Answered step by step

Verified Expert Solution

Question

1 Approved Answer

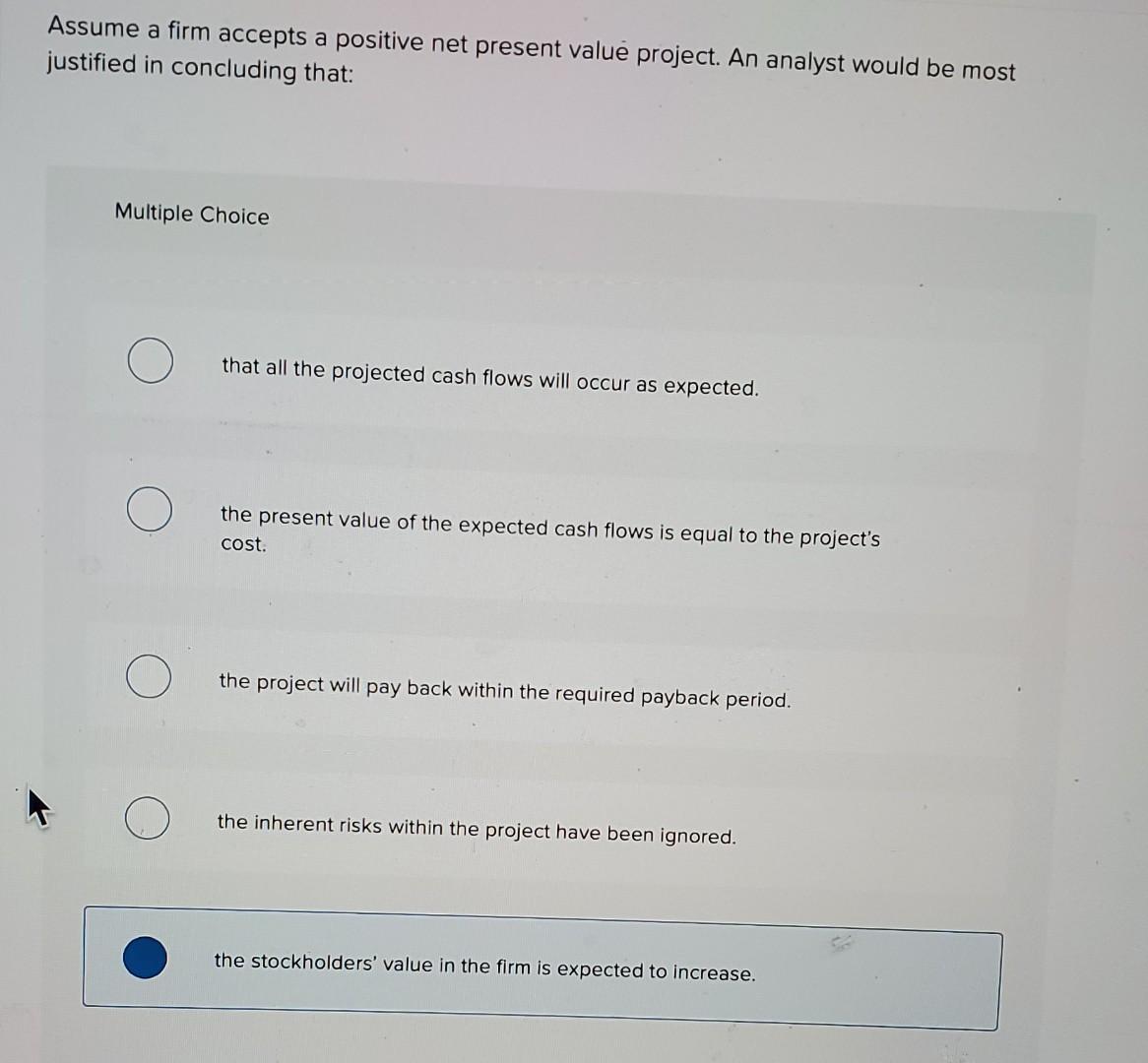

Assume a firm accepts a positive net present value project. An analyst would be most justified in concluding that: Multiple Choice that all the projected

