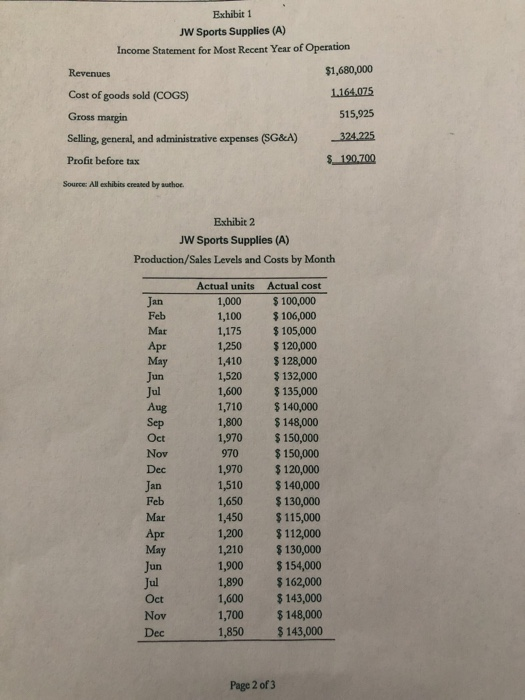

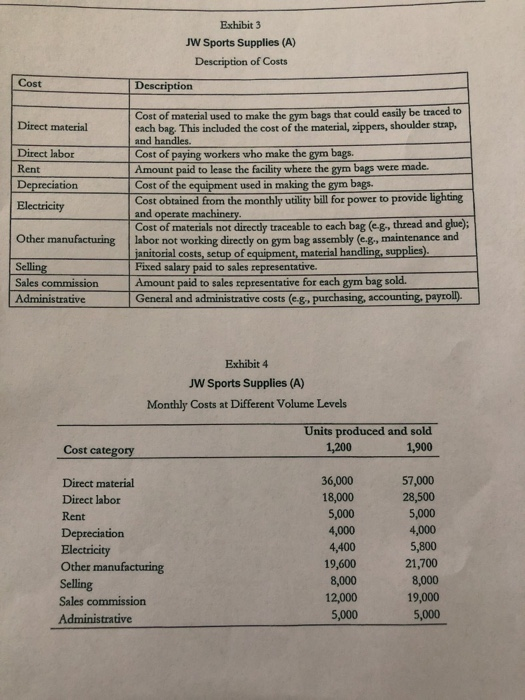

Assignment Questions For the A case Questions related to cost behavior: # Case Exhibit 2 presents monthly data of units produced and sold, and actual costs incurred, for 24 months Create a scatterplot of costs and units. b. From your scatterplot, estimate the variable cost (V) et unit and the total monthly fixed costs (FC:). Are there any outliers in the data? If so, which observations? d. What is the relevant range of activity represented by the data? 2. Using the data presented in case Exhibit 2, use the hiah-low method to estimate the VC per unit and the total monthly FC. (Learners must identify a typical high-activity observation and a typical low- activity observation, 21 calculate the VC per unit, and calculate the total monthly a) Waite the cost function (learners must write the equation y = mx + b, where a = VC/unit and FC). 3. Case Exhibit 4 presents individual costs at two levels of production/sales: 1.200 units and 1,900 units. For each cost, indicate whether it is a VC, an FC, or a mixed cost (MC) that contains both a variable and fixed component 4. From your analysis in #3, choose one VC, one FC and one MC. For each, calculate the per-unit cost at both the 1,200- and 1,900-unit levels, indicate whether the per-unit cost stays the same, increases, o decreases as volume increases, and provide an explanation Questions related to cost-volume-profit analysis: 1. For each cost in case Exhibit 3, indicate whether the cost is a manufacturing or nonmanufacturing cost 2. Assume the company expects to produce and sell 1,500 units during the following month at a price of $100 per unit. Prepare a functional income statement that shows predicted revenues and costs. Prepare a contribution margin (CM) statement that shows predicted revenues, costs, and profit before tax. 3. Assume the company prices its product at $100. What is the CM per unit? 4. Assume the company prices its product at $100. How many units does it need to sell per month to break even? 5. Assume the company sells 800 units. What is the price it must set on its product to break even? 6. The owners have set a target profit of $25,000 per month ($300,000 per year) in order for them to decide to devote themselves full time to JW Sports Supplies. Realizing from their projected income statements that their current predictions fall short of the $25,000, they want to evaluate the impact of alternative actions. Specifically, they want to evaluate each of the following factors, separately (in doing so, assume all other factors stay the same as projected in the income statement): 1. What price must the company set to achieve a profit of $25,000? b. What must the VC per unit be to achieve a profit of $25,000? How many units must it sell to achieve a profit of $25,000? d. What must total monthly FCs be to achieve a profit of $25,000? 7. The company is considering making a deluxe model. Its price would be $156, and its VC per unit would be $100, compared to a price of $100 and a VC of $60 for the basic model. It anticipates a sales mix of 60% basic model and 40% deluxe model. How many units of the basic model and how many units of the del model met the man cell to heal ren? JW Sports Supplies (A) und William West be d both saw exercise ake advantage of th James Jones and William West had worked out together almost daily for several years. Both were professionals pursuing demanding careers, and both saw exercise as an escape from the daily stresses of workplace. While they continued to update their workout wardrobes to take advantage of the latest in apparei technology, they lamented the lack of the perfect gym bag each time they met at the gym. One day, it was that lack of good storage space for their sneakers, the next, it was the lack of pocket to conveniently store their phones, keys, and other small necessities, and finally, it was the problem of the seams splitting far beyond what one would consider normal wear and tear. Jones and West were sure they couldn't be the only ones who found current gym bags inadequate in meeting their needs. Eventually, they decided to pursue a venture to make what they considered the ideal gym bap, one that would incorporate the features they both desired and that would be of a sufficient quality to withstand a regular workout schedule for several years. They each made a modest investment to start their new company Sports Supplies and began operating on the side while they continued their