Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume a market with five stocks: Stocks A through E. The metric which tracks the market movement is known as the MM-5 index or

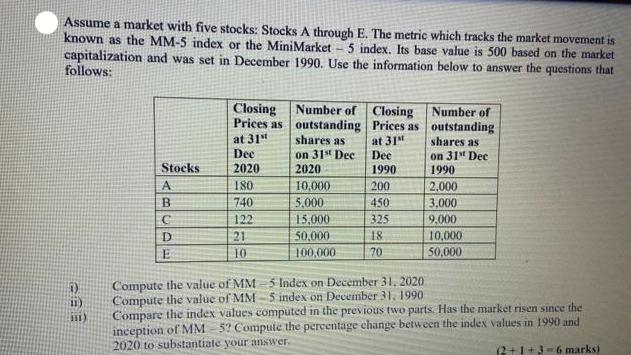

Assume a market with five stocks: Stocks A through E. The metric which tracks the market movement is known as the MM-5 index or the MiniMarket 5 index. Its base value is 500 based on the market capitalization and was set in December 1990. Use the information below to answer the questions that follows: Closing Prices as at 31st Number of Closing Number of outstanding Prices as outstanding shares as at 31 shares as Dec on 31st Dec Dec on 31st Dec Stocks 2020 2020 1990 1990 A 180 10,000 200 2,000 B 740 5,000 450 3,000 C 122 15,000 325 9,000 D 21 50,000 18 10,000 E 10 100,000 70 50,000 Compute the value of MM-5 Index on December 31, 2020 Compute the value of MM-5 index on December 31, 1990 Compare the index values computed in the previous two parts. Has the market risen since the inception of MM 5? Compute the percentage change between the index values in 1990 and 2020 to substantiate your answer. 2+1+3-6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the value of the MM5 index on December 31 2020 we first need to calculate the market capitalization of each stock and then sum them up to f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started