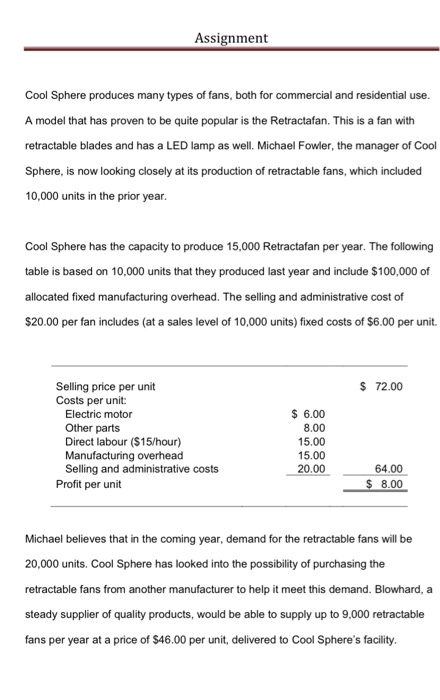

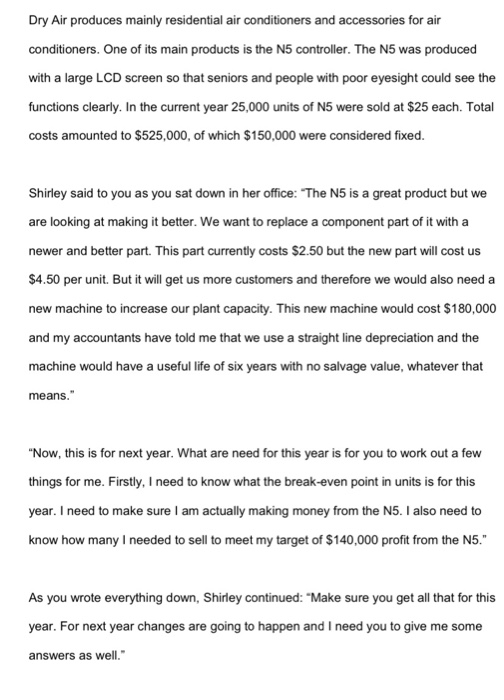

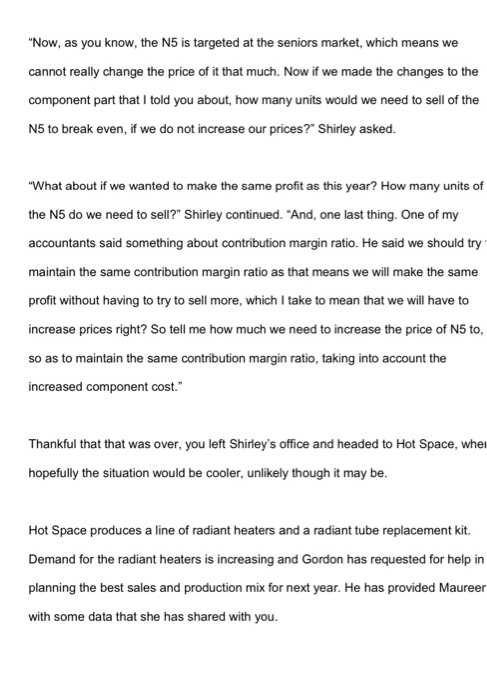

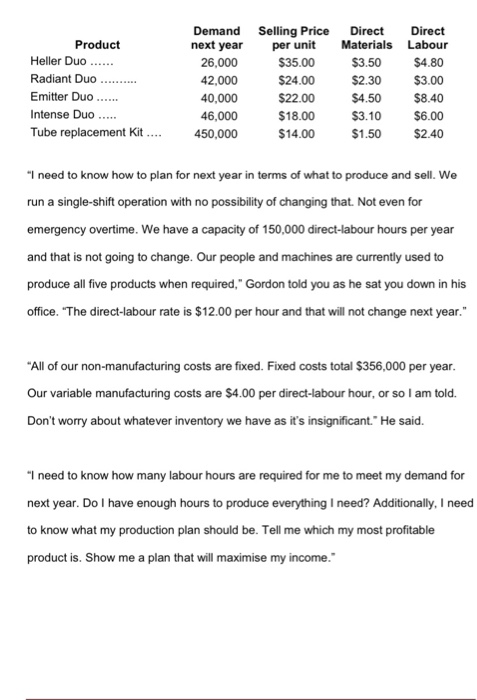

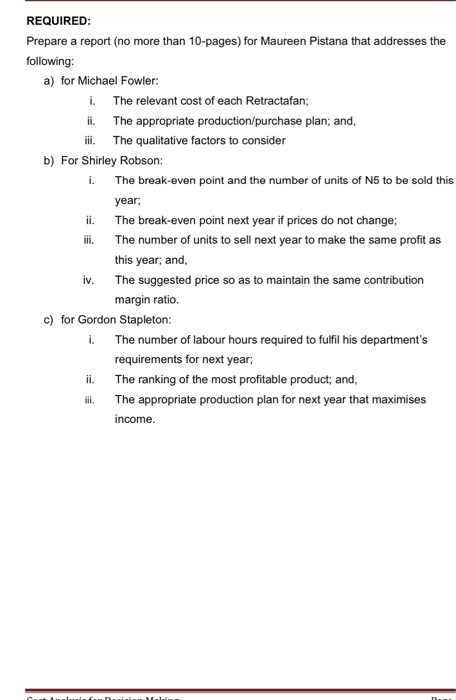

Assignment You have just been hired as a graduate accountant by Suunto Corporation, a company that manufactures a variety of electronic products. It specialises in commercial and residential products with moderate to large electric motors. There are three main divisions in Suunto: CoolSphere (that produces fans), Dry Air (that produces air conditioners) and Hot Space (that produces heaters). All divisions are stand-alone, with a manager responsible for each division, as well as its own administrative functions. The respective managers are: Michael Fowler (Cool Sphere). Shirley Robson (Dry Air) and Gordon Stapleton (Hot Space). The accounting function is centralised, however, each division has an accounts team to help with preparation of planning and reports. From time to time, an accountant from the main office may be assigned to a division to assist with issues that the division may encounter, and which the accounts team may not have the expertise or experience to handle. You have been appointed to a graduate position with the central accounting team and have been made aware that from time to time, your job assignation may take you out of the central office into a division. You will be reporting to Maureen Pistana, the Chief Financial Officer of Suunto Corporation. On your first day, Maureen called you into her office and informed you that you have to prepare a report for her. You are required to head down to Cool Sphere to speak to Michael Fowler, the manager of the division to discuss some planning issues. You are then to head to Dry Air to see Shirley Robson, who is having some issues with manufacturing and finally to Hot Space, where Gordon Stapleton needs help with his staffing requirements. Cost Analysis for Decision Making Page 1 Assignment Cool Sphere produces many types of fans, both for commercial and residential use. A model that has proven to be quite popular is the Retractafan. This is a fan with retractable blades and has a LED lamp as well. Michael Fowler, the manager of Cool Sphere, is now looking closely at its production of retractable fans, which included 10,000 units in the prior year. Cool Sphere has the capacity to produce 15,000 Retractafan per year. The following table is based on 10,000 units that they produced last year and include $100,000 of allocated fixed manufacturing overhead. The selling and administrative cost of $20.00 per fan includes (at a sales level of 10,000 units) fixed costs of $6.00 per unit. $ 72.00 Selling price per unit Costs per unit: Electric motor Other parts Direct labour ($15/hour) Manufacturing overhead Selling and administrative costs Profit per unit $ 6.00 8.00 15.00 15.00 20.00 64.00 $ 8.00 Michael believes that in the coming year, demand for the retractable fans will be 20,000 units. Cool Sphere has looked into the possibility of purchasing the retractable fans from another manufacturer to help it meet this demand. Blowhard, a steady supplier of quality products, would be able to supply up to 9,000 retractable fans per year at a price of $46.00 per unit, delivered to Cool Sphere's facility. "Look," Michael said to you. "I need you to work out for me what these all mean. My accounts team knows how to put in the numbers, but it seems like no one knows what to do with it. Is that how much it really costs me to produce a fan? If so, then Blowhard must be doing something different to be able to charge me such a low price. Can you re-work those numbers and tell me how much each of the Retractafans cost?" As you nodded your head, Michael continued: "As I have told Maureen, demand is going to go up to 20,000 units next year. But I only have capacity