respective professional careers. That had been more than five years ago. The company had grown substantially, had achieved annual sales of over $1.5 million, and had begun to generate a healthy profit (Exhibit 1 provides an income statement for the most recent year of operation). As lones and West reflected on their success to date, they contemplated what might be possible if they could devote themselves full time to JW Sports Supplies. They decided to dive deeper into the numbers. They wanted to better understand the impact that alternative decisions they could make about managing costs, changing prices, and different sales volumes would have on the company, so that they could better determine whether pursuing their venture full time was even a possibility. They both agreed that if they could see annual profit climb to around $300,000, they would consider making this a full-time endeavor. The two owners decided to begin their analysis by gaining a better understanding of the costs being incurred to produce and sell the gym bags. They gathered some data to help them in their analysis. First, they compiled data on actual total costs and number of gym bags produced and sold per month for the past 24 months (see Exhibit 2). They noted that they typically only produced the gym bags once they had an order, they were averse to tying up cash in inventory, and pursuing this strategy meant that units produced and sold were the same each month. Second, they compiled detailed data on costs by category for 2 of the 24 months (see Exhibit 3 for a description of each cost category, and Exhibit 4 for costs by category). They could have gathered this information for all 24 months, but they decided to start with just 2 months to keep their analysis more manageable. Upon gathering the data, they were ready to roll up their sleeves and get to work. They had many questions to answer This fictional case was prepared by L n J. Lynch, Almand R. Coleman Professor of Business Administration. It was in a bus for de discussion rather than to illustre effective or ineffective handling of an administression. Copyright 2017 by the University of Vila Dude School Foundation, Charlottesville, VA. All rights reserved. To anderapis, dan s le i n i ng.com No part of the pain en d e wereldet, arbeidsforarbg , Malawi e Dur Our goal is to publish materials of the highest quality, so please submit to albicaching.com Page 1 of 3 Exhibit 1 JW Sports Supplies (A) Income Statement for Most Recent Year of Operation Revenues $1,680,000 Cost of goods sold (COGS) 1.164,075 Gross margin 515,925 Selling, general, and administrative expenses (SG&A) _324.225 Profit before tax $_120.700 Source: All exhibits created by author Exhibit 2 JW Sports Supplies (A) Production/Sales Levels and Costs by Month Jan Feb Mar Apr May Jun Jul Aug Actual units Actual cost 1,000 $100,000 1,100 $ 106,000 1,175 $ 105,000 1,250 $ 120,000 1,410 $ 128,000 1,520 $ 132,000 1,600 $ 135,000 1,710 $ 140,000 1,800 $ 148,000 1,970 $ 150,000 970 $ 150,000 1,970 $120,000 1,510 $ 140,000 1,650 $ 130,000 1,450 $ 115,000 1,200 $ 112,000 1,210 $ 130,000 1,900 $154,000 1,890 $ 162,000 1,600 $ 143,000 1,700 $ 148,000 1,850 $ 143,000 Jan Feb Jun Oct Nov Dec Page 2 of 3 Exhibit 3 JW Sports Supplies (A) Description of Costs Description Direct material Direct labor Rent Depreciation Electricity Cost of material used to make the gym bags that could easily be traced to each bag. This included the cost of the material, zippers, shoulder strap. and handles. Cost of paying workers who make the gym bags. Amount paid to lease the facility where the gym bags were made. Cost of the equipment used in making the gym bags. Cost obtained from the monthly utility bill for power to provide lighting and operate machinery. Cost of materials not directly traceable to each bag (eg, thread and glue): labor not working directly on gym bag assembly (eg, maintenance and janitorial costs, setup of equipment, material handling, supplies) Fixed salary paid to sales representative. Amount paid to sales representative for each gym bag sold. General and administrative costs (eg purchasing, accounting, payroll). Other manufacturing Selling Sales commission Administrative Exhibit 4 JW Sports Supplies (A) Monthly Costs at Different Volume Levels Units produced and sold 1,200 1,900 Cost category Direct material Direct labor Rent Depreciation Electricity Other manufacturing Selling Sales commission Administrative 36,000 18,000 5,000 4,000 4,400 19,600 8,000 12,000 5,000 57,000 28,500 