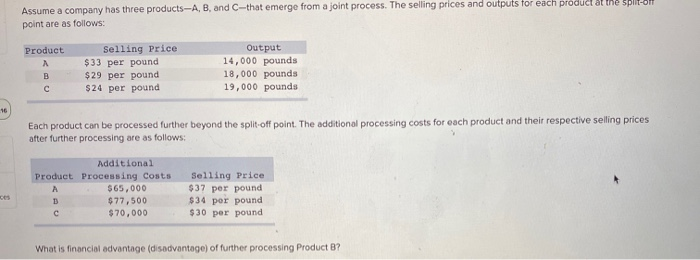

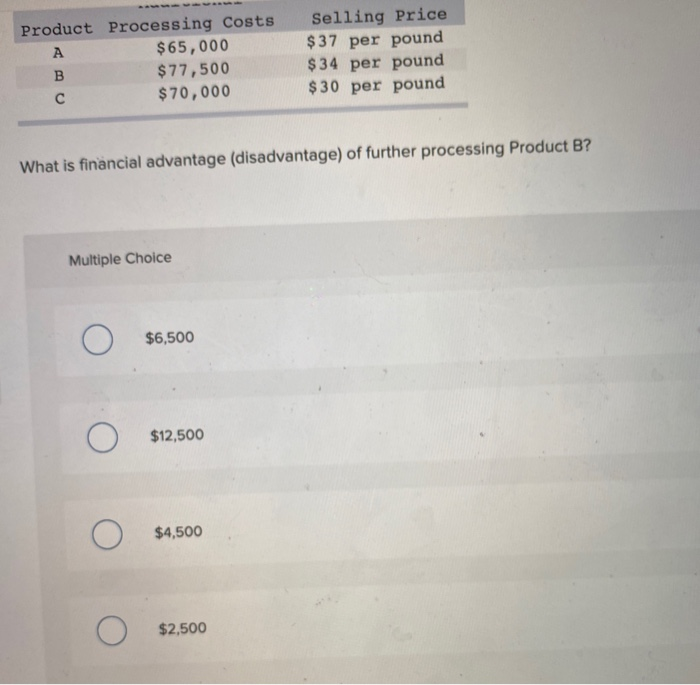

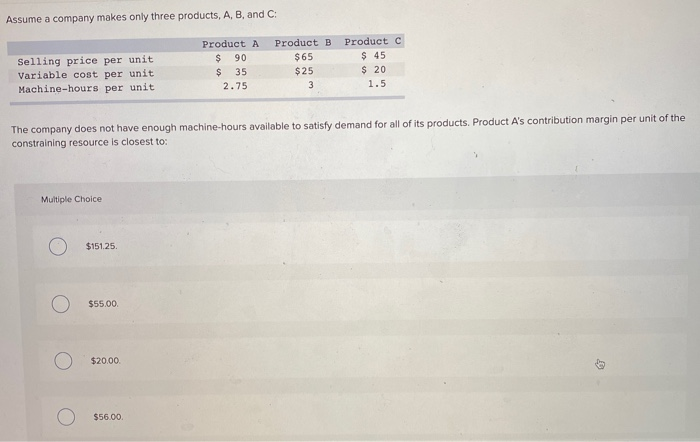

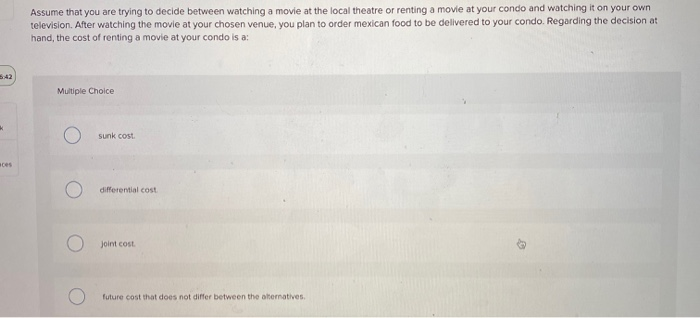

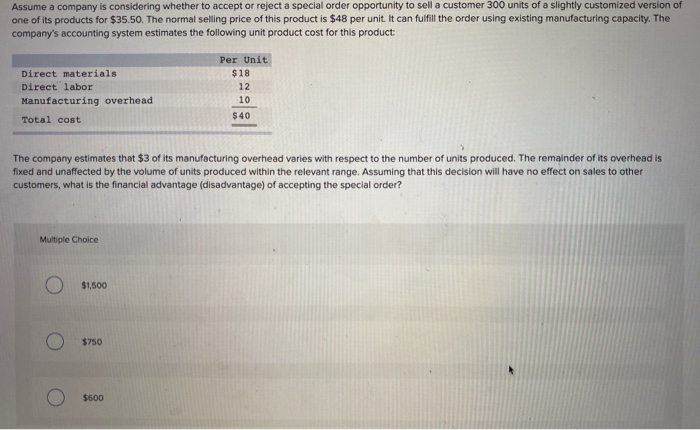

Assume a company has three products-A, B, and C-that emerge from a joint process. The selling prices and outputs for each product at the Splita point are as follows: Product A B Selling Price $33 per pound $29 per pound $24 per pound Output 14,000 pounds 18,000 pounds 19,000 pounds 16 Each product can be processed further beyond the split-off point. The additional processing costs for each product and their respective selling prices after further processing are as follows: Additional Product Processing Costs $65,000 $77,500 $70,000 A Selling Price $37 per pound $34 por pound $30 per pound D What is financial advantage (disadvantage) of further processing Product B? Product Processing Costs $65,000 B $77,500 $70,000 Selling Price $ 37 per pound $ 34 per pound $30 per pound What is financial advantage (disadvantage) of further processing Product B? Multiple Choice O $6,500 O $12,500 $4,500 $2,500 Assume a company makes only three products, A, B, and C: Selling price per unit Variable cost per unit Machine-hours per unit Product A $ 90 $ 35 2.75 Product B $65 $25 3 Product c $ 45 $ 20 1.5 The company does not have enough machine-hours available to satisfy demand for all of its products Product A's contribution margin per unit of the constraining resource is closest to: Multiple Choice $151.25 $55.00 $20.00 $56.00 Assume that you are trying to decide between watching a movie at the local theatre or renting a movie at your condo and watching it on your own television. After watching the movie at your chosen venue, you plan to order mexican food to be delivered to your condo. Regarding the decision at hand, the cost of renting a movie at your condo is a: Multiple Choice * sunk cost differential cost O Joint cout. future cost that does not differ between the alternatives Assume a company is considering whether to accept or reject a special order opportunity to sell a customer 300 units of a slightly customized version of one of its products for $35.50. The normal selling price of this product is $48 per unit. It can fulfill the order using existing manufacturing capacity. The company's accounting system estimates the following unit product cost for this product: Direct materials Direct labor Manufacturing overhead Per Unit $18 12 10 $40 Total cost The company estimates that $3 of its manufacturing overhead varies with respect to the number of units produced. The remainder of its overhead is fixed and unaffected by the volume of units produced within the relevant range. Assuming that this decision will have no effect on sales to other customers, what is the financial advantage (disadvantage) of accepting the special order? Multiple Choice $1,500 $750 $600