Answered step by step

Verified Expert Solution

Question

1 Approved Answer

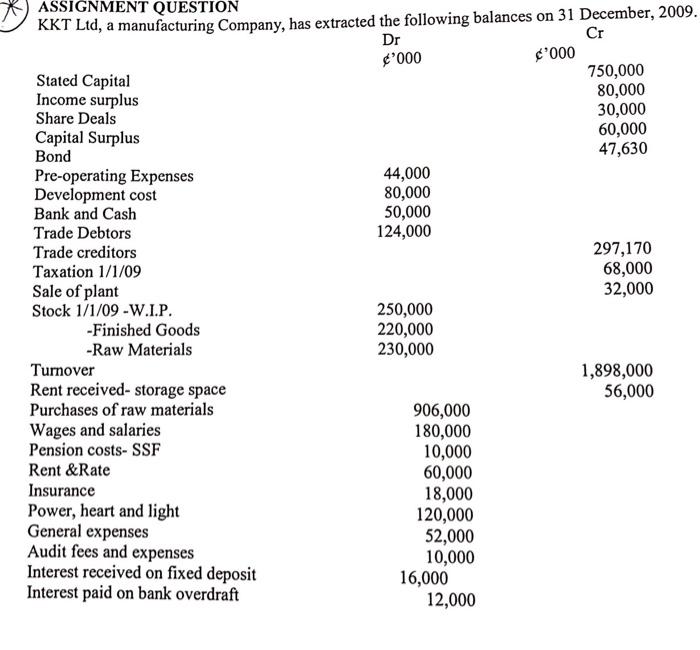

ASSIGNMENT QUESTION KKT Ltd, a manufacturing Company, has extracted the following balances on 31 December, 2009. Stated Capital Income surplus Share Deals Capital Surplus Bond

ASSIGNMENT QUESTION

KKT Ltd, a manufacturing Company, has extracted the following balances on 31 December, 2009.

Stated Capital

Income surplus

Share Deals

Capital Surplus

Bond

Pre-operating Expenses Development cost Bank and Cash

Trade Debtors Trade creditors Taxation 1/1/09 Sale of plant

Stock 1/1/09 -W.I.P.

-Finished Goods

-Raw Materials Turnover

Rent received- storage space Purchases of raw materials Wages and salaries

Pension costs- SSF

Rent &Rate

Insurance

Power, heart and light

General expenses

Audit fees and expenses

Interest received on fixed deposit

Interest paid on bank overdraft

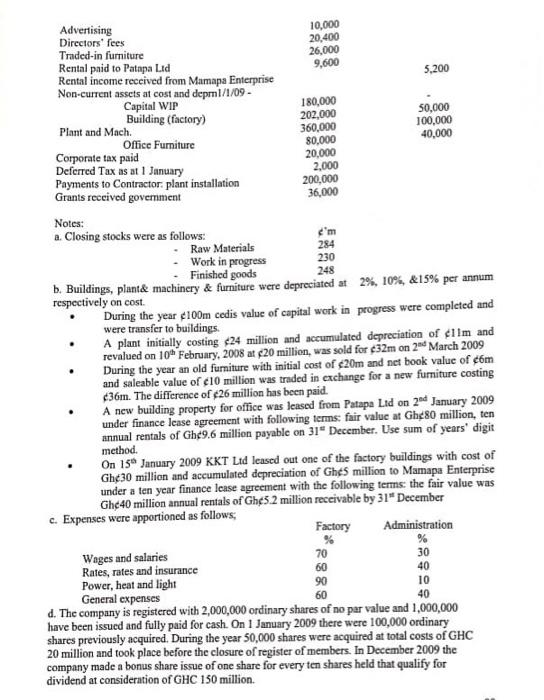

Advertising

Directors fees

Traded-in furniture

Rental paid to Patapa Ltd

Rental income received from Mamapa Enterprise Non-current assets at cost and deprn1/1/09 -

Capital WIP Building (factory)

Plant and Mach.

Office Furniture

Corporate tax paid

Deferred Tax as at 1 January

Payments to Contractor: plant installation Grants received government

Dr 000

44,000 80,000 50,000

124,000

250,000 220,000 230,000

906,000 180,000 10,000 60,000 18,000 120,000 52,000 10,000

16,000 12,000

10,000 20,400 26,000

9,600

180,000 202,000 360,000

80,000 20,000

2,000 200,000 36,000

Cr 000

750,000 80,000 30,000 60,000 47,630

297,170 68,000 32,000

1,898,000 56,000

5,200

- 50,000

100,000 40,000

Notes:

a. Closing stocks were as follows: m

- Raw Materials 284

- Work in progress 230

- Finished goods 248

b. Buildings, plant& machinery & furniture were depreciated at respectively on cost.

2%, 10%, &15% per annum

During the year 100m cedis value of capital work in progress were completed and were transfer to buildings.