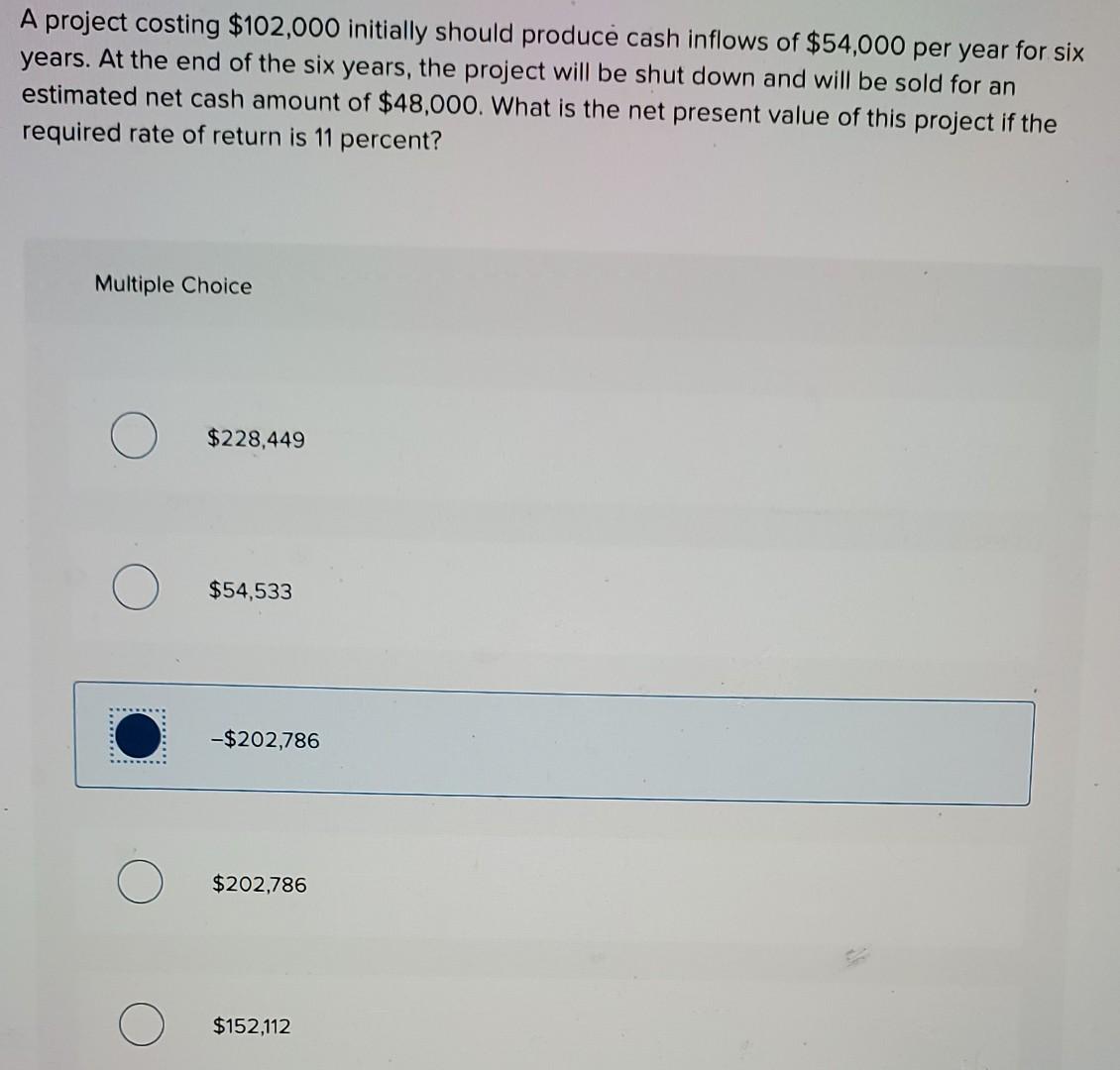

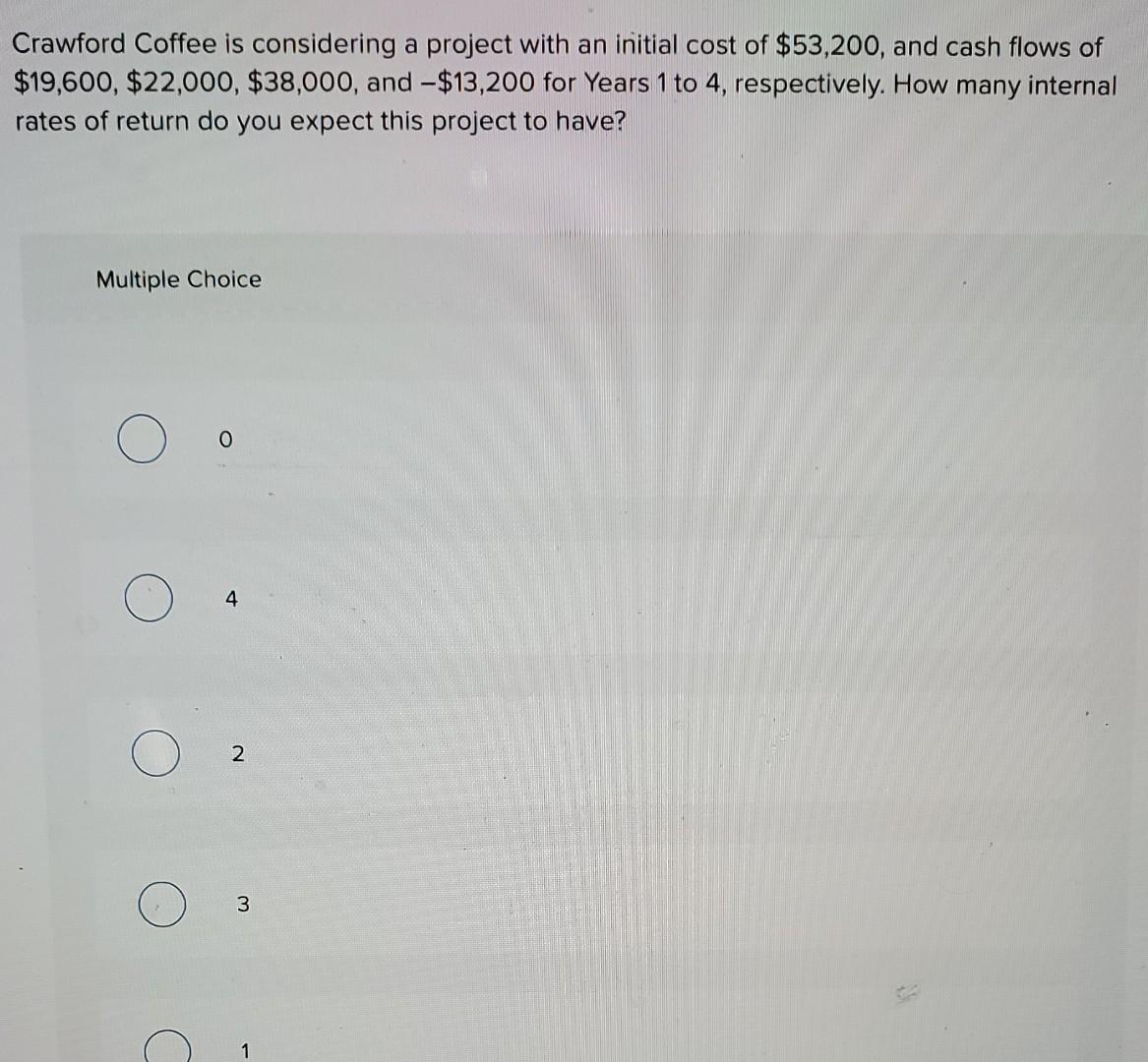

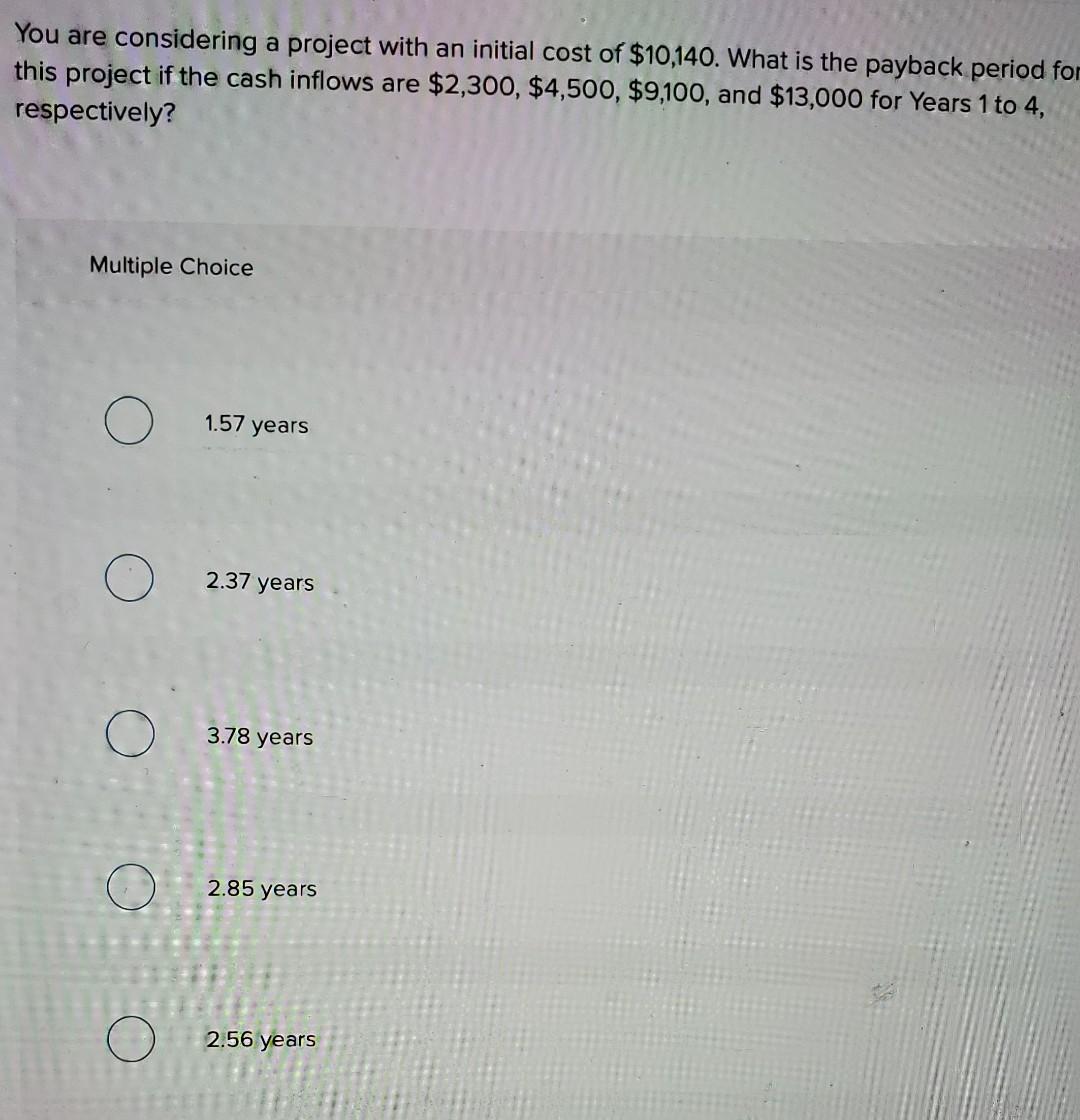

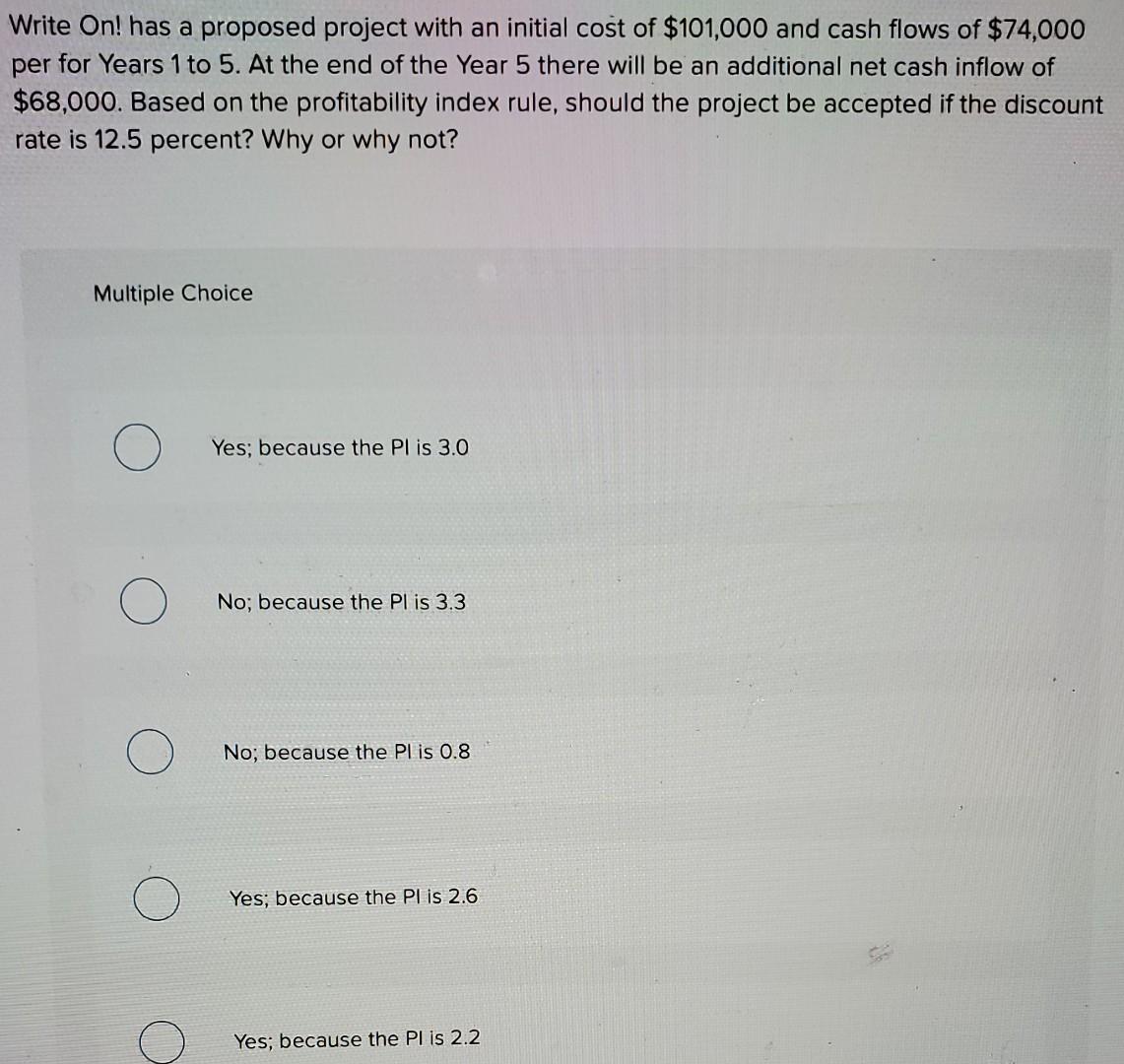

Assume a firm accepts a positive net present value project. An analyst would be most justified in concluding that: Multiple Choice that all the projected cash flows will occur as expected. the present value of the expected cash flows is equal to the project's cost. the project will pay back within the required payback period. the inherent