Answered step by step

Verified Expert Solution

Question

1 Approved Answer

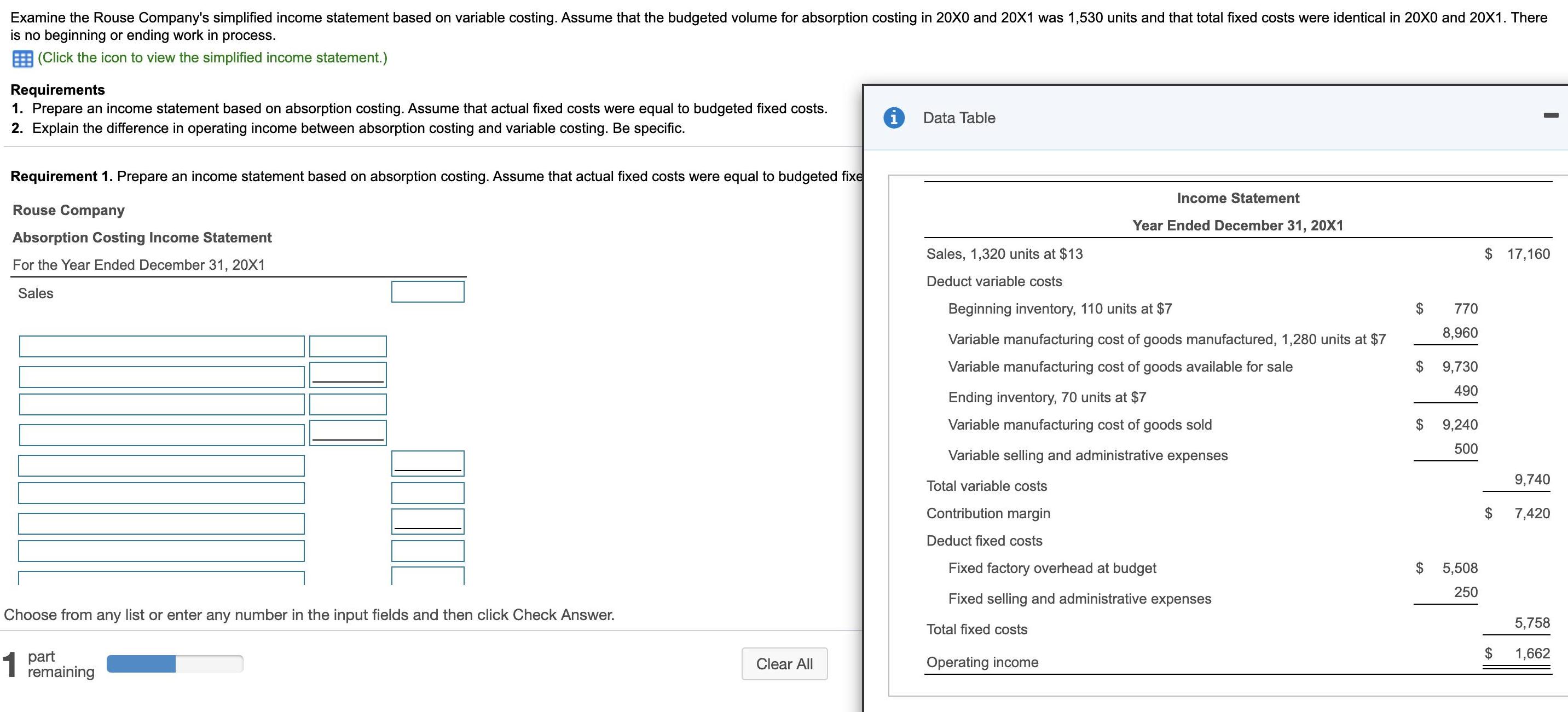

Examine the Rouse Company's simplified income statement based on variable costing. ASsume that the budgeted volume for absorption costing in 20X0 and 20X1 was

Examine the Rouse Company's simplified income statement based on variable costing. ASsume that the budgeted volume for absorption costing in 20X0 and 20X1 was 1,530 units and that total fixed costs were identical in 20X0 and 20X1. There is no beginning or ending work in process. |(Click the icon to view the simplified income statement.) Requirements 1. Prepare an income statement based on absorption costing. Assume that actual fixed costs were equal to budgeted fixed costs. 2. Explain the difference in operating income between absorption costing and variable costing. Be specific. i Data Table Requirement 1. Prepare an income statement based on absorption costing. Assume that actual fixed costs were equal to budgeted fixe Income Statement Rouse Company Year Ended December 31, 20X1 Absorption Costing Income Statement Sales, 1,320 units at $13 $ 17,160 For the Year Ended December 31, 20X1 Deduct variable costs Sales Beginning inventory, 110 units at $7 $ 770 8,960 Variable manufacturing cost of goods manufactured, 1,280 units at $7 Variable manufacturing cost of goods available for sale $ 9,730 490 Ending inventory, 70 units at $7 Variable manufacturing cost of goods sold 2$ 9,240 500 Variable selling and administrative expenses 9,740 Total variable costs Contribution margin 7,420 Deduct fixed costs Fixed factory overhead at budget $ 5,508 250 Fixed selling and administrative expenses Choose from any list or enter any number in the input fields and then click Check Answer. 5,758 Total fixed costs $ 1,662 1 remaining Clear All Operating income %24

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started