Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assinnment 3 Student ID CLO4 . Pee Company acquired 75% in See Company for $600,000 on Jan 1, 2019, when See had $500,000 capital

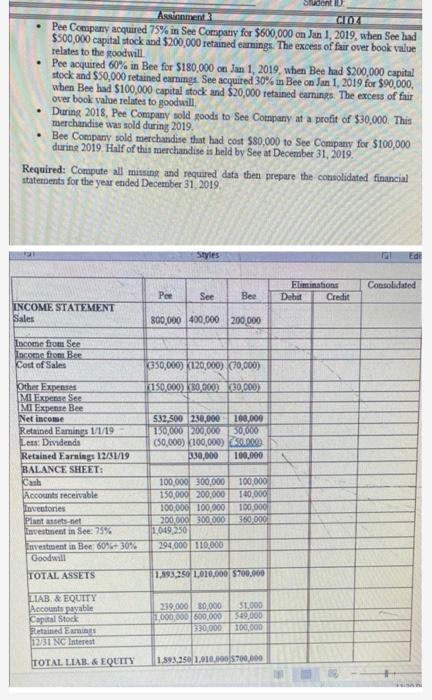

Assinnment 3 Student ID CLO4 . Pee Company acquired 75% in See Company for $600,000 on Jan 1, 2019, when See had $500,000 capital stock and $200,000 retained earnings. The excess of fair over book value relates to the goodwill Pee acquired 60% in Bee for $180,000 on Jan 1, 2019, when Bee had $200,000 capital stock and $50,000 retained earnings See acquired 30% in Bee on Jan 1, 2019 for $90,000, when Bee had $100,000 capital stock and $20,000 retained earnings. The excess of fair over book value relates to goodwill . During 2018, Pee Company sold goods to See Company at a profit of $30,000. This merchandise was sold during 2019. Bee Company sold merchandise that had cost $80,000 to See Company for $100,000 during 2019. Half of this merchandise is held by See at December 31, 2019. Required: Compute all missing and required data then prepare the consolidated financial statements for the year ended December 31, 2019. Styles Edi Pee Eliminations Bee Debit Credit See INCOME STATEMENT Sales 800,000 400,000 200,000 Income from See Income from Bee Cost of Sales (350,000) 120,000) (70,000) 150,000) 80,000) 30,000) Other Expenses MI Expense See MI Expense Bee Net income 532,500 230,000 100,000 Retained Earnings 1/1/19 Less: Dividends 150,000 200,000 50,000 (50,000) 100,000) 50.000) Retained Earnings 12/31/19 330,000 100,000 BALANCE SHEET: Cash 100,000 300,000 100,000 Accounts receivable 150,000 200,000 140,000 Inventories 100,000 100,000 100,000 200,000 300.000 360,000 Plant assets-net Investment in See: 75% 1.049,250 294,000 110,000 Investment in Bee: 60%+ 30% Goodwill TOTAL ASSETS 1,893,250 1,010,000 $700,000 LIAB & EQUITY 239.000 80,000 $1,000 Accounts payable Capital Stock 1,000,000 600,000 549,000 330,000 100,000 Retained Earnings 12/31 NC Interest TOTAL LIAB. & EQUITY 1,393,250 1,010,000 $700,000 Consolidated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Consolidated Income Statement ended Dec 31 2019 for the ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started