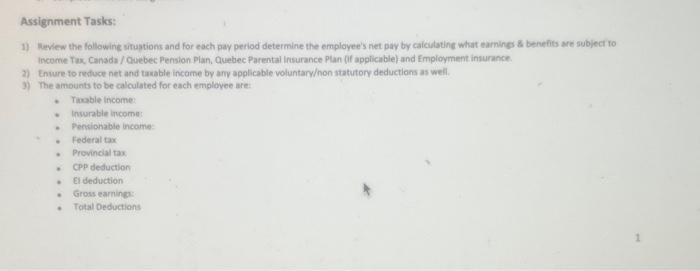

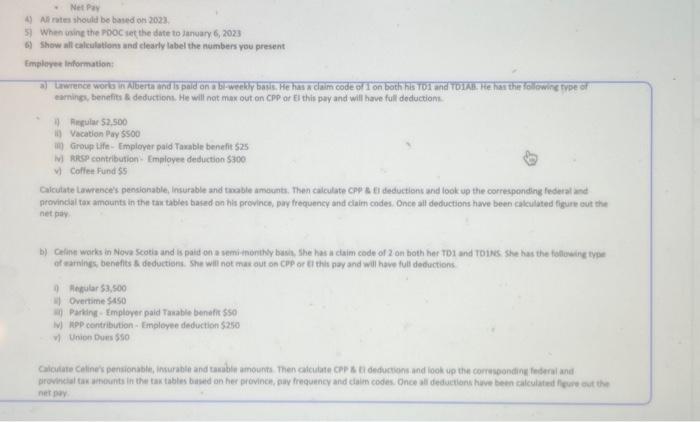

Assignment Tasks: income Fax, Cansda / Quebec Pension Plan, Quebec Parentai insurance Plan (If applicable) and fmployment insurance. 2) Enure to reduce fet and tawable incarne by ary applicable voluntaryon statutory deductions as well. 3) The amounts to be calculated for each emplovee are. - Truble incomer - invurable incomes - Fentionable income. - Federaltax - Provindal tax. * CPP deduction - Eldeduction - Gross eaming: * Total Deductions 4) Al rates should be based on 2023 . 3) When isine the PoOC set the date to ianuary 6,2023 6) Show all calculations and clearly label the numbers you present Empleree information: eiming, benefits la deduction. He will not max out an CPD or el this pur and will have full doduction. 1) Aeqular 52,500 i) Vacation Pay $500 iif) Ciroup Life- imployar paid Taxable benefit 525 (v) Rece contribution. Employee deduction S3ico v) Coffeefundss provinclai tox amounts in the tan tables based on his province, pay frequency and ciaim codes. Once alt deductions have been calculated figure eut the net par of earnings, benefies 8 deductions. She will not mas out on CPP or 8 this pay and wil have full deductions. 9) Antivar $3,500 i) Overtime $450 1) Paraing timployor paid tamable benefir $50 W) Rop contribution - Employe deduction $210 v) Union Dums $50 mitron Assignment Tasks: income Fax, Cansda / Quebec Pension Plan, Quebec Parentai insurance Plan (If applicable) and fmployment insurance. 2) Enure to reduce fet and tawable incarne by ary applicable voluntaryon statutory deductions as well. 3) The amounts to be calculated for each emplovee are. - Truble incomer - invurable incomes - Fentionable income. - Federaltax - Provindal tax. * CPP deduction - Eldeduction - Gross eaming: * Total Deductions 4) Al rates should be based on 2023 . 3) When isine the PoOC set the date to ianuary 6,2023 6) Show all calculations and clearly label the numbers you present Empleree information: eiming, benefits la deduction. He will not max out an CPD or el this pur and will have full doduction. 1) Aeqular 52,500 i) Vacation Pay $500 iif) Ciroup Life- imployar paid Taxable benefit 525 (v) Rece contribution. Employee deduction S3ico v) Coffeefundss provinclai tox amounts in the tan tables based on his province, pay frequency and ciaim codes. Once alt deductions have been calculated figure eut the net par of earnings, benefies 8 deductions. She will not mas out on CPP or 8 this pay and wil have full deductions. 9) Antivar $3,500 i) Overtime $450 1) Paraing timployor paid tamable benefir $50 W) Rop contribution - Employe deduction $210 v) Union Dums $50 mitron