Question

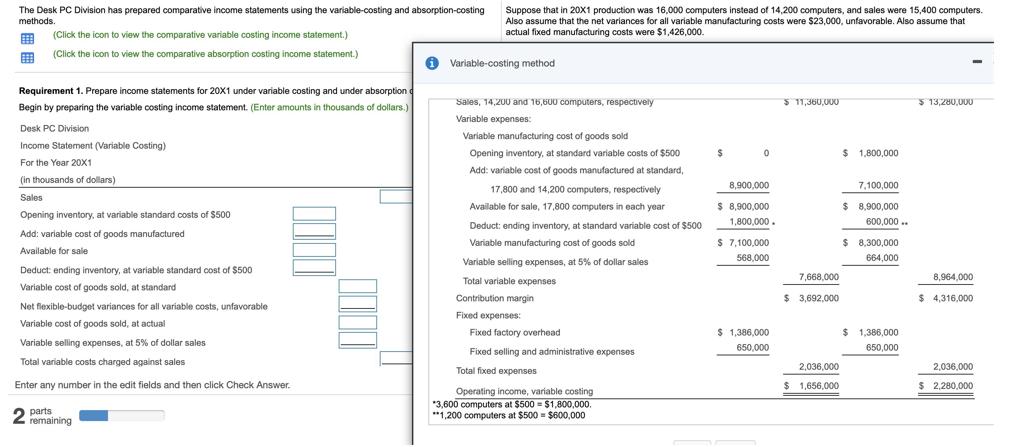

The Desk PC Division has prepared comparative income statements using the variable-costing and absorption-costing. methods. (Click the icon to view the comparative variable costing

