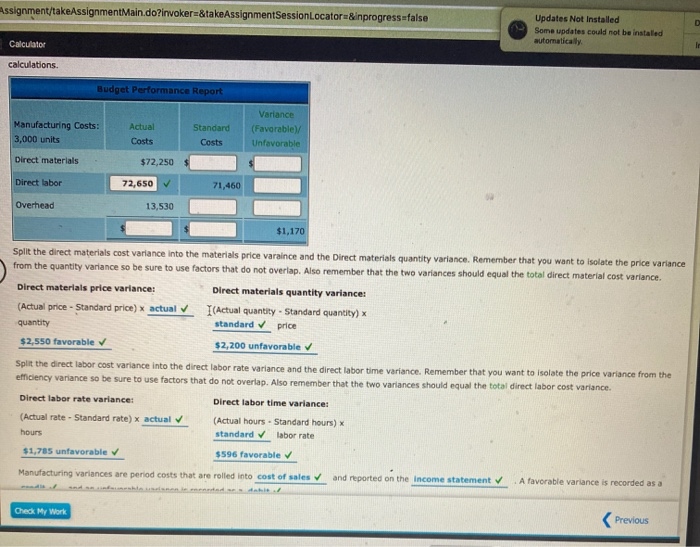

Assignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false D Updates Not Installed Some updates could not be installed automatically Calculator calculations. Budget Performance Report Manufacturing Costs: 3,000 units Actual Costs Standard Costs Variance (Favorable) Unfavorable Direct materials $72,250 Direct labor 72,650 71,460 Overhead 13,530 $1,170 Split the direct materials cost variance into the materials price varaince and the Direct materials quantity variance. Remember that you want to Isolate the price variance from the quantity variance so be sure to use factors that do not overlap. Also remember that the two variances should equal the total direct material cost variance. Direct materials price variance: Direct materials quantity variance: (Actual price - Standard price) actual (Actual quantity - Standard quantity) quantity standard price $2,550 favorable $2,200 unfavorable Split the direct labor cost variance into the direct labor rate variance and the direct labor time variance. Remember that you want to isolate the price variance from the efficiency variance so be sure to use factors that do not overlap. Also remember that the two variances should equal the total direct labor cost variance. Direct labor rate variance: Direct labor time variance: (Actual rate - Standard rate) x actual (Actual hours. Standard hours) hours standard labor rate $1,785 unfavorable $596 favorable Manufacturing variances are period costs that are rolled into cost of sales and reported on the income statement A favorable variance is recorded as a Check My Work Previous Assignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false D Updates Not Installed Some updates could not be installed automatically Calculator calculations. Budget Performance Report Manufacturing Costs: 3,000 units Actual Costs Standard Costs Variance (Favorable) Unfavorable Direct materials $72,250 Direct labor 72,650 71,460 Overhead 13,530 $1,170 Split the direct materials cost variance into the materials price varaince and the Direct materials quantity variance. Remember that you want to Isolate the price variance from the quantity variance so be sure to use factors that do not overlap. Also remember that the two variances should equal the total direct material cost variance. Direct materials price variance: Direct materials quantity variance: (Actual price - Standard price) actual (Actual quantity - Standard quantity) quantity standard price $2,550 favorable $2,200 unfavorable Split the direct labor cost variance into the direct labor rate variance and the direct labor time variance. Remember that you want to isolate the price variance from the efficiency variance so be sure to use factors that do not overlap. Also remember that the two variances should equal the total direct labor cost variance. Direct labor rate variance: Direct labor time variance: (Actual rate - Standard rate) x actual (Actual hours. Standard hours) hours standard labor rate $1,785 unfavorable $596 favorable Manufacturing variances are period costs that are rolled into cost of sales and reported on the income statement A favorable variance is recorded as a Check My Work Previous