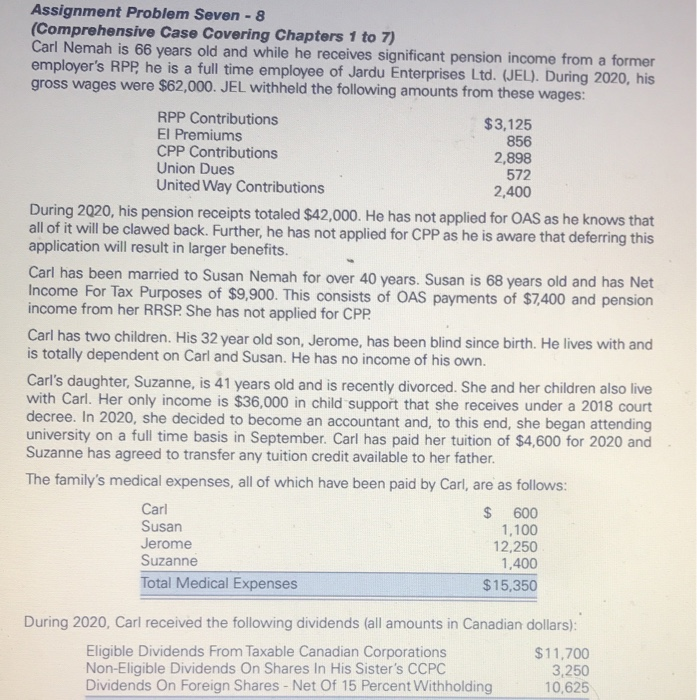

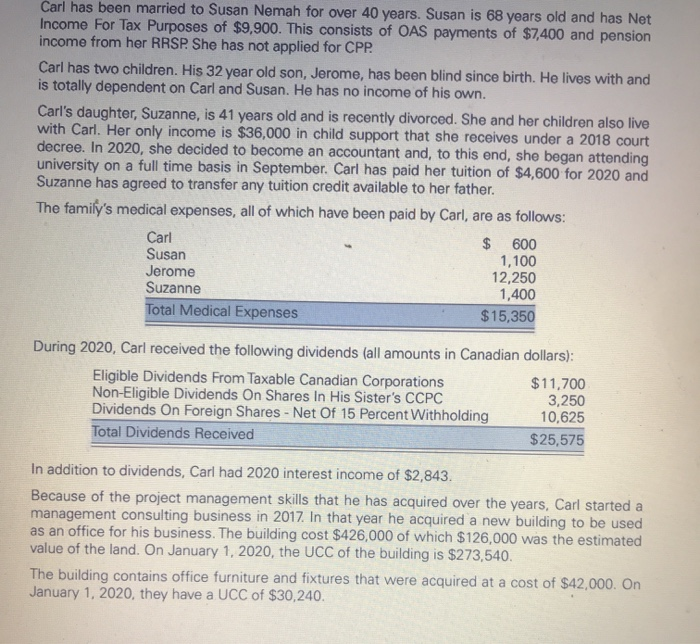

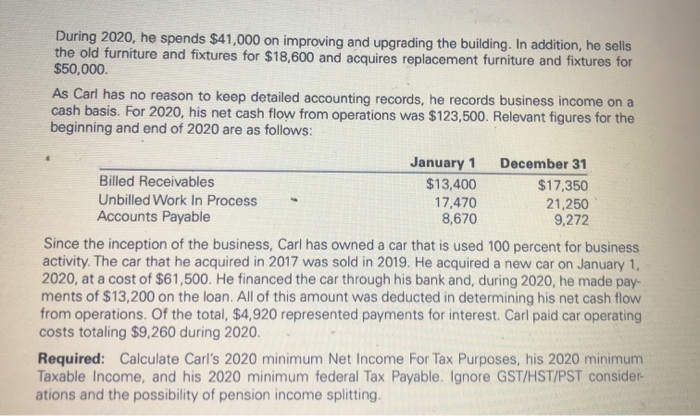

Assignment Problem Seven - 8 (Comprehensive Case Covering Chapters 1 to 7) Carl Nemah is 66 years old and while he receives significant pension income from a former employer's RPP, he is a full time employee of Jardu Enterprises Ltd. (JEL). During 2020, his gross wages were $62,000. JEL withheld the following amounts from these wages: RPP Contributions $3,125 El Premiums 856 CPP Contributions 2,898 Union Dues 572 United Way Contributions 2,400 During 2020, his pension receipts totaled $42,000. He has not applied for OAS as he knows that all of it will be clawed back. Further, he has not applied for CPP as he is aware that deferring this application will result in larger benefits. Carl has been married to Susan Nemah for over 40 years. Susan is 68 years old and has Net Income For Tax Purposes of $9,900. This consists of OAS payments of $7,400 and pension income from her RRSP. She has not applied for CPP. Carl has two children. His 32 year old son, Jerome, has been blind since birth. He lives with and is totally dependent on Carl and Susan. He has no income of his own. Carl's daughter, Suzanne, is 41 years old and is recently divorced. She and her children also live with Carl. Her only income is $36,000 in child support that she receives under a 2018 court decree. In 2020, she decided to become an accountant and, to this end, she began attending university on a full time basis in September. Carl has paid her tuition of $4,600 for 2020 and Suzanne has agreed to transfer any tuition credit available to her father. The family's medical expenses, all of which have been paid by Carl, are as follows: Carl $ 600 Susan 1,100 Jerome 12,250 Suzanne 1,400 Total Medical Expenses $15,350 During 2020, Carl received the following dividends (all amounts in Canadian dollars): Eligible Dividends From Taxable Canadian Corporations $11,700 Non-Eligible Dividends On Shares In His Sister's CCPC 3,250 Dividends On Foreign Shares - Net Of 15 Percent Withholding 10,625 Carl has been married to Susan Nemah for over 40 years. Susan is 68 years old and has Net Income For Tax Purposes of $9,900. This consists of OAS payments of $7,400 and pension income from her RRSP. She has not applied for CPP. Carl has two children. His 32 year old son, Jerome, has been blind since birth. He lives with and is totally dependent on Carl and Susan. He has no income of his own. Carl's daughter, Suzanne, is 41 years old and is recently divorced. She and her children also live with Carl. Her only income is $36,000 in child support that she receives under a 2018 court decree. In 2020, she decided to become an accountant and, to this end, she began attending university on a full time basis in September. Carl has paid her tuition of $4,600 for 2020 and Suzanne has agreed to transfer any tuition credit available to her father. The family's medical expenses, all of which have been paid by Carl, are as follows: Carl $ 600 Susan 1,100 Jerome 12,250 Suzanne 1,400 Total Medical Expenses $15,350 During 2020, Carl received the following dividends (all amounts in Canadian dollars): Eligible Dividends From Taxable Canadian Corporations $11,700 Non-Eligible Dividends On Shares In His Sister's CCPC 3,250 Dividends On Foreign Shares - Net Of 15 Percent Withholding 10,625 Total Dividends Received $25,575 In addition to dividends, Carl had 2020 interest income