Question

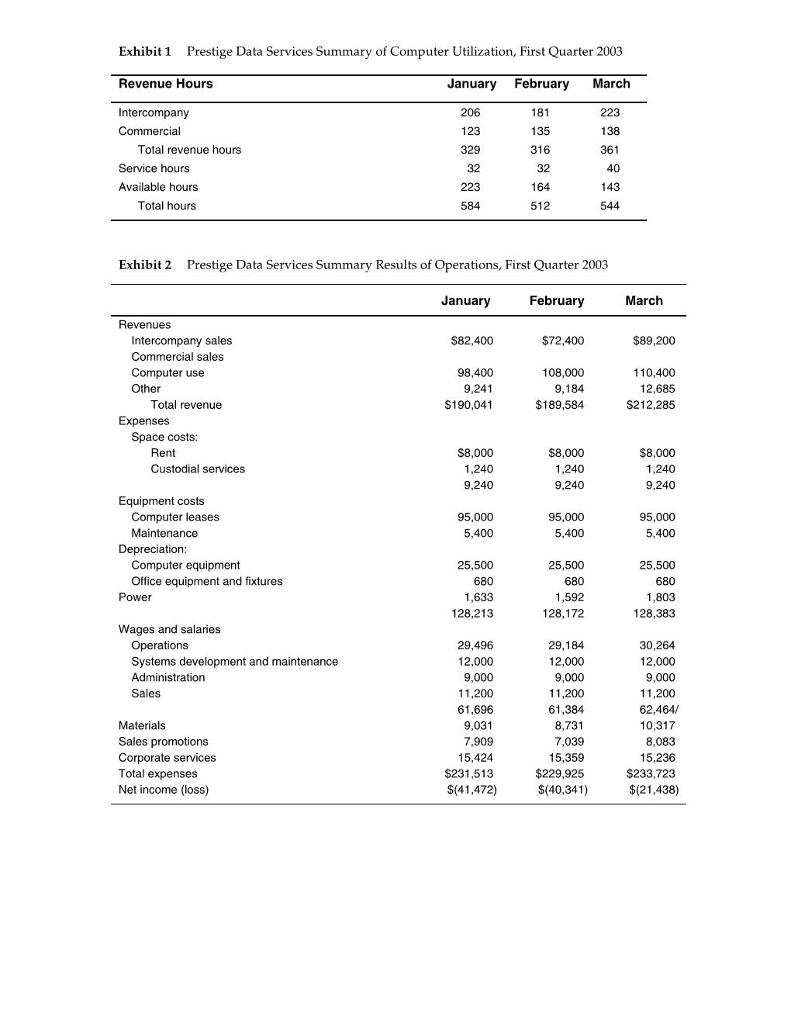

Assume a variable cost of $28 per hour, commercial revenues of $800 per hour and fixed costs of $115,820. Also, assume actual utilization of 138

Assume a variable cost of $28 per hour, commercial revenues of $800 per hour and fixed costs of $115,820. Also, assume actual utilization of 138 hours this is what is given in Exhibit 1 for March. (Please ignore any intercompany effects for this question).

a. What is the break even volume (hours)? b. Estimate the effect on income of each of the options Rowe has suggested if Bradley estimates as follows: i. Increasing the price to commercial customers to $1,000 per hours would reduce demand by 30%. ii. Reducing the price to commercial customers to $600 per hour would increase demand by 30%. iii. Reducing operations to 16 hours on weekdays and eight hours on Saturdays would result in a loss of 20% of commercial revenue hours. iv. If increased promotion would increase sales by 30%, how much can be spent each month without reducing income?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started