5,000 4,000 5,800 21,700 8,000 19,000 5,000 Assignment Questions For the A case Questions related to cost behavior: # Case Exhibit 2 presents monthly data of units produced and sold, and actual costs incurred, for 24 months Create a scatterplot of costs and units. b. From your scatterplot, estimate the variable cost (V) et unit and the total monthly fixed costs (FC:). Are there any outliers in the data? If so, which observations? d. What is the relevant range of activity represented by the data? 2. Using the data presented in case Exhibit 2, use the hiah-low method to estimate the VC per unit and the total monthly FC. (Learners must identify a typical high-activity observation and a typical low- activity observation, 21 calculate the VC per unit, and calculate the total monthly a) Waite the cost function (learners must write the equation y = mx + b, where a = VC/unit and FC). 3. Case Exhibit 4 presents individual costs at two levels of production/sales: 1.200 units and 1,900 units. For each cost, indicate whether it is a VC, an FC, or a mixed cost (MC) that contains both a variable and fixed component 4. From your analysis in #3, choose one VC, one FC and one MC. For each, calculate the per-unit cost at both the 1,200- and 1,900-unit levels, indicate whether the per-unit cost stays the same, increases, o decreases as volume increases, and provide an explanation Questions related to cost-volume-profit analysis: 1. For each cost in case Exhibit 3, indicate whether the cost is a manufacturing or nonmanufacturing cost 2. Assume the company expects to produce and sell 1,500 units during the following month at a price of $100 per unit. Prepare a functional income statement that shows predicted revenues and costs. Prepare a contribution margin (CM) statement that shows predicted revenues, costs, and profit before tax. 3. Assume the company prices its product at $100. What is the CM per unit? 4. Assume the company prices its product at $100. How many units does it need to sell per month to break even? 5. Assume the company sells 800 units. What is the price it must set on its product to break even? 6. The owners have set a target profit of $25,000 per month ($300,000 per year) in order for them to decide to devote themselves full time to JW Sports Supplies. Realizing from their projected income statements that their current predictions fall short of the $25,000, they want to evaluate the impact of alternative actions. Specifically, they want to evaluate each of the following factors, separately (in doing so, assume all other factors stay the same as projected in the income statement): 1. What price must the company set to achieve a profit of $25,000? b. What must the VC per unit be to achieve a profit of $25,000? How many units must it sell to achieve a profit of $25,000? d. What must total monthly FCs be to achieve a profit of $25,000? 7. The company is considering making a deluxe model. Its price would be $156, and its VC per unit would be $100, compared to a price of $100 and a VC of $60 for the basic model. It anticipates a sales mix of 60% basic model and 40% deluxe model. How many units of the basic model and how many units of the del model met the man cell to heal ren? JW Sports Supplies (A) und William West be d both saw exercise ake advantage of th James Jones and William West had worked out together almost daily for several years. Both were professionals pursuing demanding careers, and both saw exercise as an escape from the daily stresses of workplace. While they continued to update their workout wardrobes to take advantage of the latest in apparei technology, they lamented the lack of the perfect gym bag each time they met at the gym. One day, it was that lack of good storage space for their sneakers, the next, it was the lack of pocket to conveniently store their phones, keys, and other small necessities, and finally, it was the problem of the seams splitting far beyond what one would consider normal wear and tear. Jones and West were sure they couldn't be the only ones who found current gym bags inadequate in meeting their needs. Eventually, they decided to pursue a venture to make what they considered the ideal gym bap, one that would incorporate the features they both desired and that would be of a sufficient quality to withstand a regular workout schedule for several years. They each made a modest investment to start their new company Sports Supplies and began operating on the side while they continued their respective professional careers. That had