of $2,843. Because of the project management skills that he has acquired over the years, Carl started a management consulting business in 2017. In that year he acquired a new building to be used as an office for his business. The building cost $426,000 of which $126,000 was the estimated value of the land. On January 1, 2020, the UCC of the building is $273,540. The building contains office furniture and fixtures that were acquired at a cost of $42,000. On January 1, 2020, they have a UCC of $30,240. During 2020, he spends $41,000 on improving and upgrading the building. In addition, he sells the old furniture and fixtures for $18,600 and acquires replacement furniture and fixtures for $50,000 As Carl has no reason to keep detailed accounting records, he records business income on a cash basis. For 2020, his net cash flow from operations was $123,500. Relevant figures for the beginning and end of 2020 are as follows: January 1 December 31 Billed Receivables $13,400 $17,350 Unbilled Work In Process 17,470 21,250 Accounts Payable 8,670 9,272 Since the inception of the business, Carl has owned a car that is used 100 percent for business activity. The car that he acquired in 2017 was sold in 2019. He acquired a new car on January 1, 2020, at a cost of $61,500. He financed the car through his bank and during 2020, he made pay- ments of $13,200 on the loan. All of this amount was deducted in determining his net cash flow from operations. Of the total, $4,920 represented payments for interest. Carl paid car operating costs totaling $9,260 during 2020. Required: Calculate Carl's 2020 minimum Net Income For Tax Purposes, his 2020 minimum Taxable income, and his 2020 minimum federal Tax Payable. Ignore GST/HST/PST consider- ations and the possibility of pension income splitting. Assignment Problem Seven - 8 (Comprehensive Case Covering Chapters 1 to 7) Carl Nemah is 66 years old and while he receives significant pension income from a former employer's RPP, he is a full time employee of Jardu Enterprises Ltd. (JEL). During 2020, his gross wages were $62,000. JEL withheld the following amounts from these wages: RPP Contributions $3,125 El Premiums 856 CPP Contributions 2,898 Union Dues 572 United Way Contributions 2,400 During 2020, his pension receipts totaled $42,000. He has not applied for OAS as he knows that all of it will be clawed back. Further, he has not applied for CPP as he is aware that deferring this application will result in larger benefits. Carl has been married to Susan Nemah for over 40 years. Susan is 68 years old and has Net Income For Tax Purposes of $9,900. This consists of OAS payments of $7,400 and pension income from her RRSP. She has not applied for CPP. Carl has two children. His 32 year old son, Jerome, has been blind since birth. He lives with and is totally dependent on Carl and Susan. He has no income of his own. Carl's daughter, Suzanne, is 41 years old and is recently divorced. She and her children also live with Carl. Her only income is $36,000 in child support that she receives under a 2018 court decree. In 2020, she decided to become an accountant and, to this end, she began attending university on a full time basis in September. Carl has paid her tuition of $4,600 for 2020 and Suzanne has agreed to transfer any tuition credit available to her father. The family's medical expenses, all of which have been paid by Carl, are as follows: Carl $ 600 Susan 1,100 Jerome 12,250 Suzanne 1,400 Total