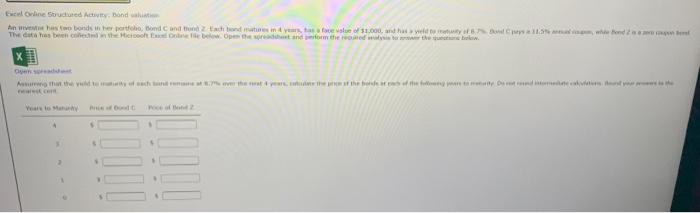

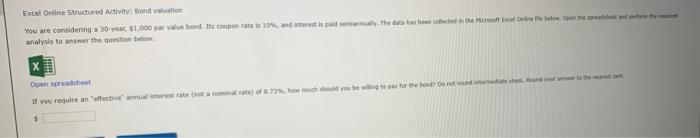

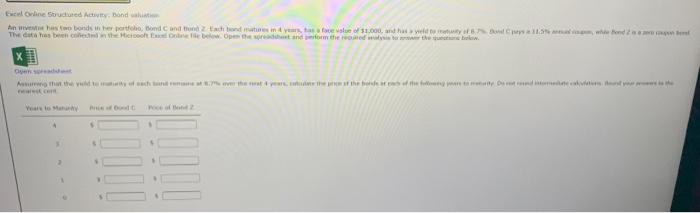

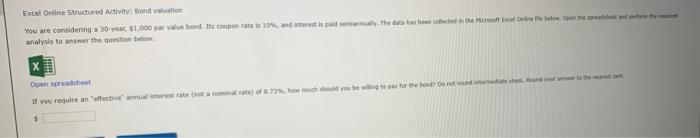

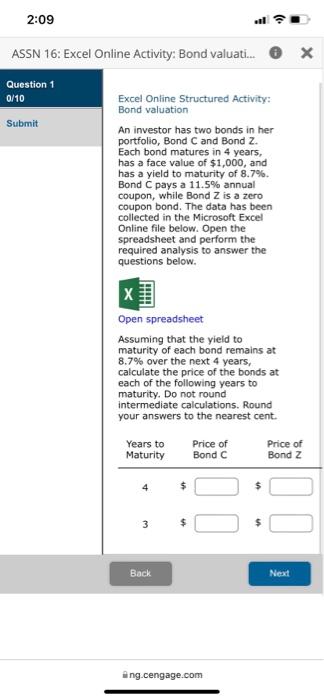

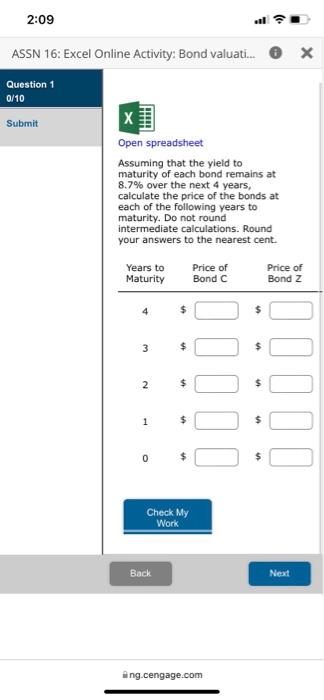

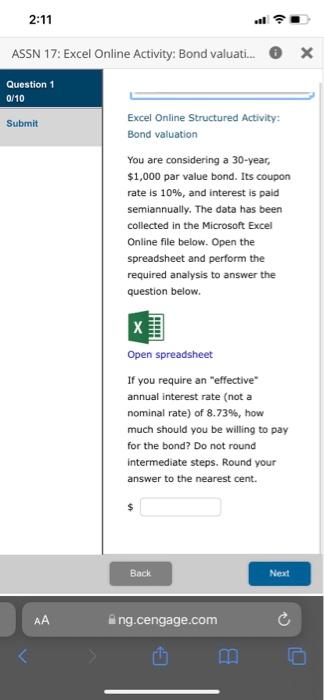

Echine Soudure Activity Bond An his two bonds in procha, donde and the action rate my face Value 11.000, and how to down, the one that The data is een collection where and therefter so that the veterano anche in pista competition from the heart of the two perso 4 2 . Excel Online Structured Activity: Bond valuation You are considering 30 y $1.000 a bond the counts ont pu The data has been collect Mode.me analysis to answer the question belon Op het If you require an efective analista aina of what you be willing to w for the wood 2:09 ASSN 16: Excel Online Activity: Bond valuati... X Question 1 0/10 Excel Online Structured Activity: Bond valuation Submit An investor has two bonds in her portfolio, Bond C and Bond Z. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity of 8.7%. Bond C pays a 11.5% annual coupon, while Bond Z is a zero coupon bond. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet Assuming that the yield to maturity of each bond remains at 8.7% over the next 4 years, calculate the price of the bonds at each of the following years to maturity. Do not round intermediate calculations. Round your answers to the nearest cent. Years to Maturity Price of Bond C Price of Bond Z 4 3 Back Neat ang.cengage.com 2:09 x ASSN 16: Excel Online Activity: Bond valuati... Question 1 0/10 Submit 11 Open spreadsheet Assuming that the yield to maturity of each bond remains at 8.7% over the next 4 years, calculate the price of the bonds at each of the following years to maturity. Do not round intermediate calculations. Round your answers to the nearest cent. Years to Maturity Price of Bond C Price of Bond Z 4 $ $ 3 $ $ 2 2 $ $ 1000 1 $ $ O Check My Work Back Next ang.cengage.com 2:11 . ASSN 17: Excel Online Activity: Bond valuati... X Question 1 0/10 Submit Excel Online Structured Activity: Bond valuation You are considering a 30-year, $1,000 par value bond. Its coupon rate is 10%, and interest is paid semiannually. