Answered step by step

Verified Expert Solution

Question

1 Approved Answer

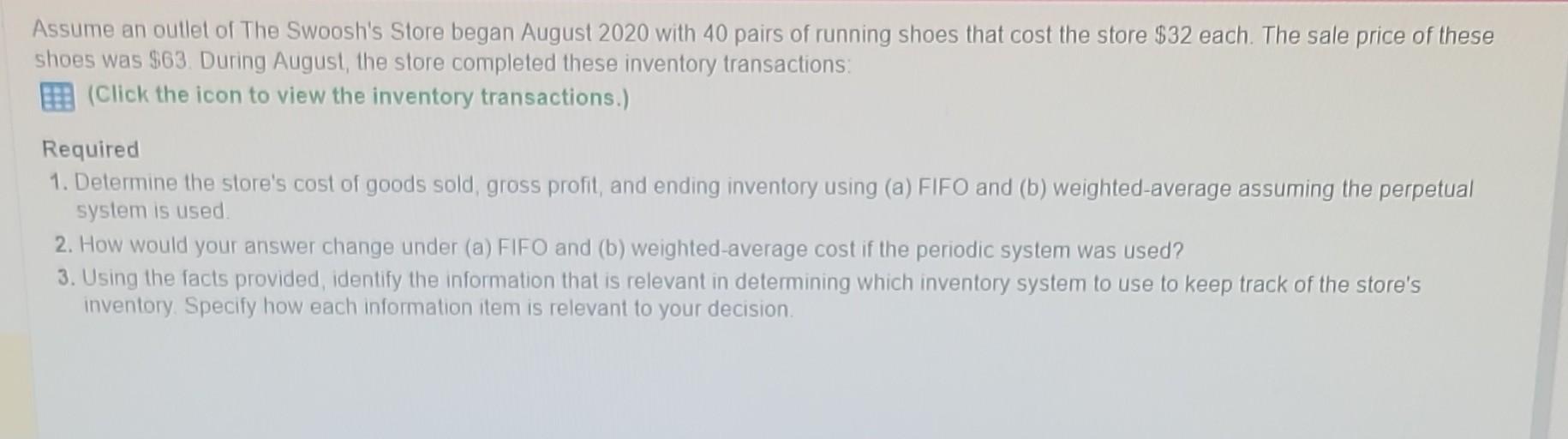

Assume an outlet of The Swoosh's Store began August 2020 with 40 pairs of running shoes that cost the store $32 each. The sale price