for 15,000 units. So what should I do? I know we can buy some from Blowhard to make up the 20,000 units requirement, but how many should I buy? Blowhard has said they can supply me with up to 9,000 units. If the price they are quoting me is lower than how much it cost me to produce, then maybe I should just buy from Blowhard and then produce the remainder. Tell me how many I need to buy. Give me a plan of how many to make and how many to buy and show me what is the maximum contribution margin can make." "And one last thing," Michael went on. "Is there anything else I should consider apart from the price of the fans from Blowhard? Maureen always talks about these so- called "qualitative factors". Maybe consider them for me as well? Thanks." With that, you were dismissed. You now have a few questions to work out for your report and you still have to meet Gordon and Shirley, so off you wander again. Dry Air produces mainly residential air conditioners and accessories for air conditioners. One of its main products is the N5 controller. The N5 was produced with a large LCD screen so that seniors and people with poor eyesight could see the functions clearly. In the current year 25,000 units of N5 were sold at $25 each. Total costs amounted to $525,000, of which $150,000 were considered fixed. Shirley said to you as you sat down in her office: "The N5 is a great product but we are looking at making it better. We want to replace a component part of it with a newer and better part. This part currently costs $2.50 but the new part will cost us $4.50 per unit. But it will get us more customers and therefore we would also need a new machine to increase our plant capacity. This new machine would cost $180,000 and my accountants have told me that we use a straight line depreciation and the machine would have a useful life of six years with no salvage value, whatever that means." "Now, this is for next year. What are need for this year is for you to work out a few things for me. Firstly, I need to know what the break-even point in units is for this year. I need to make sure I am actually making money from the N5. I also need to know how many I needed to sell to meet my target of $140,000 profit from the N5." As you wrote everything down, Shirley continued: "Make sure you get all that for this year. For next year changes are going to happen and I need you to give me some answers as well." "Now, as you know, the N5 is targeted at the seniors market, which means we cannot really change the price of it that much. Now if we made the changes to the component part that I told you about, how many units would we need to sell of the N5 to break even if we do not increase our prices? Shirley asked. "What about if we wanted to make the same profit as this year? How many units of the N5 do we need to sell?" Shirley continued. "And, one last thing. One of my accountants said something about contribution margin ratio. He said we should try maintain the same contribution margin ratio as that means we will make the same profit without having to try to sell more, which I take to mean that we will have to increase prices right? So tell me how much we need to increase the price of N5 to, so as to maintain the same contribution margin ratio, taking into account the increased component cost." Thankful that that was over, you left Shirley's office and headed to Hot Space, wher hopefully the situation would be cooler, unlikely though it may be. Hot Space produces a line of radiant heaters and a radiant tube replacement kit. Demand for the radiant heaters is increasing and Gordon has requested for help in planning the best sales and production mix for next year. He has provided Maureer with some data that she has shared with you. Product Heller Duo ...... Radiant Duo Emitter Duo ...... Intense Duo ... Tube replacement Kit.. Demand Selling