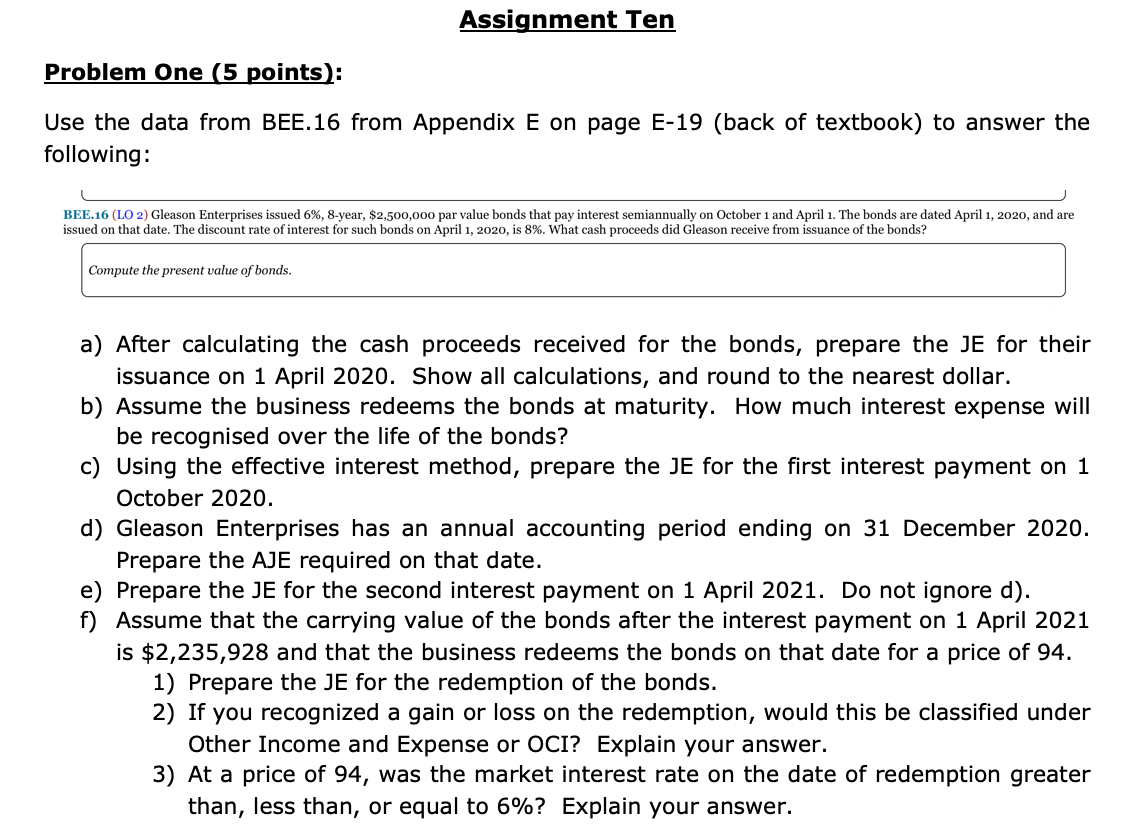

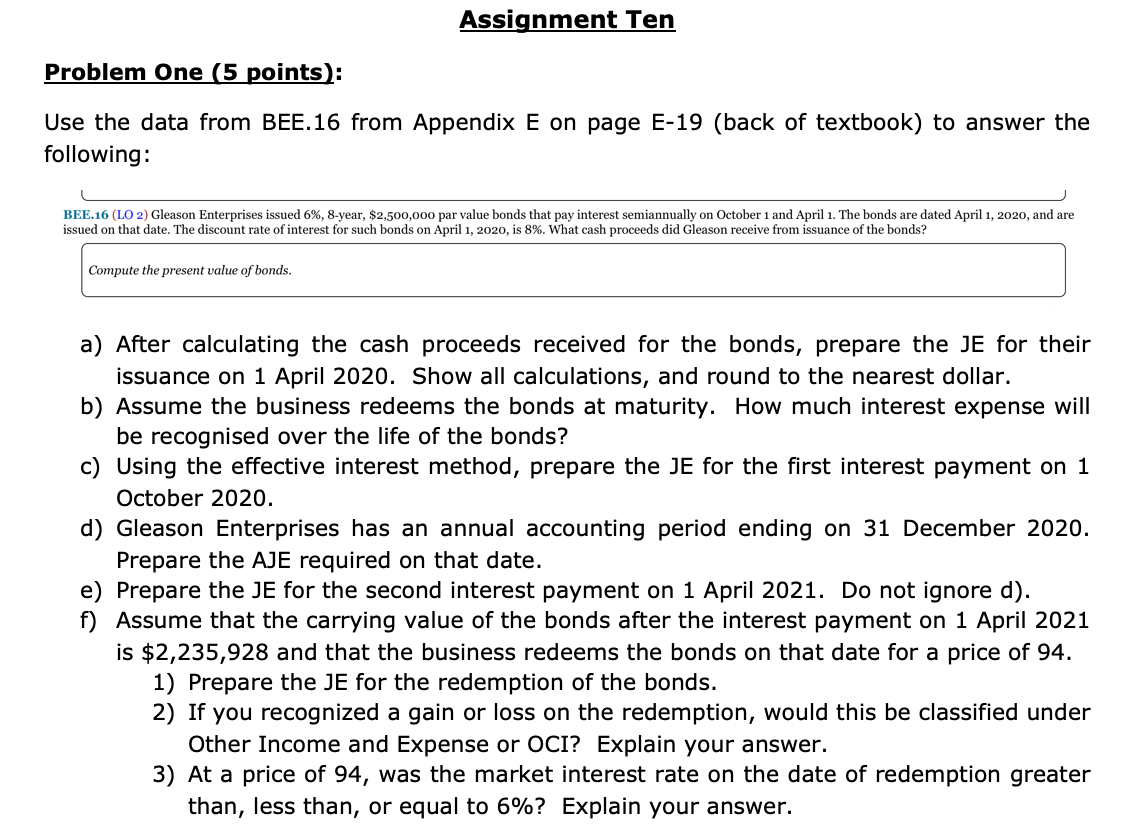

Assignment Ten Problem One (5 points): Use the data from BEE.16 from Appendix E on page E-19 (back of textbook) to answer the following: BEE.16 (LO 2) Gleason Enterprises issued 6%, 8-year, $2,500,000 par value bonds that pay interest semiannually on October 1 and April 1. The bonds are dated April 1, 2020, and are issued on that date. The discount rate of interest for such bonds on April 1, 2020, is 8%. What cash proceeds did Gleason receive from issuance of the bonds? Compute the present value of bonds. a) After calculating the cash proceeds received for the bonds, prepare the JE for their issuance on 1 April 2020. Show all calculations, and round to the nearest dollar. b) Assume the business redeems the bonds at maturity. How much interest expense will be recognised over the life of the bonds? c) Using the effective interest method, prepare the JE for the first interest payment on 1 October 2020. d) Gleason Enterprises has an annual accounting period ending on 31 December 2020. Prepare the AJE required on that date. e) Prepare the JE for the second interest payment on 1 April 2021. Do not ignore d). f) Assume that the carrying value of the bonds after the interest payment on 1 April 2021 is $2,235,928 and that the business redeems the bonds on that date for a price of 94. 1) Prepare the JE for the redemption of the bonds. 2) If you recognized a gain or loss on the redemption, would this be classified under Other Income and Expense or OCI? Explain your answer. 