Answered step by step

Verified Expert Solution

Question

1 Approved Answer

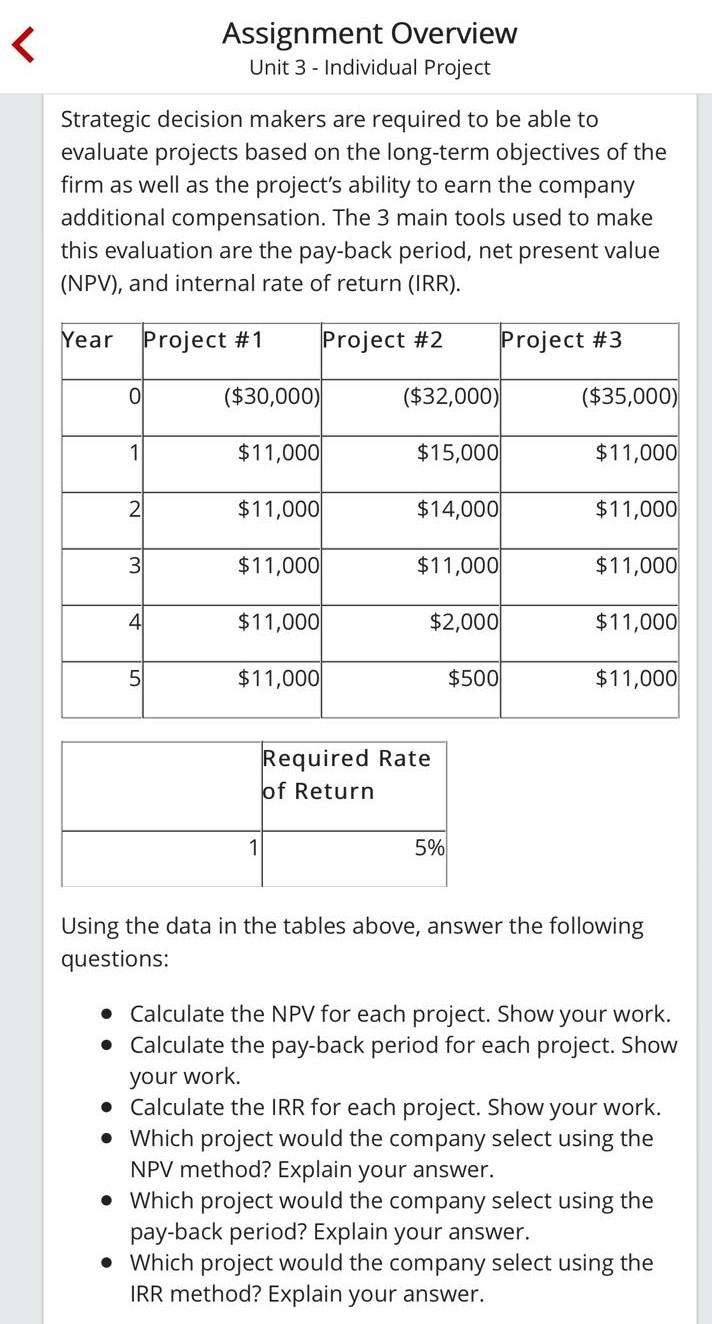

< Assignment Overview Unit 3 Individual Project Strategic decision makers are required to be able to evaluate projects based on the long-term objectives of

< Assignment Overview Unit 3 Individual Project Strategic decision makers are required to be able to evaluate projects based on the long-term objectives of the firm as well as the project's ability to earn the company additional compensation. The 3 main tools used to make this evaluation are the pay-back period, net present value (NPV), and internal rate of return (IRR). Year Project #1 Project #2 Project #3 0 ($30,000) ($32,000) ($35,000) 1 $11,000 $15,000 $11,000 2 $11,000 $14,000 $11,000 3 $11,000 $11,000 $11,000 4 $11,000 $2,000 $11,000 5 $11,000 $500 $11,000 1 Required Rate of Return 5% Using the data in the tables above, answer the following questions: Calculate the NPV for each project. Show your work. Calculate the pay-back period for each project. Show your work. Calculate the IRR for each project. Show your work. Which project would the company select using the NPV method? Explain your answer. Which project would the company select using the pay-back period? Explain your answer. Which project would the company select using the IRR method? Explain your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started