Price next year per unit 26,000 $35.00 42,000 $24.00 40,000 $22.00 46,000 $18.00 450,000 $14.00 Direct Direct Materials Labour $3.50 $4.80 $2.30 $3.00 $4.50 $8.40 $3.10 $6.00 $1.50 $2.40 "I need to know how to plan for next year in terms of what to produce and sell. We run a single-shift operation with no possibility of changing that. Not even for emergency overtime. We have a capacity of 150,000 direct-labour hours per year and that is not going to change. Our people and machines are currently used to produce all five products when required," Gordon told you as he sat you down in his office. "The direct-labour rate is $12.00 per hour and that will not change next year." "All of our non-manufacturing costs are fixed. Fixed costs total $356,000 per year. Our variable manufacturing costs are $4.00 per direct-labour hour, or so I am told. Don't worry about whatever inventory we have as it's insignificant." He said. "I need to know how many labour hours are required for me to meet my demand for next year. Do I have enough hours to produce everything I need? Additionally, I need to know what my production plan should be. Tell me which my most profitable product is. Show me a plan that will maximise my income." i. REQUIRED: Prepare a report (no more than 10-pages) for Maureen Pistana that addresses the following: a) for Michael Fowler: i. The relevant cost of each Retractafan; ii. The appropriate production/purchase plan; and, ii. The qualitative factors to consider b) For Shirley Robson: The break-even point and the number of units of N5 to be sold this year; The break-even point next year if prices do not change; The number of units to sell next year to make the same profit as this year, and The suggested price so as to maintain the same contribution margin ratio c) for Gordon Stapleton: i. The number of labour hours required to fulfil his department's requirements for next year, ii. The ranking of the most profitable product, and, The appropriate production plan for next year that maximises income. ii. iii. iv. Assignment You have just been hired as a graduate accountant by Suunto Corporation, a company that manufactures a variety of electronic products. It specialises in commercial and residential products with moderate to large electric motors. There are three main divisions in Suunto: CoolSphere (that produces fans), Dry Air (that produces air conditioners) and Hot Space (that produces heaters). All divisions are stand-alone, with a manager responsible for each division, as well as its own administrative functions. The respective managers are: Michael Fowler (Cool Sphere). Shirley Robson (Dry Air) and Gordon Stapleton (Hot Space). The accounting function is centralised, however, each division has an accounts team to help with preparation of planning and reports. From time to time, an accountant from the main office may be assigned to a division to assist with issues that the division may encounter, and which the accounts team may not have the expertise or experience to handle. You have been appointed to a graduate position with the central accounting team and have been made aware that from time to time, your job assignation may take you out of the central office into a division. You will be reporting to Maureen Pistana, the Chief Financial Officer of Suunto Corporation. On your first day, Maureen called you into her office and informed you that you have to prepare a report for her. You are required to head down to Cool Sphere to speak to Michael Fowler, the manager of the division to discuss some planning issues. You are then to head to Dry Air to see Shirley Robson, who is having some issues with manufacturing and finally to Hot Space, where Gordon Stapleton needs help with his staffing requirements. Cost Analysis for Decision Making Page 1 Assignment Cool Sphere produces many types of fans, both for