Question

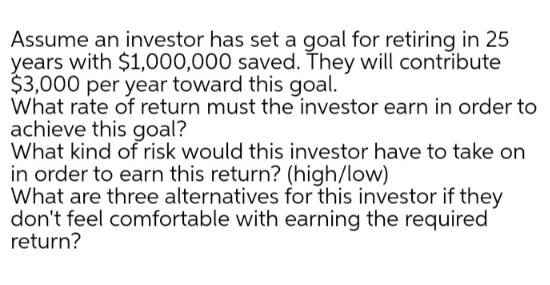

Assume an investor has set a goal for retiring in 25 years with $1,000,000 saved. They will contribute $3,000 per year toward this goal.

Assume an investor has set a goal for retiring in 25 years with $1,000,000 saved. They will contribute $3,000 per year toward this goal. What rate of return must the investor earn in order to achieve this goal? What kind of risk would this investor have to take on in order to earn this return? (high/low) What are three alternatives for this investor if they don't feel comfortable with earning the required return?

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the rate of return required to achieve a future value of 1000000 in 25 years with annua...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management Accounting Information for Decision-Making and Strategy Execution

Authors: Anthony A. Atkinson, Robert S. Kaplan, Ella Mae Matsumura, S. Mark Young

6th Edition

137024975, 978-0137024971

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App