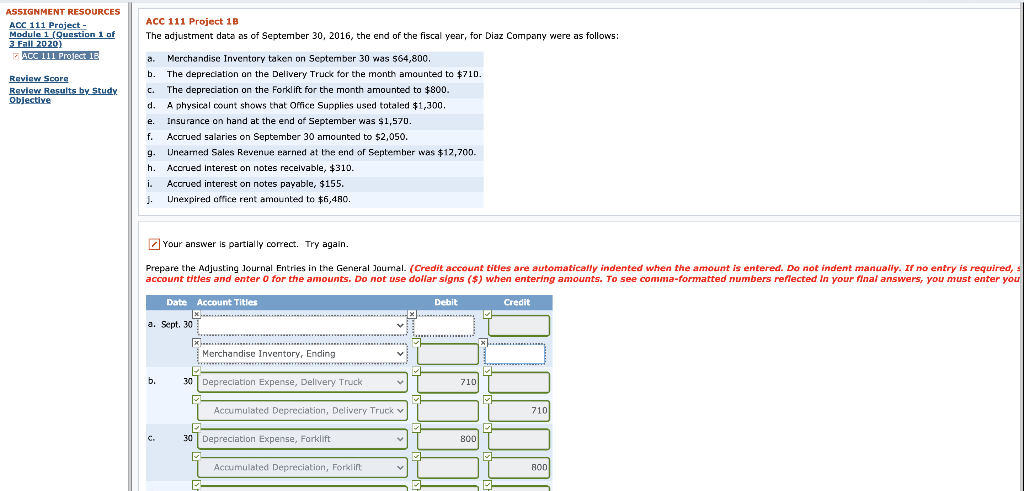

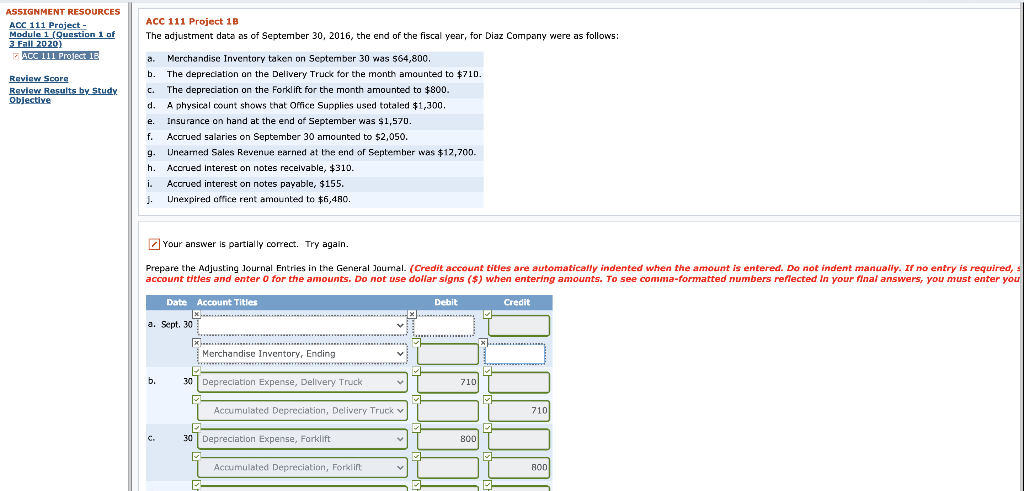

ASSIGNMENT RESOURCES ACC 111 Project - Module 1 (Question 1 of 3. Fall 2020) ACC III Protect 1 ACC 111 Project 1B The adjustment data as of September 30, 2016, the end of the fiscal year, for Diaz Company were as follows: a. Review Score Review Results by Study Objective C. Merchandise Inventory taken on September 30 was $64,800. b. The depreciation on the Delivery Truck for the month amounted to $710. The depreciation on the Forklift for the month amounted to $800. d. A physical count shows that Office Supplies used totaled $1,300, , e. Insurance on hand at the end of September was $1,570. f. Accrued salaries on September 30 amounted to $2,050. 9 Uneamed Sales Revenue earned at the end of September was $12,700. h. Accrued Interest on notes receivable, $310. i. Accrued interest on notes payable, $155. j. Unexpired office rent amounted to $6,480. Your answer is partially correct. Try again. Prepare the Adjusting Journal Entries in the General Joumal. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, account titles and enter o for the amounts. Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected in your final answers, you must enter you Date Account Titles Debit Credit a. Sept. 30 Merchandise Inventory, Ending b. 30 Depreciation Expense, Delivery Truck 710 Accumulated Depreciation, Delivery Truck 710 30 Depreciation Expense, Forklift 800 Accumulated Depreciation, Forklin NOD CALCULATOR PRINTER VERSION 4 NEXT c. 14 30 Depreciation Expense, Forklift 800 ASSIGNMENT RESOURCES ACC 111 Project - Module 1 (Question 1 of 3 Fall 2020) ACC 111 Protect 1 Accumulated Depreciation, Forklift 800 d d. 30 Office Supplies Expense 1300 Review Score Review Results by Study Objective Office Supplies 1300 CE e 30 Insurance Expense 1570 x Prepaid Insurance 1570 f. 30 Salarles Expense 2050 Salaries Payable 2050 9 30 Unearned Sales Revenue 12700 Sales Revenue ULULUSUAL 12700 h. 30 Interest Receivable 310 Interest Revenue 310 i. 30 Interest Expense v 155 Interest Payable 155 30 Office Rent Expense 6480 x Prepaid office Rent 6480 Before moving onto the detection ne do the following for en helo click on the humerlinks below