commercial and residential use. A model that has proven to be quite popular is the Retractafan. This is a fan with retractable blades and has a LED lamp as well. Michael Fowler, the manager of Cool Sphere, is now looking closely at its production of retractable fans, which included 10,000 units in the prior year. Cool Sphere has the capacity to produce 15,000 Retractafan per year. The following table is based on 10,000 units that they produced last year and include $100,000 of allocated fixed manufacturing overhead. The selling and administrative cost of $20.00 per fan includes (at a sales level of 10,000 units) fixed costs of $6.00 per unit. $ 72.00 Selling price per unit Costs per unit: Electric motor Other parts Direct labour ($15/hour) Manufacturing overhead Selling and administrative costs Profit per unit $ 6.00 8.00 15.00 15.00 20.00 64.00 $ 8.00 Michael believes that in the coming year, demand for the retractable fans will be 20,000 units. Cool Sphere has looked into the possibility of purchasing the retractable fans from another manufacturer to help it meet this demand. Blowhard, a steady supplier of quality products, would be able to supply up to 9,000 retractable fans per year at a price of $46.00 per unit, delivered to Cool Sphere's facility. "Look," Michael said to you. "I need you to work out for me what these all mean. My accounts team knows how to put in the numbers, but it seems like no one knows what to do with it. Is that how much it really costs me to produce a fan? If so, then Blowhard must be doing something different to be able to charge me such a low price. Can you re-work those numbers and tell me how much each of the Retractafans cost?" As you nodded your head, Michael continued: "As I have told Maureen, demand is going to go up to 20,000 units next year. But I only have capacity for 15,000 units. So what should I do? I know we can buy some from Blowhard to make up the 20,000 units requirement, but how many should I buy? Blowhard has said they can supply me with up to 9,000 units. If the price they are quoting me is lower than how much it cost me to produce, then maybe I should just buy from Blowhard and then produce the remainder. Tell me how many I need to buy. Give me a plan of how many to make and how many to buy and show me what is the maximum contribution margin can make." "And one last thing," Michael went on. "Is there anything else I should consider apart from the price of the fans from Blowhard? Maureen always talks about these so- called "qualitative factors". Maybe consider them for me as well? Thanks." With that, you were dismissed. You now have a few questions to work out for your report and you still have to meet Gordon and Shirley, so off you wander again. Dry Air produces mainly residential air conditioners and accessories for air conditioners. One of its main products is the N5 controller. The N5 was produced with a large LCD screen so that seniors and people with poor eyesight could see the functions clearly. In the current year 25,000 units of N5 were sold at $25 each. Total costs amounted to $525,000, of which $150,000 were considered fixed. Shirley said to you as you sat down in her office: "The N5 is a great product but we are looking at making it better. We want to replace a component part of it with a newer and better part. This part currently costs $2.50 but the new part will cost us $4.50 per unit. But it will get us more customers and therefore we would also need a new machine to increase our plant capacity. This new machine would cost $180,000 and my accountants have told me that we use a straight line depreciation and the machine would have a useful life of six years with no salvage value, whatever that means." "Now, this is for next year. What are need for this year is for you to work out a few things for me. Firstly, I need to know what the break-even