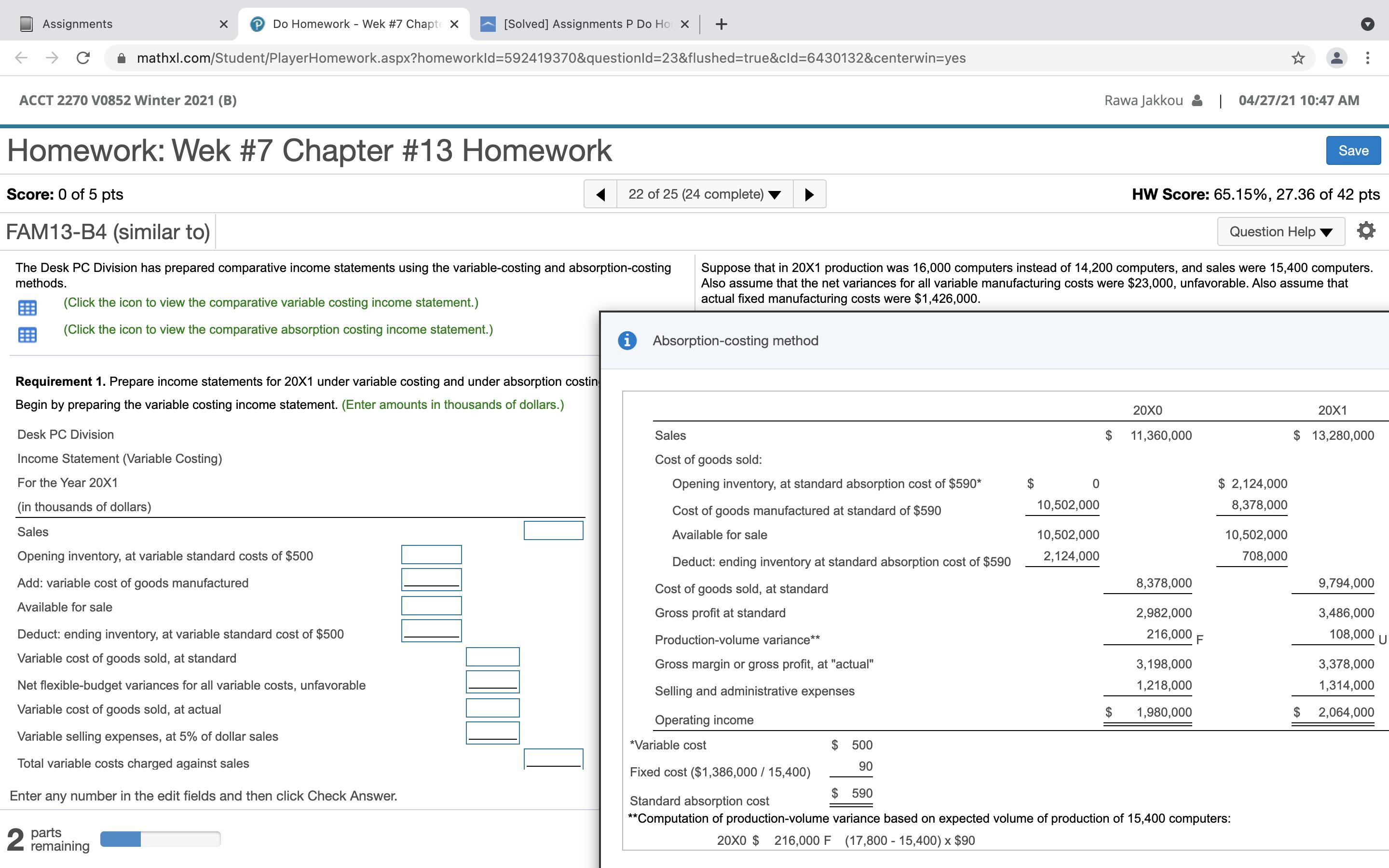

The Desk PC Division has prepared comparative income statements using the variable-costing and absorption-costing. methods. (Click the icon to view the comparative variable costing income statement.) (Click the icon to view the comparative absorption costing income statement.) Requirement 1. Prepare income statements for 20X1 under variable costing and under absorption Begin by preparing the variable costing income statement. (Enter amounts in thousands of dollars.) Desk PC Division Income Statement (Variable Costing) For the Year 20X1 (in thousands of dollars) Sales Opening inventory, at variable standard costs of $500 Add: variable cost of goods manufactured Available for sale Deduct: ending inventory, at variable standard cost of $500 Variable cost of goods sold, at standard Net flexible-budget variances for all variable costs, unfavorable Variable cost of goods sold, at actual Variable selling expenses, at 5% of dollar sales Total variable costs charged against sales Enter any number in the edit fields and then click Check Answer. 2 parts remaining i Suppose that in 20X1 production was 16,000 computers instead of 14,200 computers, and sales were 15,400 computers. Also assume that the net variances for all variable manufacturing costs were $23,000, unfavorable. Also assume that actual fixed manufacturing costs were $1,426,000. Variable-costing method Sales, 14,200 and 16,600 computers, respectively Variable expenses: Variable manufacturing cost of goods sold Opening inventory, at standard variable costs of $500 Add: variable cost of goods manufactured at standard, 17,800 and 14,200 computers, respectively Available for sale, 17,800 computers in each year Deduct: ending inventory, at standard variable cost of $500 Variable manufacturing cost of goods sold Variable selling expenses, at 5% of dollar sales Total variable expenses Contribution margin Fixed expenses: Fixed factory overhead Fixed selling and administrative expenses Total fixed expenses Operating income, variable costing *3,600 computers at $500 $1,800,000. **1,200 computers at $500 $600,000 $ 0 8,900,000 $ 8,900,000 1,800,000. $ 7,100,000 568,000 $ 1,386,000 650.000 $11,360,000 7,668,000 $ 3,692,000 2,036,000 $1,656,000 $ 1,800,000 7,100,000 $ 8,900,000 600,000.. $ 8,300,000 664,000 $ 1,386,000 650,000 $13,280,000 8,964,000 $ 4,316,000 2,036,000 $ 2,280,000 Assignments X P Do Homework - Wek #7 Chapte X ACCT 2270 V0852 Winter 2021 (B) mathxl.com/Student/PlayerHomework.aspx?homeworkId=592419370&questionId=23&flushed=true&cid=6430132¢erwin=yes Homework: Wek #7 Chapter #13 Homework Score: 0 of 5 pts FAM13-B4 (similar to) The Desk PC Division has prepared comparative income statements using the variable-costing and absorption-costing methods. (Click the icon to view the comparative variable costing income statement.) (Click the icon to view the comparative absorption costing income statement.) 2 Requirement 1. Prepare income statements for 20X1 under variable costing and under absorption costin Begin by preparing the variable costing income statement. (Enter amounts in thousands of dollars.) Desk PC Division Income Statement (Variable Costing) For the Year 20X1 (in thousands of dollars) Sales Opening inventory, at variable standard costs of $500 Add: variable cost of goods manufactured Available for sale Deduct: ending inventory, at variable standard cost of $500 Variable cost of goods sold, at standard [Solved] Assignments P Do Ho x + Net flexible-budget variances for all variable costs, unfavorable Variable cost of goods sold, at actual Variable selling expenses, at 5% of dollar sales Total variable costs charged against sales Enter any number in the edit