Answered step by step

Verified Expert Solution

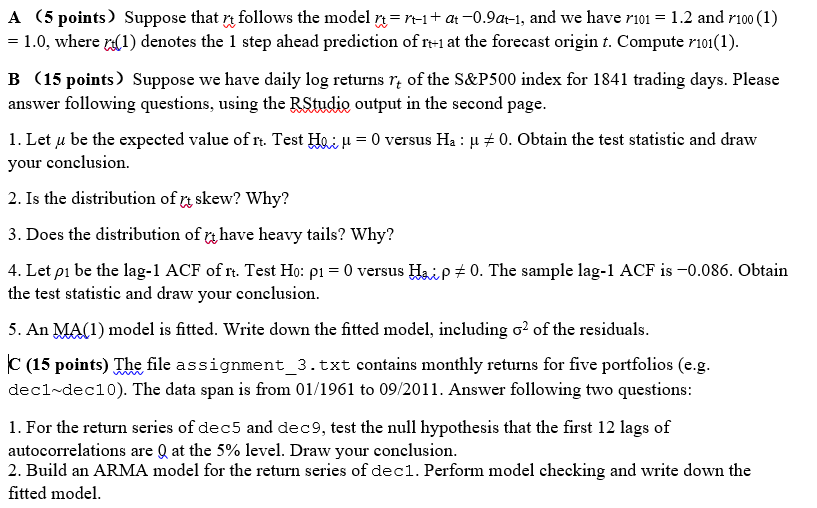

Question

1 Approved Answer

Assignment_3.txt date 1-Dec 2-Dec 5-Dec 9-Dec 10-Dec 19610131 0.058011 0.067392 0.081767 0.096754 0.087207 19610228 0.029241 0.042784 0.055524 0.056564 0.060245 19610330 0.025896 0.025474 0.041304 0.060563 0.071875

Assignment_3.txt

| date | 1-Dec | 2-Dec | 5-Dec | 9-Dec | 10-Dec |

| 19610131 | 0.058011 | 0.067392 | 0.081767 | 0.096754 | 0.087207 |

| 19610228 | 0.029241 | 0.042784 | 0.055524 | 0.056564 | 0.060245 |

| 19610330 | 0.025896 | 0.025474 | 0.041304 | 0.060563 | 0.071875 |

| 19610428 | 0.005667 | 0.001365 | 0.00078 | 0.011911 | 0.023328 |

| 19610531 | 0.019208 | 0.036852 | 0.04959 | 0.046248 | 0.050362 |

| 19610630 | -0.02467 | -0.02523 | -0.04005 | -0.05065 | -0.05143 |

| 19610731 | 0.035668 | 0.027452 | 0.00937 | 0.004484 | -0.00896 |

| 19610831 | 0.024092 | 0.041437 | 0.015614 | 0.008745 | 0.011384 |

| 19610929 | -0.01618 | -0.02478 | -0.01676 | -0.03624 | -0.03203 |

| 19611031 | 0.028087 | 0.028174 | 0.023155 | 0.023609 | 0.027843 |

| 19611130 | 0.048685 | 0.036955 | 0.043721 | 0.052817 | 0.048427 |

| 19611229 | 0.005025 | -0.01109 | -0.00404 | 0.002387 | 0.002329 |

| 19620131 | -0.04526 | -0.02255 | -0.02908 | 0.007979 | 0.048003 |

| 19620228 | 0.02362 | 0.012706 | 0.015649 | 0.01248 | 0.027391 |

| 19620330 | -0.0039 | -0.00269 | -0.00575 | 0.004284 | -0.0071 |

| 19620430 | -0.06129 | -0.06965 | -0.05903 | -0.06924 | -0.07276 |

| 19620531 | -0.07885 | -0.08584 | -0.10734 | -0.10079 | -0.10835 |

| 19620629 | -0.08326 | -0.07597 | -0.08563 | -0.0798 | -0.0753 |

| 19620731 | 0.068084 | 0.060073 | 0.051869 | 0.072275 | 0.077477 |

| 19620831 | 0.020698 | 0.02718 | 0.022439 | 0.036381 | 0.04777 |

| 19620928 | -0.04482 | -0.05854 | -0.05907 | -0.07738 | -0.0736 |

| 19621031 | 0.012499 | -0.00814 | -0.01707 | -0.05581 | -0.05956 |

| 19621130 | 0.099604 | 0.133502 | 0.125354 | 0.129271 | 0.107458 |

| 19621231 | 0.019592 | 0.01113 | -0.00794 | -0.03834 | -0.04075 |

| 19630131 | 0.045429 | 0.055389 | 0.066401 | 0.094983 | 0.104486 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started