point in units is for this year. I need to make sure I am actually making money from the N5. I also need to know how many I needed to sell to meet my target of $140,000 profit from the N5." As you wrote everything down, Shirley continued: "Make sure you get all that for this year. For next year changes are going to happen and I need you to give me some answers as well." "Now, as you know, the N5 is targeted at the seniors market, which means we cannot really change the price of it that much. Now if we made the changes to the component part that I told you about, how many units would we need to sell of the N5 to break even if we do not increase our prices? Shirley asked. "What about if we wanted to make the same profit as this year? How many units of the N5 do we need to sell?" Shirley continued. "And, one last thing. One of my accountants said something about contribution margin ratio. He said we should try maintain the same contribution margin ratio as that means we will make the same profit without having to try to sell more, which I take to mean that we will have to increase prices right? So tell me how much we need to increase the price of N5 to, so as to maintain the same contribution margin ratio, taking into account the increased component cost." Thankful that that was over, you left Shirley's office and headed to Hot Space, wher hopefully the situation would be cooler, unlikely though it may be. Hot Space produces a line of radiant heaters and a radiant tube replacement kit. Demand for the radiant heaters is increasing and Gordon has requested for help in planning the best sales and production mix for next year. He has provided Maureer with some data that she has shared with you. Product Heller Duo ...... Radiant Duo Emitter Duo ...... Intense Duo ... Tube replacement Kit.. Demand Selling Price next year per unit 26,000 $35.00 42,000 $24.00 40,000 $22.00 46,000 $18.00 450,000 $14.00 Direct Direct Materials Labour $3.50 $4.80 $2.30 $3.00 $4.50 $8.40 $3.10 $6.00 $1.50 $2.40 "I need to know how to plan for next year in terms of what to produce and sell. We run a single-shift operation with no possibility of changing that. Not even for emergency overtime. We have a capacity of 150,000 direct-labour hours per year and that is not going to change. Our people and machines are currently used to produce all five products when required," Gordon told you as he sat you down in his office. "The direct-labour rate is $12.00 per hour and that will not change next year." "All of our non-manufacturing costs are fixed. Fixed costs total $356,000 per year. Our variable manufacturing costs are $4.00 per direct-labour hour, or so I am told. Don't worry about whatever inventory we have as it's insignificant." He said. "I need to know how many labour hours are required for me to meet my demand for next year. Do I have enough hours to produce everything I need? Additionally, I need to know what my production plan should be. Tell me which my most profitable product is. Show me a plan that will maximise my income." i. REQUIRED: Prepare a report (no more than 10-pages) for Maureen Pistana that addresses the following: a) for Michael Fowler: i. The relevant cost of each Retractafan; ii. The appropriate production/purchase plan; and, ii. The qualitative factors to consider b) For Shirley Robson: The break-even point and the number of units of N5 to be sold this year; The break-even point next year if prices do not change; The number of units to sell next year to make the same profit as this year, and The suggested price so as to maintain the same contribution margin ratio c) for Gordon Stapleton: i. The number of labour hours required to fulfil his department's requirements for next year, ii. The ranking of the most profitable product, and, The appropriate production plan for next year that maximises income. ii. iii. iv