fields and then click Check Answer. parts remaining 22 of 25 (24 complete) i Absorption-costing method HW Score: 65.15%, 27.36 of 42 pts Question Help Suppose that in 20X1 production was 16,000 computers instead of 14,200 computers, and sales were 15,400 computers. Also assume that the net variances for all variable manufacturing costs were $23,000, unfavorable. Also assume that actual fixed manufacturing costs were $1,426,000. Sales Cost of goods sold: Opening inventory, at standard absorption cost of $590* Cost of goods manufactured at standard of $590 Available for sale Deduct: ending inventory at standard absorption cost of $590 Cost of goods sold, at standard Gross profit at standard Production-volume variance** Gross margin or gross profit, at "actual" Selling and administrative expenses Operating income *Variable cost Fixed cost ($1,386,000/ 15,400) $ $ 0 Rawa Jakkou 10,502,000 10,502,000 2,124,000 $ 20X0 11,360,000 8,378,000 2,982,000 216,000 F | 04/27/21 10:47 AM 3,198,000 1,218,000 1,980,000 $ 2,124,000 8,378,000 10,502,000 708,000 Save 500 90 $ 590 Standard absorption cost **Computation of production-volume variance based on expected volume of production of 15,400 computers: 20X0 $ 216,000 F (17,800 - 15,400) x $90 20X1 $ 13,280,000 9,794,000 3,486,000 108,000 U 3,378,000 1,314,000 $ 2,064,000 Assignments X P Do Homework - Wek #7 Chapte X ACCT 2270 V0852 Winter 2021 (B) mathxl.com/Student/PlayerHomework.aspx?homeworkId=592419370&questionId=23&flushed=true&cid=6430132¢erwin=yes Homework: Wek #7 Chapter #13 Homework Score: 0 of 5 pts FAM13-B4 (similar to) The Desk PC Division has prepared comparative income statements using the variable-costing and absorption-costing methods. (Click the icon to view the comparative variable costing income statement.) (Click the icon to view the comparative absorption costing income statement.) 2 Requirement 1. Prepare income statements for 20X1 under variable costing and under absorption costing. Begin by preparing the variable costing income statement. (Enter amounts in thousands of dollars.) Desk PC Division Income Statement (Variable Costing) For the Year 20X1 (in thousands of dollars) Sales Opening inventory, at variable standard costs of $500 Add: variable cost of goods manufactured Available for sale Deduct: ending inventory, at variable standard cost of $500 Variable cost of goods sold, at standard [Solved] Assignments P Do Ho x + Net flexible-budget variances for all variable costs, unfavorable Variable cost of goods sold, at actual Variable selling expenses, at 5% of dollar sales Total variable costs charged against sales Enter any number in the edit fields and then click Check Answer. parts remaining 22 of 25 (24 complete) i Requirements HW Score: 65.15%, 27.36 of 42 pts Question Help Suppose that in 20X1 production was 16,000 computers instead of 14,200 computers, and sales were 15,400 computers. Also assume that the net variances for all variable manufacturing costs were $23,000, unfavorable. Also assume that actual fixed manufacturing costs were $1,426,000. Read the requirements. Clear All Rawa Jakkou Print | 04/27/21 10:47 AM 1. Prepare income statements for 20X1 under variable costing and under absorption costing. 2. Explain why operating income was different under variable costing and absorption costing. Show your calculations. Done x Save Check Answer

Step by Step Solution

3.35 Rating (133 Votes )

There are 3 Steps involved in it

Step: 1

Income statement under variable costing method Amount 13280000 Less Variable cost of goods sold Opening inventory at variable cost of 500 1800000 Cost of goods manufactured 500 7100000 Variable cost o...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started