Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume a 21% tax rate for both years Please Show All Work!! Corporation VB was formed in 2019. Immediately prior to year-end, VB is considering

Assume a 21% tax rate for both years

Please Show All Work!!

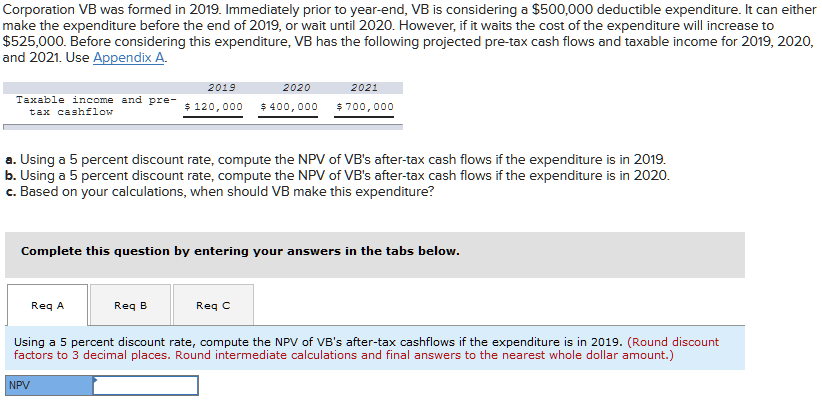

Corporation VB was formed in 2019. Immediately prior to year-end, VB is considering a $500,000 deductible expenditure. It can either make the expenditure before the end of 2019, or wait until 2020. However, if it waits the cost of the expenditure will increase to $525,000. Before considering this expenditure, VB has the following projected pre-tax cash flows and taxable income for 2019, 2020, and 2021. Use Appendix A. Taxable income and pre- tax cash flow 2019 120.000 2020 $400,000 2021 $700,000 a. Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2019. b. Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2020. c. Based on your calculations, when should VB make this expenditure? Complete this question by entering your answers in the tabs below. Reg A Red B Rego Using a 5 percent discount rate, compute the NPV of VB's after-tax cashflows if the expenditure is in 2019. (Round discount factors to 3 decimal places. Round intermediate calculations and final answers to the nearest whole dollar amount.) NPVStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started