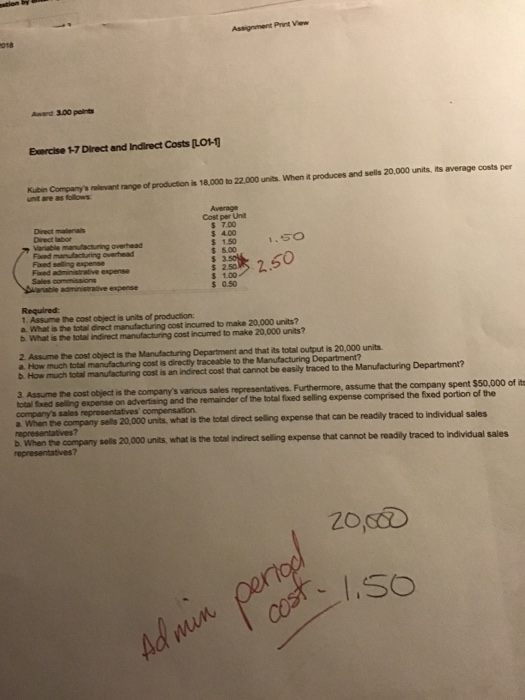

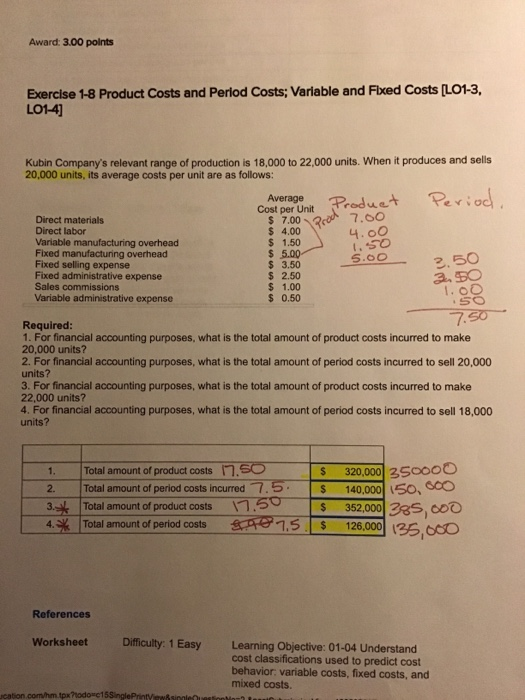

Assignment Print View 018 Award 300 points Exercise +7 Direct and Indirect Costs LO+1 Kubin Company's relevant range of production is 18,000 to 22,000 units. When it produces and sells 20,000 units, its average costs per unt are as follows Average Dieect materials Direct labor Cost per Unit s 7.00 S 1.50 $ 5.00 .50 Faxed administrative expense $ 2.50 s 1.00 $ 0.50 .5O 1. Assume the cost object is units of production: .what ste Ital dect mantacting cost named to make 20.000 urits? b. What is the total indirect manufacturing cost incurred to make 20,000 units? 2 Assume the cost object is the Manufacturing Department and that its total outout is 20,000 units. a. How much total manufacturing cost is directly traceable to the Manufacturing Department? b. How much total manufacturing cost is an indirect cost that cannot be easily traced to the Manufacturing Department? 3. Assume the cost object is the total fixed company's various sales representatives. Furthermore, assume that the company spent $50,000 of its seang excense one remainder of the total fxed selling expense comprised the fxed portion of the a When the company sells 20,000 units, what is the total direct selling expense that can be readily traced to Individual sales b. When the company sells 20,000 units, what is the total indirect selling expense that cannot be readily traced to individual sales Award: 300 points Exercise 1-8 Product Costs and Period Costs; Variable and Fixed Costs [LO1-3, LO1-4] Kubin Company's relevant range of production is 18,000 to 22,000 units. When it produces and sells 20,000 units, its average costs per unit are as follows: Average Cost per Unit Produet Pev S 7.00 S 4.00 S 1.50 -30P 7.60 4.00 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead 2.50 a. 50 Fixed selling expense S 3.50 $ 2.50 $ 1.00 S 0.50 Fixed administrative expense Sales commissions Variable administrative expense 7.50 Required 1. For financial accounting purposes, what is the total amount of product costs incurred to make 20,000 units? 2. For financial accounting purposes, what is the total amount of period costs incurred to sell 20,000 units? 3. For financial accounting purposes, what is the total amount of product costs incurred to make 22,000 units? 4. For financial accounting purposes, what is the total amount of period costs incurred to sell 18,000 units? 320,000 3500oo 1 $ 1. Total amount of product costs n 1. Total amount of product costs .B0 | Total amount of period costs incurred 75 Total amount of product costs352.000 2s. coo Total amount of period costs 2. 140,00050 4) 126-186,co References Worksheet Difficulty: 1 EasyLearning Objective: 01-04 Understand cost classifications used to predict cost behavior: variable costs, fixed costs, and mixed costs. cation.com/hm tpxtodoct