Question

Assistance is needed with Expected Cash Disbursements for Cash Budget, Accounts Payable, and Inventory Raw. I WILL NOT PAY YOU TO CONTACT YOU OUTSIDE OF

Assistance is needed with Expected Cash Disbursements for Cash Budget, Accounts Payable, and Inventory Raw.

I WILL NOT PAY YOU TO CONTACT YOU OUTSIDE OF THIS PLATFORM!

YOU WILL BE REPORTED!

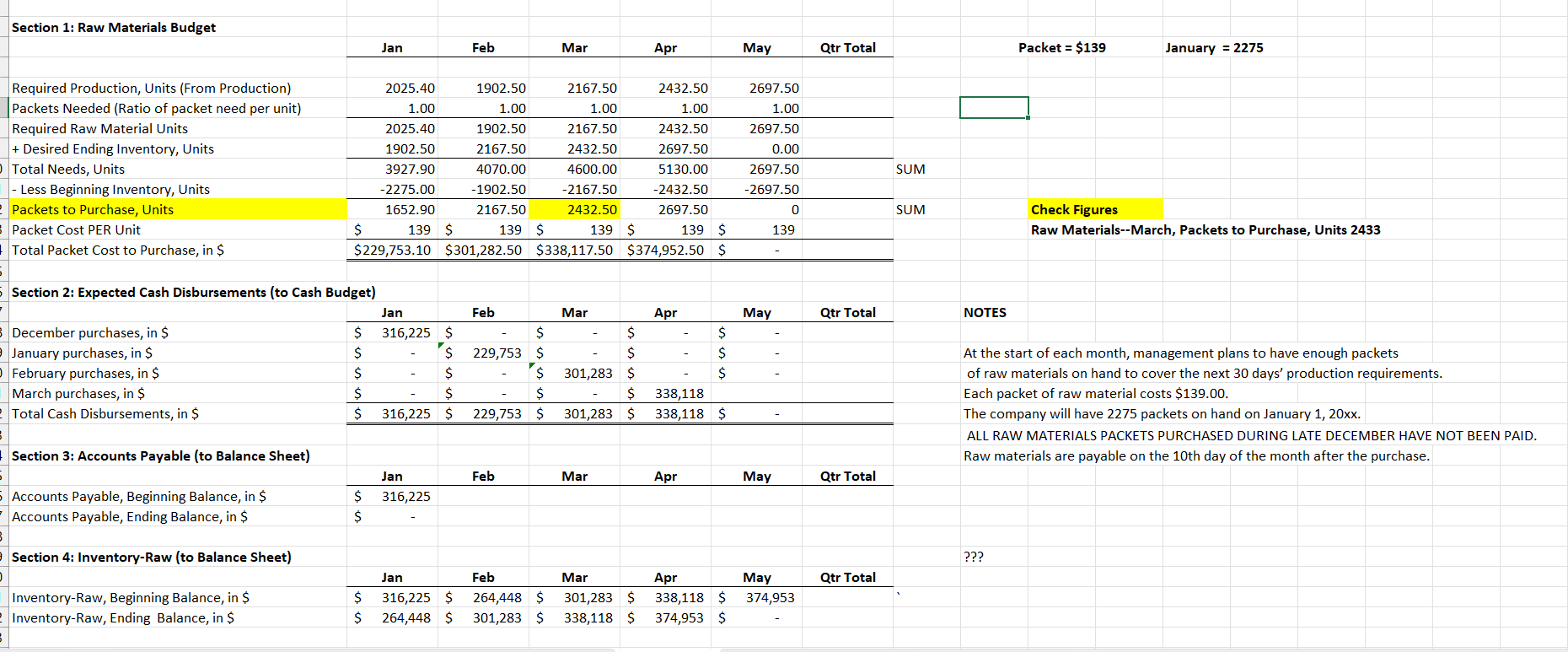

I believe my beginning numbers from SECTION 1 are correct. Amounts are to be rounded in the final project, but I have put them in two decimal places so you can see the dollars and cents.