Medical Expenses $15,350 During 2020, Carl received the following dividends (all amounts in Canadian dollars): Eligible Dividends From Taxable Canadian Corporations $11,700 Non-Eligible Dividends On Shares In His Sister's CCPC 3,250 Dividends On Foreign Shares - Net Of 15 Percent Withholding 10,625 Carl has been married to Susan Nemah for over 40 years. Susan is 68 years old and has Net Income For Tax Purposes of $9,900. This consists of OAS payments of $7,400 and pension income from her RRSP. She has not applied for CPP. Carl has two children. His 32 year old son, Jerome, has been blind since birth. He lives with and is totally dependent on Carl and Susan. He has no income of his own. Carl's daughter, Suzanne, is 41 years old and is recently divorced. She and her children also live with Carl. Her only income is $36,000 in child support that she receives under a 2018 court decree. In 2020, she decided to become an accountant and, to this end, she began attending university on a full time basis in September. Carl has paid her tuition of $4,600 for 2020 and Suzanne has agreed to transfer any tuition credit available to her father. The family's medical expenses, all of which have been paid by Carl, are as follows: Carl $ 600 Susan 1,100 Jerome 12,250 Suzanne 1,400 Total Medical Expenses $15,350 During 2020, Carl received the following dividends (all amounts in Canadian dollars): Eligible Dividends From Taxable Canadian Corporations $11,700 Non-Eligible Dividends On Shares In His Sister's CCPC 3,250 Dividends On Foreign Shares - Net Of 15 Percent Withholding 10,625 Total Dividends Received $25,575 In addition to dividends, Carl had 2020 interest income of $2,843. Because of the project management skills that he has acquired over the years, Carl started a management consulting business in 2017. In that year he acquired a new building to be used as an office for his business. The building cost $426,000 of which $126,000 was the estimated value of the land. On January 1, 2020, the UCC of the building is $273,540. The building contains office furniture and fixtures that were acquired at a cost of $42,000. On January 1, 2020, they have a UCC of $30,240. During 2020, he spends $41,000 on improving and upgrading the building. In addition, he sells the old furniture and fixtures for $18,600 and acquires replacement furniture and fixtures for $50,000 As Carl has no reason to keep detailed accounting records, he records business income on a cash basis. For 2020, his net cash flow from operations was $123,500. Relevant figures for the beginning and end of 2020 are as follows: January 1 December 31 Billed Receivables $13,400 $17,350 Unbilled Work In Process 17,470 21,250 Accounts Payable 8,670 9,272 Since the inception of the business, Carl has owned a car that is used 100 percent for business activity. The car that he acquired in 2017 was sold in 2019. He acquired a new car on January 1, 2020, at a cost of $61,500. He financed the car through his bank and during 2020, he made pay- ments of $13,200 on the loan. All of this amount was deducted in determining his net cash flow from operations. Of the total, $4,920 represented payments for interest. Carl paid car operating costs totaling $9,260 during 2020. Required: Calculate Carl's 2020 minimum Net Income For Tax Purposes, his 2020 minimum Taxable income, and his 2020 minimum federal Tax Payable. Ignore GST/HST/PST consider- ations and the possibility of pension income splitting