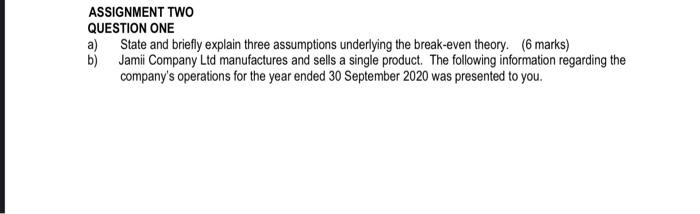

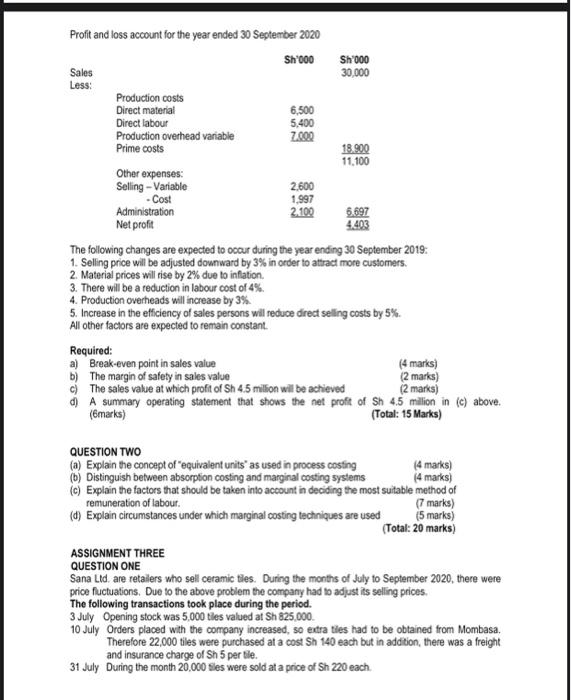

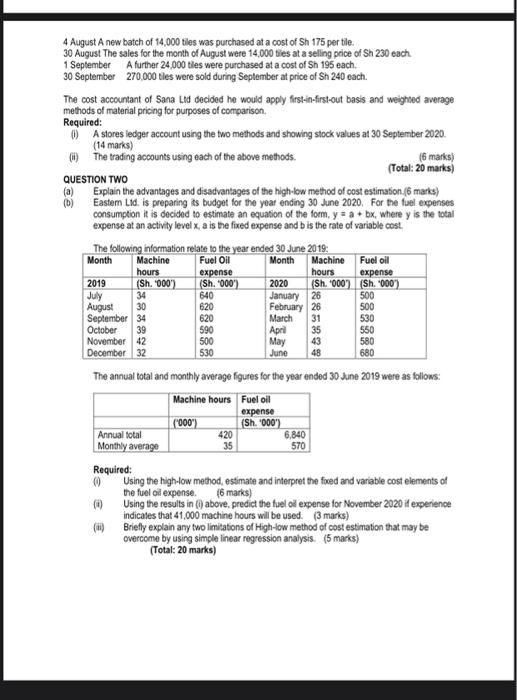

ASSIGNMENT TWO QUESTION ONE a) State and briefly explain three assumptions underlying the break-even theory. (6 marks) b) Jamii Company Ltd manufactures and sells a single product. The following information regarding the company's operations for the year ended 30 September 2020 was presented to you. Profit and loss account for the year ended 30 September 2020 Sh000 Sh'000 Sales 30,000 Less: Production costs Direct material 6,500 Direct labour 5,400 Production overhead variable 2.000 Prime costs 18.900 11.100 Other expenses: Selling - Variable 2.600 - Cost 1,997 Administration 2.100 6.697 Net profit 4.403 The following changes are expected to occur during the year ending 30 September 2019: 1. Selling price will be adjusted downward by 3% in order to attract more customers. 2. Material prices will rise by 2% due to inflation 3. There will be a reduction in labour cost of 4%. 4. Production overheads will increase by 3% 5. Increase in the efficiency of sales persons will reduce direct selling costs by 5% All other factors are expected to remain constant. Required: a) Break-even point in sales value (4 marks) b) The margin of safety in sales value (2 marks) c) The sales value at which profit of Sh 4.5 million will be achieved (2 marks) A summary operating statement that shows the net proft of Sh 4.5 million in (c) above. (Emarks) (Total: 15 Marks) QUESTION TWO (a) Explain the concept of "equivalent units' as used in process costing (4 marks) (6) Distinguish between absorption costing and marginal costing systems (4 marks) (c) Explain the factors that should be taken into account in deciding the most suitable method of remuneration of labour (7 marks) (d) Explain circumstances under which marginal costing techniques are used (5 marks) (Total: 20 marks) ASSIGNMENT THREE QUESTION ONE Sana Ltd are retailers who sell ceramic tiles. During the months of July to September 2020, there were price fuctuations. Due to the above problem the company had to adjust is selling prices The following transactions took place during the period. 3 July Opening stock was 5.000 tiles valued at Sh 825,000 10 July Orders placed with the company increased, so extra ties had to be obtained from Mombasa. Therefore 22,000 tiles were purchased at a cost Sh 140 each but in addition, there was a freight and insurance charge of Sh 5 per tile. 31 July During the month 20,000 sles were sold at a price of Sh 220 each. 4 August A new batch of 14,000 tiles was purchased at a cost of Sh 175 per tile. 30 August The sales for the month of August were 14,000 tiles at a seling price of Sh 230 each 1 September A further 24.000 tles were purchased at a cost of Sh 195 each. 30 September 270,000 tiles were sold during September at price of Sh 240 each. The cost accountant of Sana Lid decided he would apply first-in-first-out basis and weighted average methods of material pricing for purposes of comparison Required: 0 Astores ledger account using the two methods and showing stock values at 30 September 2020. (14 marks) The trading accounts using each of the above methods. (6 marks) (Total: 20 marks QUESTION TWO (a) Explain the advantages and disadvantages of the high-low method of cost estimation (6 marks) Eastem Lid. is preparing is budget for the year ending 30 June 2020. For the fuel expenses consumption it is decided to estimate an equation of the form, y = a + bx, where y is the total expense at an activity level x, a is the fixed expense and is the rate of variable cost. The following information relate to the year ended 30 June 2019: Month Machine Fuel Oil Month Machine Fuel oil hours expense hours expense 2019 (Sh. "000") (Sh.'000') 2020 (Sh."000(Sh.000) July 34 640 January 26 500 Augus! 30 620 February 26 500 September 34 620 March 31 530 October 39 590 April 35 550 November 42 500 May 43 580 December 32 530 June 680 The annual total and monthly average figures for the year ended 30 June 2019 were as follows: Machine hours Fuel oil expense (000" (Sh. 1000) Annual total 420 Monthly average 35 570 Required: 0 Using the high-low method, estimate and interpret the fixed and variable cost elements of the fuel oil expense. (6 marks) Using the results in () above, predict the fuel oil expense for November 2020 il experience indicates that 41,000 machine hours will be used. (3 marks) Brielly explain any two limitations of High-low method of cost estimation that may be overcome by using simple linear regression analysis. (5 marks) (Total: 20 marks) 48 6.840