Answered step by step

Verified Expert Solution

Question

1 Approved Answer

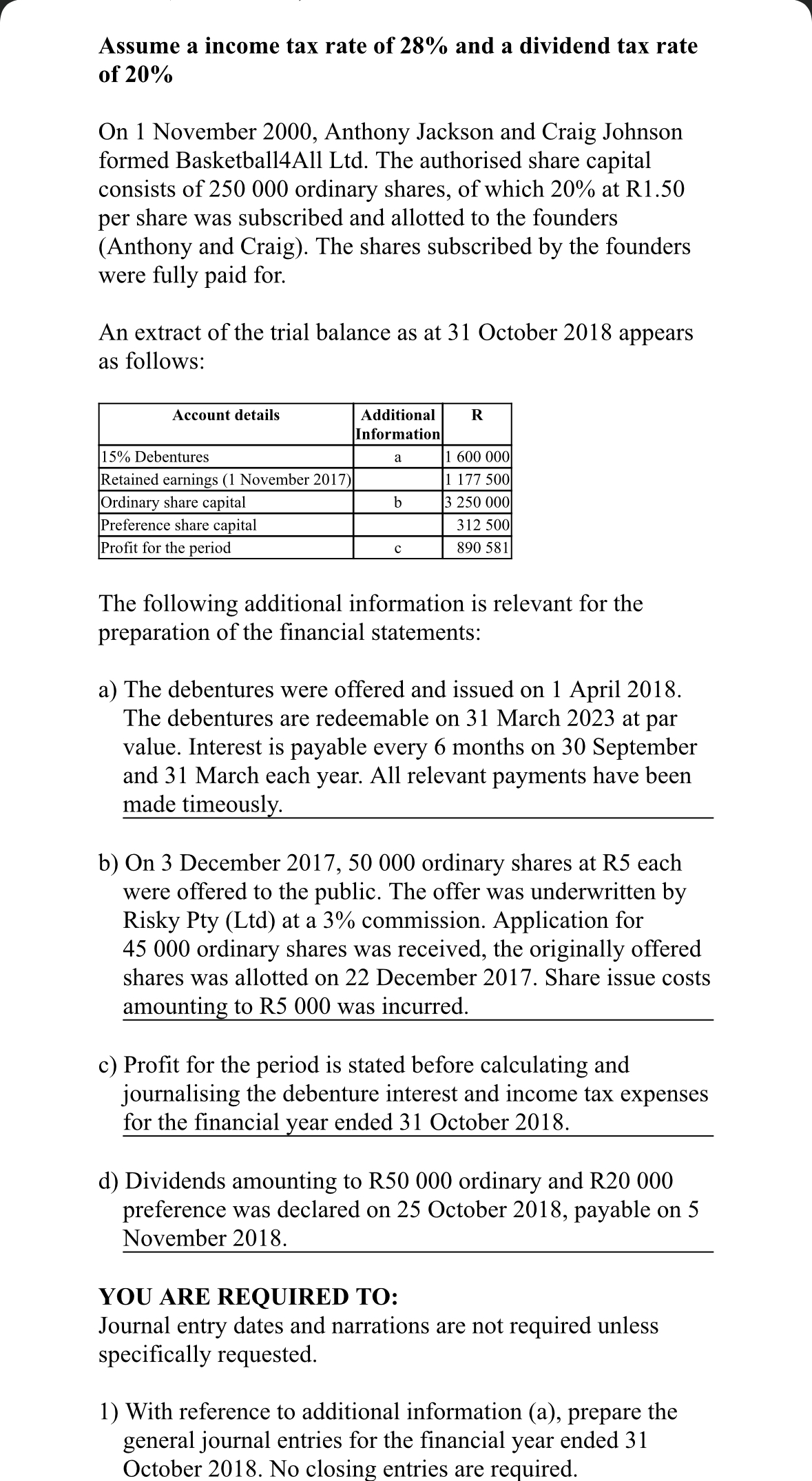

Assume a income tax rate of 2 8 % and a dividend tax rate of 2 0 % On 1 November 2 0 0 0

Assume a income tax rate of and a dividend tax rate

of

On November Anthony Jackson and Craig Johnson

formed BasketballAll Ltd The authorised share capital

consists of ordinary shares, of which at R

per share was subscribed and allotted to the founders

Anthony and Craig The shares subscribed by the founders

were fully paid for.

An extract of the trial balance as at October appears

as follows:

The following additional information is relevant for the

preparation of the financial statements:

a The debentures were offered and issued on April

The debentures are redeemable on March at par

value. Interest is payable every months on September

and March each year. All relevant payments have been

b On December ordinary shares at R each

were offered to the public. The offer was underwritten by

Risky Pty Ltd at a commission. Application for

ordinary shares was received, the originally offered

shares was allotted on December Share issue costs

amounting to R was incurred.

c Profit for the period is stated before calculating and

journalising the debenture interest and income tax expenses

for the financial year ended October

d Dividends amounting to R ordinary and R

preference was declared on October payable on

November

YOU ARE REQUIRED TO:

Journal entry dates and narrations are not required unless

specifically requested.

With reference to additional information a prepare the

general journal entries for the financial year ended

October No closing entries are required.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started