Question

You are saving for a new house. You place $47,000 into an investment account at the end of each year for five years. How

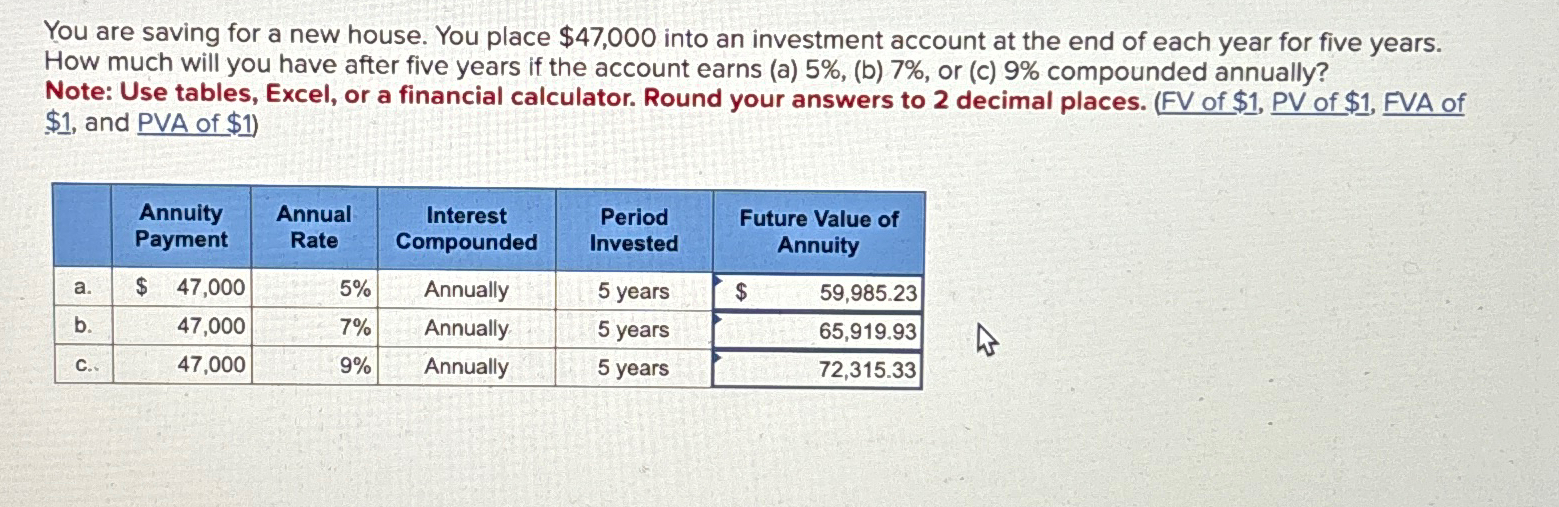

You are saving for a new house. You place $47,000 into an investment account at the end of each year for five years. How much will you have after five years if the account earns (a) 5%, (b) 7%, or (c) 9% compounded annually? Note: Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places. (FV of $1, PV of $1, FVA of $1, and PVA of $1) Annuity Payment Annual Rate Interest Compounded Period Invested Future Value of Annuity a. $ 47,000 5% Annually 5 years $ 59,985.23 b. 47,000 7% Annually 5 years 65,919.93 C.. 47,000 9% Annually 5 years 72,315.33

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

15th edition

1337671002, 978-1337395250

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App