been more than five years ago. The company had grown substantially, had achieved annual sales of over $1.5 million, and had begun to generate a healthy profit (Exhibit 1 provides an income statement for the most recent year of operation). As lones and West reflected on their success to date, they contemplated what might be possible if they could devote themselves full time to JW Sports Supplies. They decided to dive deeper into the numbers. They wanted to better understand the impact that alternative decisions they could make about managing costs, changing prices, and different sales volumes would have on the company, so that they could better determine whether pursuing their venture full time was even a possibility. They both agreed that if they could see annual profit climb to around $300,000, they would consider making this a full-time endeavor. The two owners decided to begin their analysis by gaining a better understanding of the costs being incurred to produce and sell the gym bags. They gathered some data to help them in their analysis. First, they compiled data on actual total costs and number of gym bags produced and sold per month for the past 24 months (see Exhibit 2). They noted that they typically only produced the gym bags once they had an order, they were averse to tying up cash in inventory, and pursuing this strategy meant that units produced and sold were the same each month. Second, they compiled detailed data on costs by category for 2 of the 24 months (see Exhibit 3 for a description of each cost category, and Exhibit 4 for costs by category). They could have gathered this information for all 24 months, but they decided to start with just 2 months to keep their analysis more manageable. Upon gathering the data, they were ready to roll up their sleeves and get to work. They had many questions to answer This fictional case was prepared by L n J. Lynch, Almand R. Coleman Professor of Business Administration. It was in a bus for de discussion rather than to illustre effective or ineffective handling of an administression. Copyright 2017 by the University of Vila Dude School Foundation, Charlottesville, VA. All rights reserved. To anderapis, dan s le i n i ng.com No part of the pain en d e wereldet, arbeidsforarbg , Malawi e Dur Our goal is to publish materials of the highest quality, so please submit to albicaching.com Page 1 of 3 Exhibit 1 JW Sports Supplies (A) Income Statement for Most Recent Year of Operation Revenues $1,680,000 Cost of goods sold (COGS) 1.164,075 Gross margin 515,925 Selling, general, and administrative expenses (SG&A) _324.225 Profit before tax $_120.700 Source: All exhibits created by author Exhibit 2 JW Sports Supplies (A) Production/Sales Levels and Costs by Month Jan Feb Mar Apr May Jun Jul Aug Actual units Actual cost 1,000 $100,000 1,100 $ 106,000 1,175 $ 105,000 1,250 $ 120,000 1,410 $ 128,000 1,520 $ 132,000 1,600 $ 135,000 1,710 $ 140,000 1,800 $ 148,000 1,970 $ 150,000 970 $ 150,000 1,970 $120,000 1,510 $ 140,000 1,650 $ 130,000 1,450 $ 115,000 1,200 $ 112,000 1,210 $ 130,000 1,900 $154,000 1,890 $ 162,000 1,600 $ 143,000 1,700 $ 148,000 1,850 $ 143,000 Jan Feb Jun Oct Nov Dec Page 2 of 3 Exhibit 3 JW Sports Supplies (A) Description of Costs Description Direct material Direct labor Rent Depreciation Electricity Cost of material used to make the gym bags that could easily be traced to each bag. This included the cost of the material, zippers, shoulder strap. and handles. Cost of paying workers who make the gym bags. Amount paid to lease the facility where the gym bags were made. Cost of the equipment used in making the gym bags. Cost obtained from the monthly utility bill for power to provide lighting and operate machinery. Cost of materials not directly traceable to each bag (eg, thread and glue): labor not working directly on gym bag assembly (eg, maintenance and janitorial costs, setup of equipment, material handling, supplies) Fixed salary paid to sales representative. Amount paid to sales representative for each gym bag sold. General and administrative costs (eg purchasing, accounting, payroll). Other manufacturing Selling Sales commission Administrative Exhibit 4 JW Sports Supplies (A) Monthly Costs at Different Volume Levels Units produced and sold 1,200 1,900 Cost category Direct material Direct labor Rent Depreciation Electricity Other manufacturing Selling Sales commission Administrative 36,000 18,000 5,000 4,000 4,400 19,600 8,000 12,000 5,000 57,000 28,500 5,000 4,000 5,800 21,700 8,000 19,000 5,000