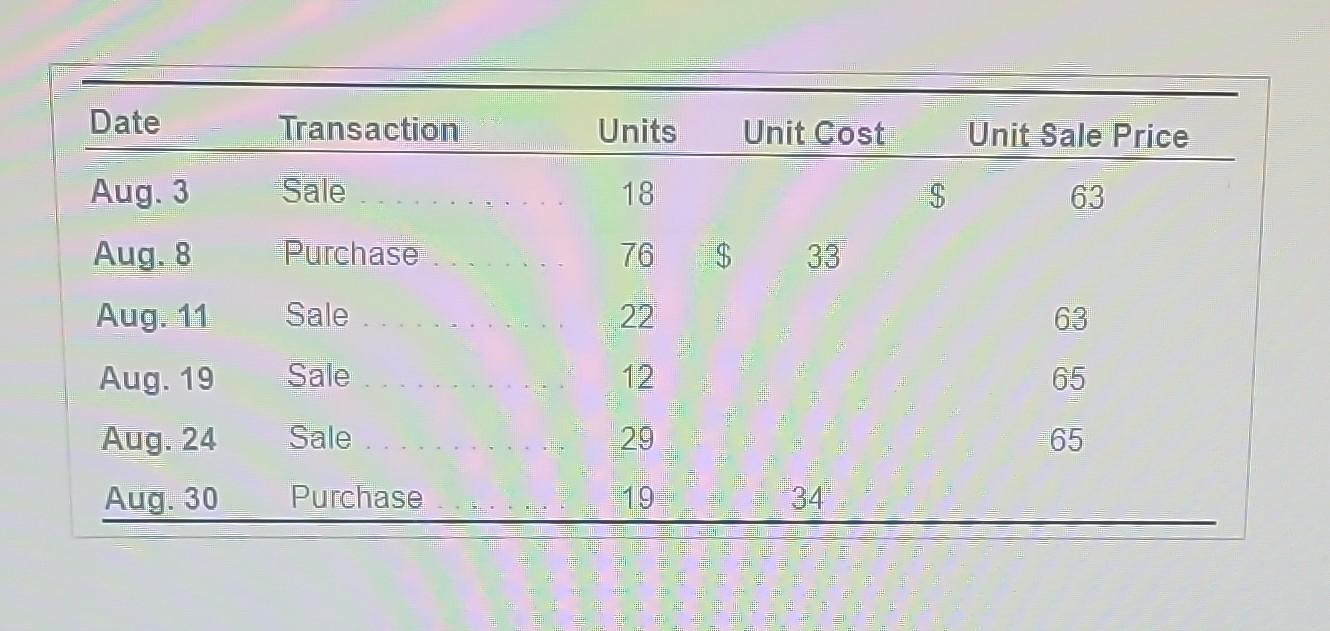

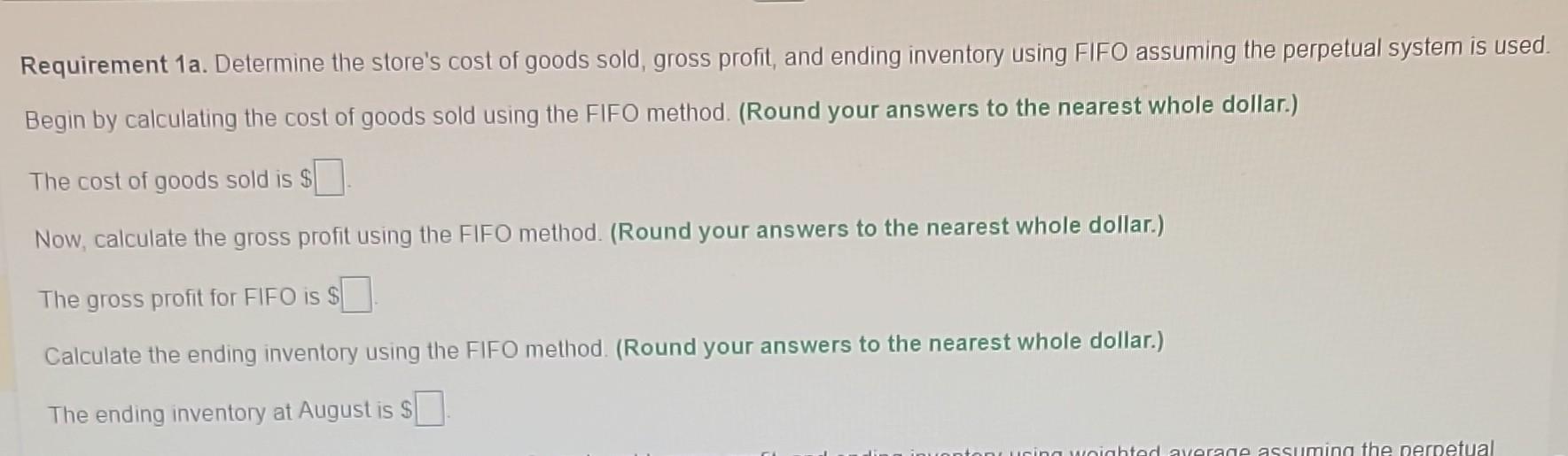

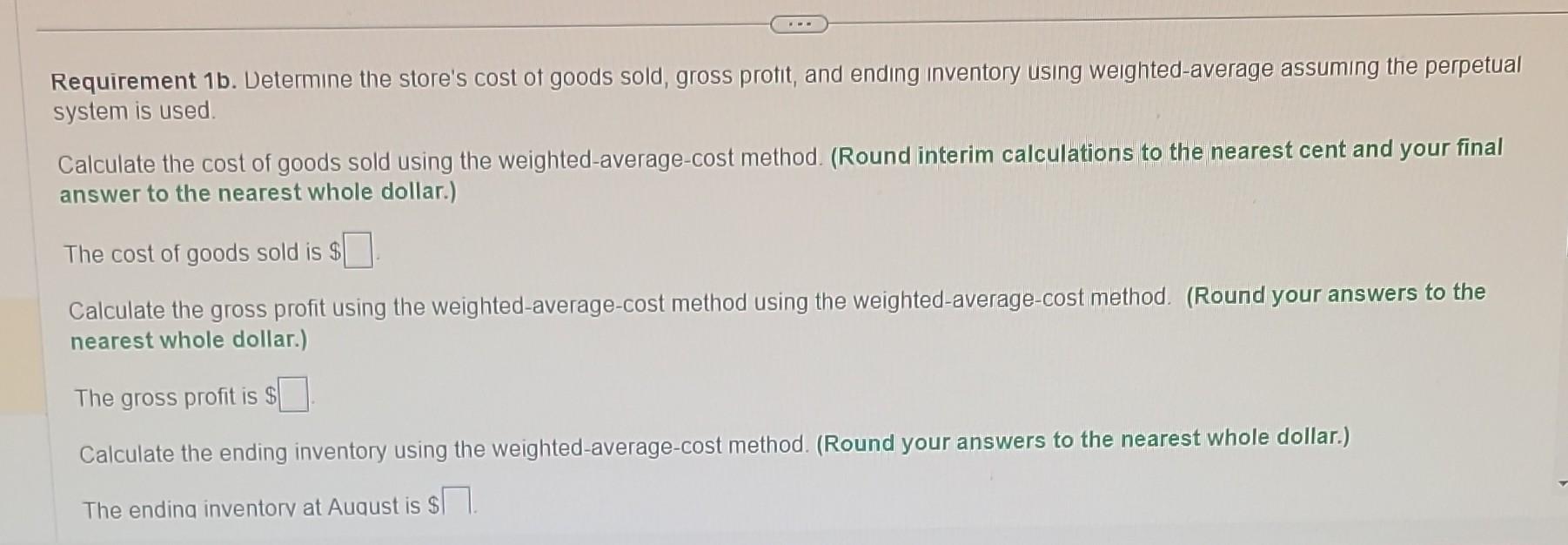