3) At a price of 94, was the market interest rate on the date of redemption greater than, less than, or equal to 6%? Explain your answer. Assignment Ten Problem One (5 points): Use the data from BEE.16 from Appendix E on page E-19 (back of textbook) to answer the following: BEE.16 (LO 2) Gleason Enterprises issued 6%, 8-year, $2,500,000 par value bonds that pay interest semiannually on October 1 and April 1. The bonds are dated April 1, 2020, and are issued on that date. The discount rate of interest for such bonds on April 1, 2020, is 8%. What cash proceeds did Gleason receive from issuance of the bonds? Compute the present value of bonds. a) After calculating the cash proceeds received for the bonds, prepare the JE for their issuance on 1 April 2020. Show all calculations, and round to the nearest dollar. b) Assume the business redeems the bonds at maturity. How much interest expense will be recognised over the life of the bonds? c) Using the effective interest method, prepare the JE for the first interest payment on 1 October 2020. d) Gleason Enterprises has an annual accounting period ending on 31 December 2020. Prepare the AJE required on that date. e) Prepare the JE for the second interest payment on 1 April 2021. Do not ignore d). f) Assume that the carrying value of the bonds after the interest payment on 1 April 2021 is $2,235,928 and that the business redeems the bonds on that date for a price of 94. 1) Prepare the JE for the redemption of the bonds. 2) If you recognized a gain or loss on the redemption, would this be classified under Other Income and Expense or OCI? Explain your answer. 3) At a price of 94, was the market interest rate on the date of redemption greater than, less than, or equal to 6%? Explain your