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet If you require an effective annual interest rate (not a nominal rate) of 8.73%, how much should you be willing to pay for the bond? Do not round intermediate steps. Round your answer to the nearest cent. $ Back Next ang.cengage.com Echine Soudure Activity Bond An his two bonds in procha, donde and the action rate my face Value 11.000, and how to down, the one that The data is een collection where and therefter so that the veterano anche in pista competition from the heart of the two perso 4 2 . Excel Online Structured Activity: Bond valuation You are considering 30 y $1.000 a bond the counts ont pu The data has been collect Mode.me analysis to answer the question belon Op het If you require an efective analista aina of what you be willing to w for the wood 2:09 ASSN 16: Excel Online Activity: Bond valuati... X Question 1 0/10 Excel Online Structured Activity: Bond valuation Submit An investor has two bonds in her portfolio, Bond C and Bond Z. Each bond matures in 4 years, has a face value of $1,000, and has a yield to maturity of 8.7%. Bond C pays a 11.5% annual coupon, while Bond Z is a zero coupon bond. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet Assuming that the yield to maturity of each bond remains at 8.7% over the next 4 years, calculate the price of the bonds at each of the following years to maturity. Do not round intermediate calculations. Round your answers to the nearest cent. Years to Maturity Price of Bond C Price of Bond Z 4 3 Back Neat ang.cengage.com 2:09 x ASSN 16: Excel Online Activity: Bond valuati... Question 1 0/10 Submit 11 Open spreadsheet Assuming that the yield to maturity of each bond remains at 8.7% over the next 4 years, calculate the price of the bonds at each of the following years to maturity. Do not round intermediate calculations. Round your answers to the nearest cent. Years to Maturity Price of Bond C Price of Bond Z 4 $ $ 3 $ $ 2 2 $ $ 1000 1 $ $ O Check My Work Back Next ang.cengage.com 2:11 . ASSN 17: Excel Online Activity: Bond valuati... X Question 1 0/10 Submit Excel Online Structured Activity: Bond valuation You are considering a 30-year, $1,000 par value bond. Its coupon rate is 10%, and interest is paid semiannually. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet If you require an effective annual interest rate (not a nominal rate) of 8.73%, how much should you be willing to pay for the bond? Do not round intermediate steps. Round your answer to the nearest cent. $ Back Next ang.cengage.com