The instructions ask for the following. I will post my questions in BOLD.

| At the start of each month, management plans to have enough packets. | ||||

| of raw materials on hand to cover the next 30 days production requirements. | ||||

| Each packet of raw material costs $139.00. | ||||

| The company will have 2275 packets on hand on January 1, 20xx. | ||||

| ALL RAW MATERIALS PACKETS PURCHASED DURING LATE DECEMBER HAVE NOT BEEN PAID. | ||||

| Raw materials are payable on the 10th day of the month after the purchase. |

Since RAW MATERIALS in DECEMBER have not been paid, does that mean that the CASH DISBURSEMENT for January would be the ending balance of December (which is the beginning inventory balance for January.) The 2275 would be inventory that needs to be paid for, thus, the cash disbursement would need to be the following:

$316,225 = (2275 packets multiplied by the cost of $139.00)

Therefore, January inventory would be paid in December, and December inventory would be paid in February, etc.

I don't quite understand the Section 3.

Is accounts payable what's left after we pay our cash disbursements? Is this our Outstanding Debt?

My Section 4 - Inventory Raw to Balance Sheet is my Beginning and Ending amounts multiplied by the packet cost.

This is the information cut and paste from the excel sheet. I keep notes on the right side. April and May months will be removed (hidden), and quarter totals will be for January, February, and March.

| Section 1: Raw Materials Budget | ||||||||||||||||

| Jan | Feb | Mar | Apr | May | Qtr Total | Packet = $139 | January = 2275 | |||||||||

| Required Production, Units (From Production) | 2025.40 | 1902.50 | 2167.50 | 2432.50 | 2697.50 | |||||||||||

| Packets Needed (Ratio of packet need per unit) | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | |||||||||||

| Required Raw Material Units | 2025.40 | 1902.50 | 2167.50 | 2432.50 | 2697.50 | |||||||||||

| + Desired Ending Inventory, Units | 1902.50 | 2167.50 | 2432.50 | 2697.50 | 0.00 | |||||||||||

| Total Needs, Units | 3927.90 | 4070.00 | 4600.00 | 5130.00 | 2697.50 | SUM | ||||||||||

| - Less Beginning Inventory, Units | -2275.00 | -1902.50 | -2167.50 | -2432.50 | -2697.50 | |||||||||||

| Packets to Purchase, Units | 1652.90 | 2167.50 | 2432.50 | 2697.50 | 0 | SUM | Check Figures | |||||||||

| Packet Cost PER Unit | $ 139 | $ 139 | $ 139 | $ 139 | $ 139 | Raw Materials--March, Packets to Purchase, Units 2433 | ||||||||||

| Total Packet Cost to Purchase, in $ | $229,753.10 | $301,282.50 | $338,117.50 | $374,952.50 | $ - | |||||||||||

| Section 2: Expected Cash Disbursements (to Cash Budget) | ||||||||||||||||

| Jan | Feb | Mar | Apr | May | Qtr Total | NOTES | ||||||||||

| December purchases, in $ | $ 316,225 | $ - | $ - | $ - | $ - | |||||||||||

| January purchases, in $ | $ - | $ 229,753 | $ - | $ - | $ - | At the start of each month, management plans to have enough packets | ||||||||||

| February purchases, in $ | $ - | $ - | $ 301,283 | $ - | $ - | of raw materials on hand to cover the next 30 days production requirements. | ||||||||||

| March purchases, in $ | $ - | $ - | $ - | $ 338,118 | Each packet of raw material costs $139.00. | |||||||||||

| Total Cash Disbursements, in $ | $ 316,225 | $ 229,753 | $ 301,283 | $ 338,118 | $ - | The company will have 2275 packets on hand on January 1, 20xx. | ||||||||||

| ALL RAW MATERIALS PACKETS PURCHASED DURING LATE DECEMBER HAVE NOT BEEN PAID. | ||||||||||||||||

| Section 3: Accounts Payable (to Balance Sheet) | Raw materials are payable on the 10th day of the month after the purchase. | |||||||||||||||

| Jan | Feb | Mar | Apr | May | Qtr Total | |||||||||||

| Accounts Payable, Beginning Balance, in $ | $ 316,225 | |||||||||||||||

| Accounts Payable, Ending Balance, in $ | $ - | |||||||||||||||

| Section 4: Inventory-Raw (to Balance Sheet) | ??? | |||||||||||||||

| Jan | Feb | Mar | Apr | May | Qtr Total | |||||||||||

| Inventory-Raw, Beginning Balance, in $ | $ 316,225 | $ 264,448 | $ 301,283 | $ 338,118 | $ 374,953 | ` | ||||||||||

| Inventory-Raw, Ending Balance, in $ | $ 264,448 | $ 301,283 | $ 338,118 | $ 374,953 | $ - | |||||||||||

| Raw Inventory Value, PER Unit (use this number to change Section 1 units to $ in Section 4) |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started