Answered step by step

Verified Expert Solution

Question

1 Approved Answer

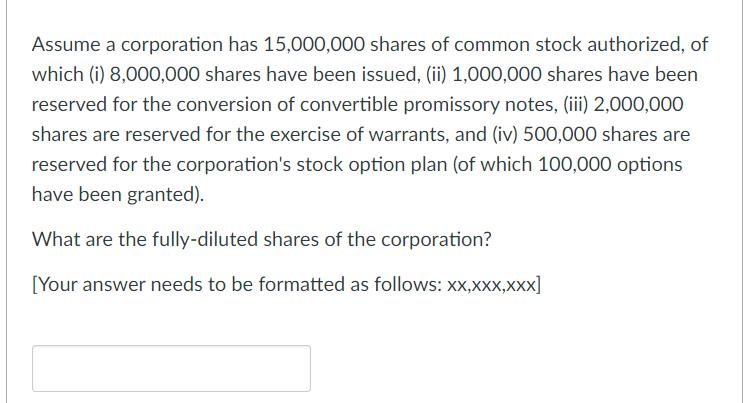

Assume a corporation has 15,000,000 shares of common stock authorized, of which (i) 8,000,000 shares have been issued, (ii) 1,000,000 shares have been reserved

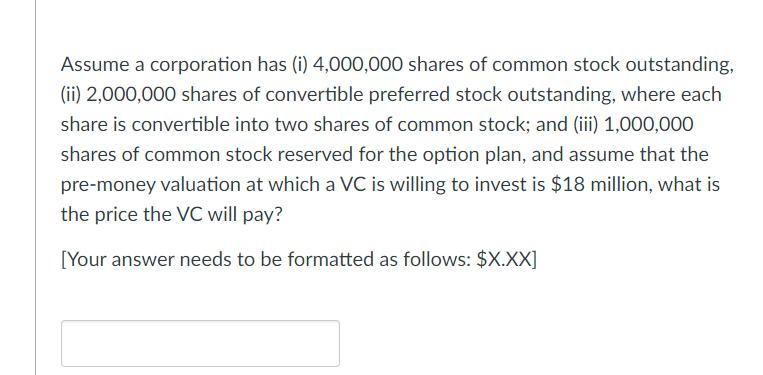

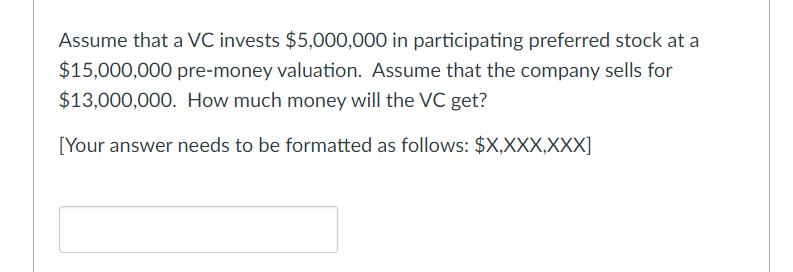

Assume a corporation has 15,000,000 shares of common stock authorized, of which (i) 8,000,000 shares have been issued, (ii) 1,000,000 shares have been reserved for the conversion of convertible promissory notes, (iii) 2,000,000 shares are reserved for the exercise of warrants, and (iv) 500,000 shares are reserved for the corporation's stock option plan (of which 100,000 options have been granted). What are the fully-diluted shares of the corporation? [Your answer needs to be formatted as follows: XX,XXX,XXX] Assume a corporation has (i) 4,000,000 shares of common stock outstanding, (ii) 2,000,000 shares of convertible preferred stock outstanding, where each share is convertible into two shares of common stock; and (iii) 1,000,000 shares of common stock reserved for the option plan, and assume that the pre-money valuation at which a VC is willing to invest is $18 million, what is the price the VC will pay? [Your answer needs to be formatted as follows: $X.XX] Assume that a VC invests $5,000,000 in participating preferred stock at a $15,000,000 pre-money valuation. Assume that the company sells for $13,000,000. How much money will the VC get? [Your answer needs to be formatted as follows: $X,XXX,XXX]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Fullydiluted shares Total authorized shares 15000000 Shares issued 8000000 Shares reserved for con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started