Answered step by step

Verified Expert Solution

Question

1 Approved Answer

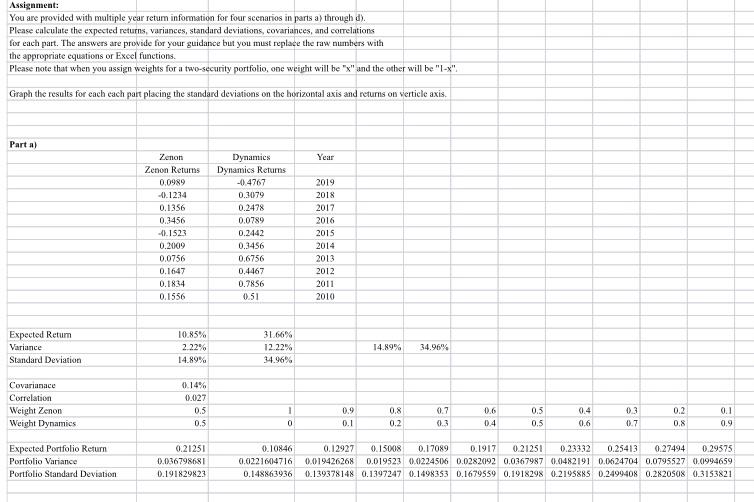

Assignment: You are provided with multiple year retum information for four scenarios in parts a) through d). Please calculate the expected returns, variances, standard deviations,

Assignment: You are provided with multiple year retum information for four scenarios in parts a) through d). Please calculate the expected returns, variances, standard deviations, covariances, and correlations for each part. The answers are provide for your guidance but you must replace the raw numbers with the appropriate equations or Excel functions. Please note that when you assign weights for a two-security portfolio, one weight will be "x" and the other will be "I-X". Graph the results for each each part placing the standard deviations on the horizontal axis and returns on verticle axis. Parta) Year Zenon Zenon Returns 0.0989 -1).1234 0.1356 0.3456 -1.1523 0.2009 0.0756 0.1647 0.1834 0.1556 Dynamics Dynamics Returns -0.4767 0.3079 0.2478 0.0789 0.2442 0.3456 0.6756 0.4467 0.7856 0.51 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 Expected Retur Variance Standard Deviation 10.85% 2.22% 14.89% 31.66% 12.22% 34.96% 14.89% 34.96% Covariance Correlation Weight Zenon Weight Dynamics 0.14% 0.027 0.5 0.5 0.9 1 0 0.8 0.2 0.7 0.3 0.6 0.4 0.5 0.5 0.4 0.6 0.3 0.7 0.2 0.8 0.1 0.9 0.1 Expected Portfolio Return Portfolio Variance Portfolio Standard Deviation 0.21251 0.036798681 0.191829823 0.10846 0.0221004716 0.148863936 0.12927 0.15008 0.17089 0.1917 0.21251 0.23332 0.25413 0.27494 0.29575 0.019426268 0.019523 0.0224506 0.0282092 0.0367987 0.0482191 0.0624704 0.0795527 0.0994659 0.139378148 0.1397247 0.1498353 0.1679559 0.1918298 0.2195885 0.2499408 0.2820508 0.3153821

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started