Answered step by step

Verified Expert Solution

Question

1 Approved Answer

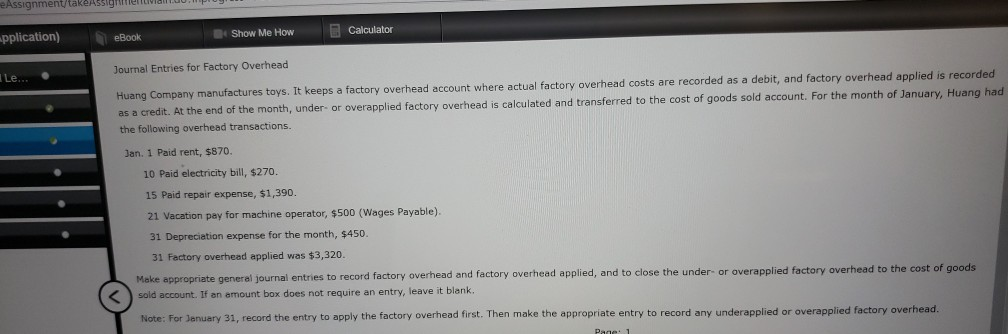

Assignment/takeAssignment application) Calculator eBook Show Me How Journal Entries for Factory Overhead ILe. Huang Company manufactures toys. keeps a factory overhead account where actual factory

Assignment/takeAssignment application) Calculator eBook Show Me How Journal Entries for Factory Overhead ILe. Huang Company manufactures toys. keeps a factory overhead account where actual factory overhead costs are recorded as a debit, and factory overhead applied is recorded as a credit. At the end of the month, under-or overapplied factory overhead is calculated and transferred to the cost of goods sold account. For the month of January, Huang had the following overhead transactions. Jan. 1 Paid rent, $870. 10 Paid electricity bill, $270. 15 Paid repair expense, $1,390. 21 Vacation pay for machine operator, $500 (Wages Payable) 31 Depreciation expense for the month, $450 31 Factory overhead applied was $3,320 Make appropriate general journal entries to record factory overhead and factory overhead applied, and to close the under or overapplied factory overhead to the cost of goods sold account. If an amount box does not require an entry, leave it blank. Note: For January 31, record the entry to apply the factory overhead first. Then make the appropriate entry to record any underapplied or overapplied factory overhead. Page 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started