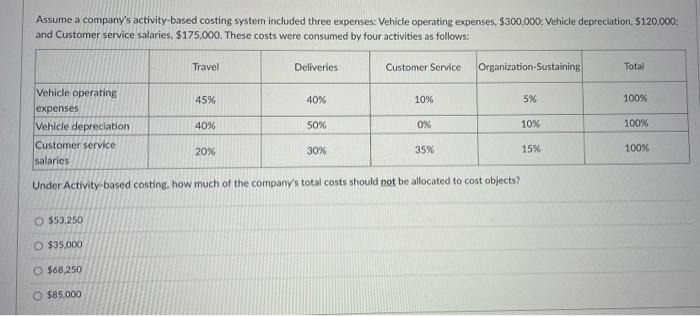

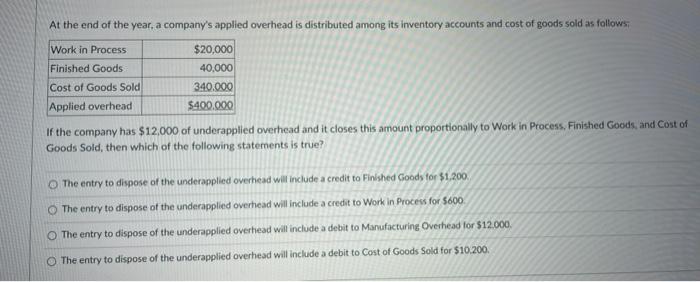

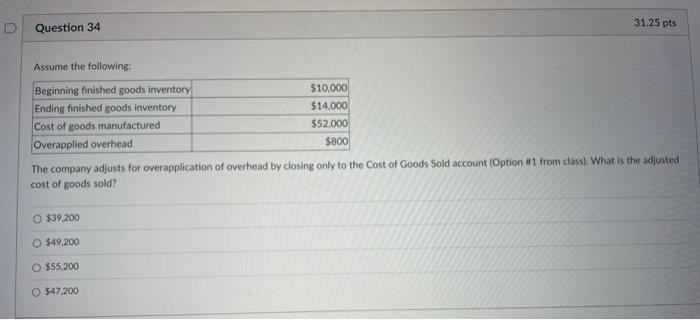

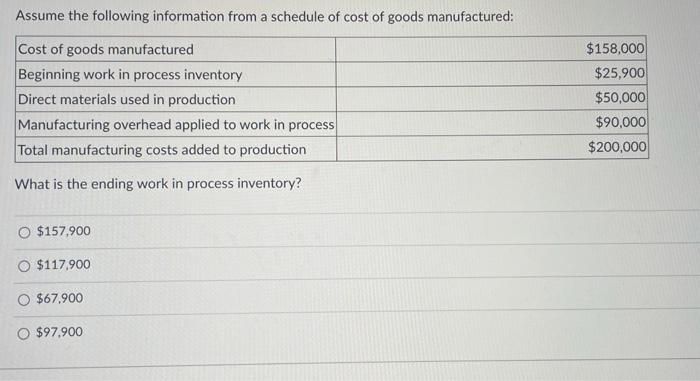

Assume a company's activity-based costing system included three expenses: Vehicle operating expenses, $300,000. Vehicle depreciation. $120.000, and Customer service salaries, $175,000. These costs were consumed by four activities as follows: Travel Deliveries Customer Service Organization-Sustaining Total 4596 40% 10% 5% 100% Vehicle operating expenses Vehicle depreciation 40% 50% 0% 10% 100% Customer service salaries 20% 30% 35% 15% 100% Under Activity based costing, how much of the company's total costs should not be allocated to cost objects? O $53.250 $35.000 O $68,250 $85,000 At the end of the year, a company's applied overhead is distributed among its inventory accounts and cost of goods sold as follows Work in Process $20,000 Finished Goods 40,000 Cost of Goods Sold 340.000 Applied overhead $400.000 If the company has $12.000 of underapplied overhead and it closes this amount proportionally to Work in Process. Finished Goods and Cost of Goods Sold, then which of the following statements is true? o The entry to dispose of the underapplied overhead will include a credit to Finished Goods for $1.200 The entry to dispose of the underapplied overhead will include a credit to Work in Process for $600 The entry to dispose of the underapplied overhead will include a debit to Manufacturing Overhead for $12.000 The entry to dispose of the underapplied overhead will include a debit to Cost of Goods Sold for $10.200. 31.25 pts Question 34 Assume the following: Beginning finished goods inventory $10,000 Ending finished goods inventory $14,000 Cost of goods manufactured $52.000 Overapplied overhead $800 The company adjusts for overapplication of overhead by closing only to the Cost of Goods Sold account (Option #1 from class). What is the adjusted cost of goods sold? O $39.200 $49.200 O $55,200 O $47.200 Assume the following information from a schedule of cost of goods manufactured: Cost of goods manufactured Beginning work in process inventory Direct materials used in production Manufacturing overhead applied to work in process Total manufacturing costs added to production $158,000 $25.900 $50,000 $90,000 $200,000 What is the ending work in process inventory? $157,900 $117.900 O $67.900 O $97.900