risks within the project have been ignored. the stockholders' value in the firm is expected to increase. A project costing $102,000 initially should produce cash inflows of $54,000 per year for six years. At the end of the six years, the project will be shut down and will be sold for an estimated net cash amount of $48,000. What is the net present value of this project if the required rate of return is 11 percent? Multiple Choice $228,449 $54,533 -$202,786 $202,786 $152,112 Crawford Coffee is considering a project with an initial cost of $53,200, and cash flows of $19,600, $22,000, $38,000, and -$13,200 for Years 1 to 4, respectively. How many internal rates of return do you expect this project to have? Multiple Choice 0 4 2 3 1 You are considering a project with an initial cost of $10,140. What is the payback period for this project if the cash inflows are $2,300, $4,500, $9,100, and $13,000 for Years 1 to 4, respectively? Multiple Choice 1.57 years 2.37 years 3.78 years 2.85 years 2.56 years Write On! has a proposed project with an initial cost of $101,000 and cash flows of $74,000 per for Years 1 to 5. At the end of the Year 5 there will be an additional net cash inflow of $68,000. Based on the profitability index rule, should the project be accepted if the discount rate is 12.5 percent? Why or why not? Multiple Choice Yes; because the Pl is 3.0 No, because the Pl is 3.3 No, because the PL is 0.8 Yes; because the PL is 2.6 Yes; because the Pl is 2.2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started