Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume a perfect capital market. In this market corporate bonds issued by Mclreno are traded. The nominal value of the bonds is 1 , 0

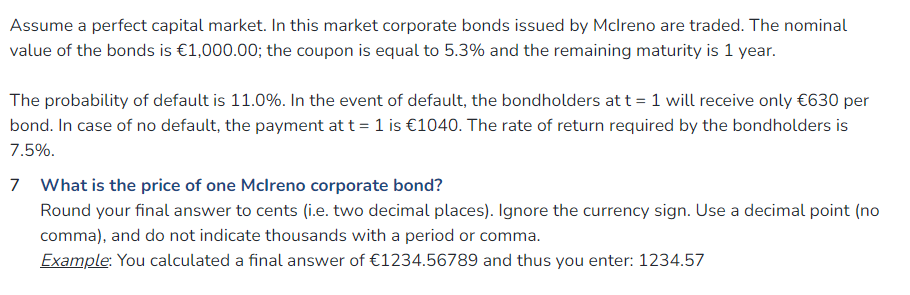

Assume a perfect capital market. In this market corporate bonds issued by Mclreno are traded. The nominal

value of the bonds is ; the coupon is equal to and the remaining maturity is year.

The probability of default is In the event of default, the bondholders at will receive only per

bond. In case of no default, the payment at is The rate of return required by the bondholders is

What is the price of one McIreno corporate bond?

Round your final answer to cents ie two decimal places Ignore the currency sign. Use a decimal point no

comma and do not indicate thousands with a period or comma.

Example: You calculated a final answer of and thus you enter:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started