENT ONE-include three questions M2020 QUESTIONS marka Aplu Company Limited coses is books at the end of the you. The wil Wence December 1, 2019 before adjustments is as follows Aplu Company Limited Trial Balance December 31, 2019 Debil Account Cred 51.300,000 $480,000 5500,000 SHOD $450.000 365.000 Cash Prepaid rent Notes receivable office equipment Accumulated depreciation Accounts payable Uneamed sales revenus Common stocks Retained earnings Sales revenue Salary expense Advertising expense ilities expense Dividend $1.000.000 5565.000 52,410.000 S0000 $130.000 $160.000 $200,000 $180,000 $120.00 54.610.000 Sales commission S48100 (1) Additional data on Dec 31, 2019 One year imurce policy was purchased on Nov 1, 2019 and it was recorded wrongly assurance expense The life of effice equipment is 10 years and equipment is deprecated on straight-line basis One year routal expense from May 1, 2019 to Apr 30, 2020 had been paid in full and the amounted was entirely debhed to Prepaid Rent account only A sales transaction totaling $190,000 received in September 2019 had wil teen Recorded as "Uneamed sales revenue". In fact, only $90,000 is for the year 2030 Accrued salaries of $120,000 not yet been recorded. VD) The note of $500,000 is a 12%. 1 year to which was received from a customer on Aug 1, 2019. No any interest has been received yet because it will be paid only on the maturity dute. Required: (a Prepare the adjusting way for each of the above items. Omit native description (1995) (b) Prepare the Income Statement for the year ending Dec 31, 2019. (c) Prepare the Statement of Financial Position (Balance Sheet) as at Dec 31, 2019 Question 2 20 marks) mnts QUESTION 1 (50 marks) Apiu Company Limited closes its books at the end of the year. The trial balance on December 31, 2019 before adjustments is as follows: Apiu Company Limited Trial Balance December 31, 2019 Debid Account Credid $1,260,000 $480,000 $500,000 $800,000 Cash Prepaid rent Notes receivable Office equipment Accumulated depreciation Accounts payable Uneamed sales revenue Common stocks Retained earnings Sales revenue Salary expense Advertising expense Utilities expense Dividend Insurance expense Sales commission $480,000 $65.000 $290,000 $1,000,000 $565,000 $2,410,000 $980,000 $130,000 $160,000 $200,000 $180,000 $120,000 $4.810,000 $4.810.000 (iii) Additional data on Dec 31, 2019: One year insurance policy was purchased on Nov 1, 2019 and it was recorded wrongly as insurance expense The useful life of office equipment is 10 years and equipment is depreciated on straight-line basis One year rental expense from May 1, 2019 to Apr 30, 2020 had been paid in full and the amounted was entirely debited to Prepaid Rent account wrongly. xiv) A sales transaction totaling $290,000 received in September 2019 had all been recorded as "Unearned sales revenue". In fact, only $90,000 is for the year 2020. (V) Accrued salaries of $120,000 not yet been recorded. The note of $500,000 is a 12%, 1-year note which was received from a customer on Aug 1, 2019. No any interest has been received yet because it will be paid only on the maturity date