A plant initially costing 24 million and accumulated depreciation of 11m and revalued on 10th February, 2008 at 20 million, was sold for 32m on 2nd March 2009

During the year an old furniture with initial cost of 20m and net book value of 6m

and saleable value of 10 million was traded in exchange for a new furniture costing

36m. The difference of 26 million has been paid.

A new building property for office was leased from Patapa Ltd on 2nd January 2009

under finance lease agreement with following terms: fair value at Gh80 million, ten annual rentals of Gh9.6 million payable on 31st December. Use sum of years digit method.

On 15th January 2009 KKT Ltd leased out one of the factory buildings with cost of Gh30 million and accumulated depreciation of Gh5 million to Mamapa Enterprise under a ten year finance lease agreement with the following terms: the fair value was Gh40 million annual rentals of Gh5.2 million receivable by 31st December

c. Expenses were apportioned as follows;

Wages and salaries

Rates, rates and insurance Power, heat and light General expenses

Factory Administration %%

70 30

60 40

90 10

60 40

d. The company is registered with 2,000,000 ordinary shares of no par value and 1,000,000 have been issued and fully paid for cash. On 1 January 2009 there were 100,000 ordinary shares previously acquired. During the year 50,000 shares were acquired at total costs of GHC 20 million and took place before the closure of register of members. In December 2009 the company made a bonus share issue of one share for every ten shares held that qualify for dividend at consideration of GHC 150 million.

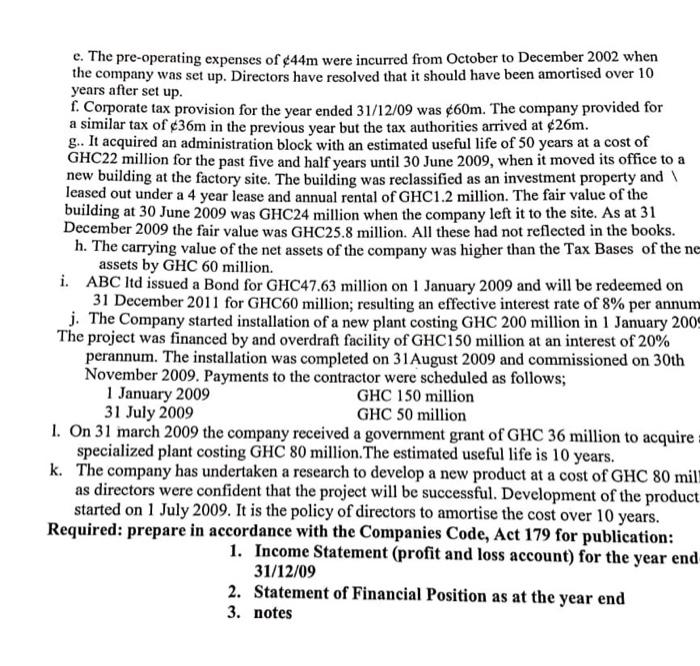

e. The pre-operating expenses of 44m were incurred from October to December 2002 when the company was set up. Directors have resolved that it should have been amortised over 10 years after set up.

f. Corporate tax provision for the year ended 31/12/09 was 60m. The company provided for a similar tax of 36m in the previous year but the tax authorities arrived at 26m.

g.. It acquired an administration block with an estimated useful life of 50 years at a cost of GHC22 million for the past five and half years until 30 June 2009, when it moved its office to a new building at the factory site. The building was reclassified as an investment property and \ leased out under a 4 year lease and annual rental of GHC1.2 million. The fair value of the building at 30 June 2009 was GHC24 million when the company left it to the site. As at 31

December 2009 the fair value was GHC25.8 million. All these had not reflected in the books. h. The carrying value of the net assets of the company was higher than the Tax Bases of the

net

assets by GHC 60 million.

i. ABC ltd issued a Bond for GHC47.63 million on 1 January 2009 and will be redeemed on 31 December 2011 for GHC60 million; resulting an effective interest rate of 8% per annum.

j. The Company started installation of a new plant costing GHC 200 million in 1 January 2009.

The project was financed by and overdraft facility of GHC150 million at an interest of 20% perannum. The installation was completed on 31August 2009 and commissioned on 30th November 2009. Payments to the contractor were scheduled as follows;

1 January 2009 GHC 150 million

31 July 2009 GHC 50 million

l. On 31 march 2009 the company received a government grant of GHC 36 million to acquire a

specialized plant costing GHC 80 million.The estimated useful life is 10 years.

k. The company has undertaken a research to develop a new product at a cost of GHC 80 million

as directors were confident that the project will be successful. Development of the product

started on 1 July 2009. It is the policy of directors to amortise the cost over 10 years.

Required: prepare in accordance with the Companies Code, Act 179 for publication:

1. Income Statement (profit and loss account) for the year ended

31/12/09

2. Statement of Financial Position as at the year end

3. notes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started