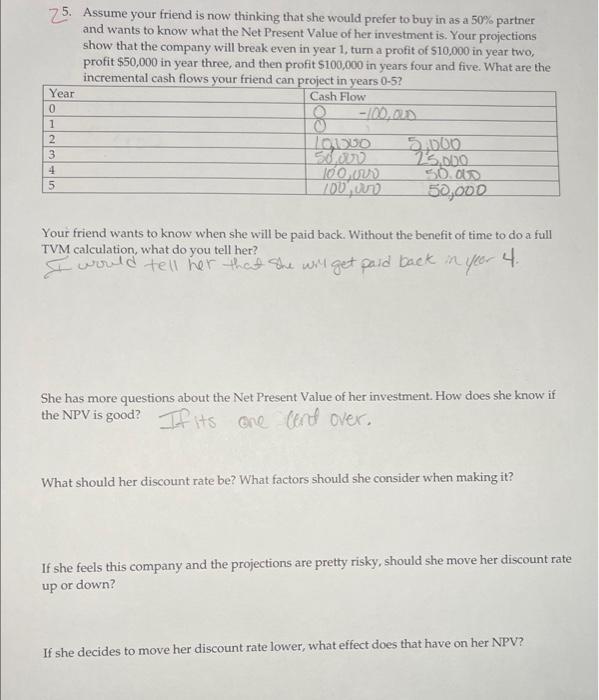

Assume after your projections that you have decided to sell the SELUxe shoe for $300. Also assume that your friend, flush with NIL cash, is willing to give you the loan for the full $100k and will only charge you 10% simple interest if you are able to pay off the loan in one year. If you fail to pay it off in one year, she takes full ownership of the company. After crunching the numbers on labor costs, raw materials, shipping, equipment rental, and manufacturing space you figure that each pair of SELUxe will cost an average of $133 to produce in year 1 (it will likely go down once you have established relationships and have achieved scale in future years). How many pairs of shoes will you need to sell in order to pay back your friend in year 1 and keep the company? Analyze the likelihood of success under this plan. What would you change in order to improve your odds of turning a profit in year 1 ? (Keep in mind that you have not budgeted for any marketing expenses or paying yourself a salary). 75. Assume your friend is now thinking that she would prefer to buy in as a 50% partner and wants to know what the Net Present Value of her investment is. Your projections show that the company will break even in year 1 , turn a profit of $10,000 in year two, profit $50,000 in year three, and then profit $100,000 in years four and five. What are the incremental cash flows vour friend can nroviout in wosso n.6) Your friend wants to know when she will be paid back. Without the benefit of time to do a full TVM calculation, what do you tell her? Ti vould tell her than ohe wiy get paid back in yeer 4 . She has more questions about the Net Present Value of her investment. How does she know if the NPV is good? IA its cen (cent over. What should her discount rate be? What factors should she consider when making it? If she feels this company and the projections are pretty risky, should she move her discount rate up or down? If she decides to move her discount rate lower, what effect does that have on her NPV? You and your friend feel good about moving forward with the business, now you must figure out what type of organization you will be. Briefly discuss what your options are for this company (including a brief discussion on why certain entity types would not be options), and weigh the pros and cons of each. Fully explain which entity structure you would use for SELUxe and why. Assume after your projections that you have decided to sell the SELUxe shoe for $300. Also assume that your friend, flush with NIL cash, is willing to give you the loan for the full $100k and will only charge you 10% simple interest if you are able to pay off the loan in one year. If you fail to pay it off in one year, she takes full ownership of the company. After crunching the numbers on labor costs, raw materials, shipping, equipment rental, and manufacturing space you figure that each pair of SELUxe will cost an average of $133 to produce in year 1 (it will likely go down once you have established relationships and have achieved scale in future years). How many pairs of shoes will you need to sell in order to pay back your friend in year 1 and keep the company? Analyze the likelihood of success under this plan. What would you change in order to improve your odds of turning a profit in year 1 ? (Keep in mind that you have not budgeted for any marketing expenses or paying yourself a salary). 75. Assume your friend is now thinking that she would prefer to buy in as a 50% partner and wants to know what the Net Present Value of her investment is. Your projections show that the company will break even in year 1 , turn a profit of $10,000 in year two, profit $50,000 in year three, and then profit $100,000 in years four and five. What are the incremental cash flows vour friend can nroviout in wosso n.6) Your friend wants to know when she will be paid back. Without the benefit of time to do a full TVM calculation, what do you tell her? Ti vould tell her than ohe wiy get paid back in yeer 4 . She has more questions about the Net Present Value of her investment. How does she know if the NPV is good? IA its cen (cent over. What should her discount rate be? What factors should she consider when making it? If she feels this company and the projections are pretty risky, should she move her discount rate up or down? If she decides to move her discount rate lower, what effect does that have on her NPV? You and your friend feel good about moving forward with the business, now you must figure out what type of organization you will be. Briefly discuss what your options are for this company (including a brief discussion on why certain entity types would not be options), and weigh the pros and cons of each. Fully explain which entity structure you would use for SELUxe and why