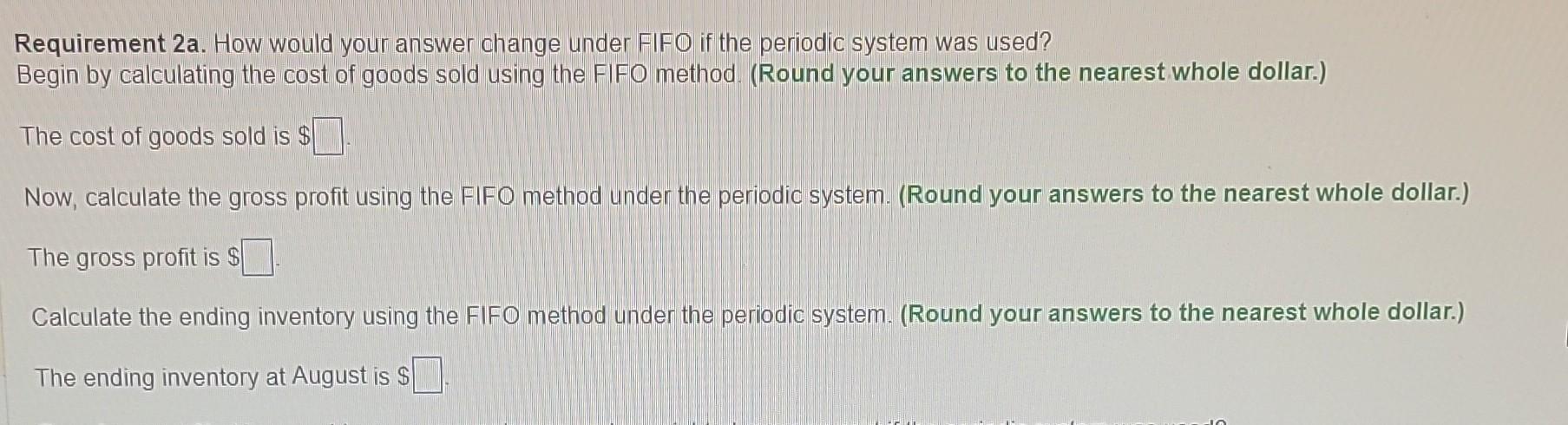

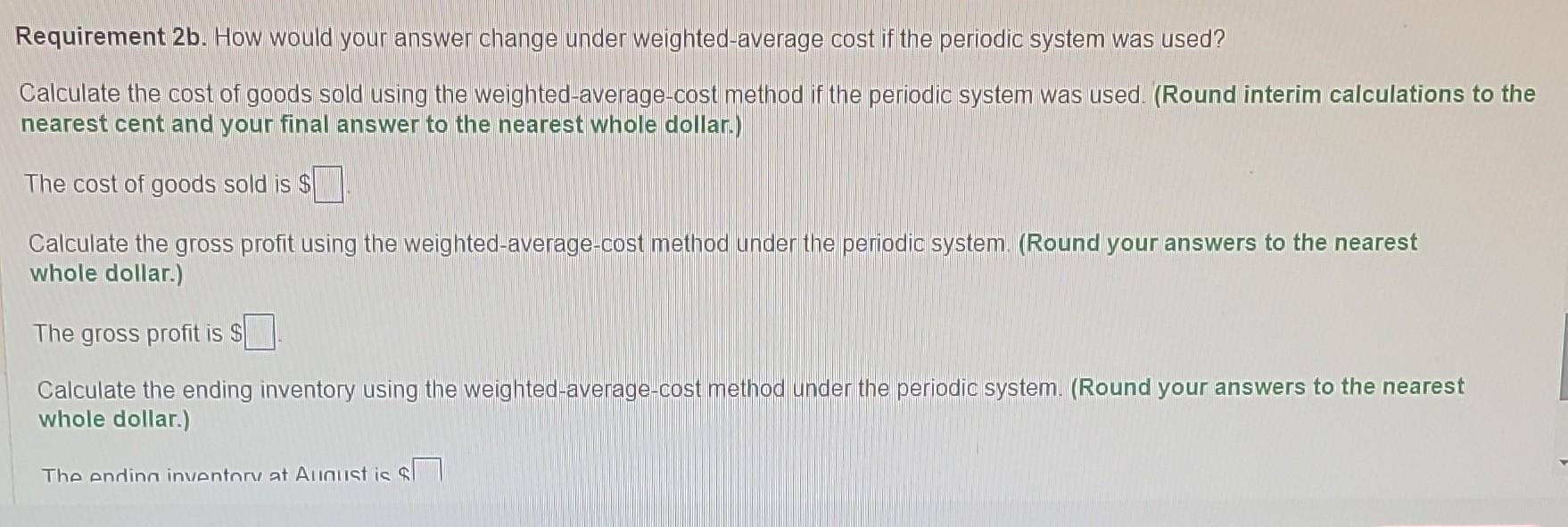

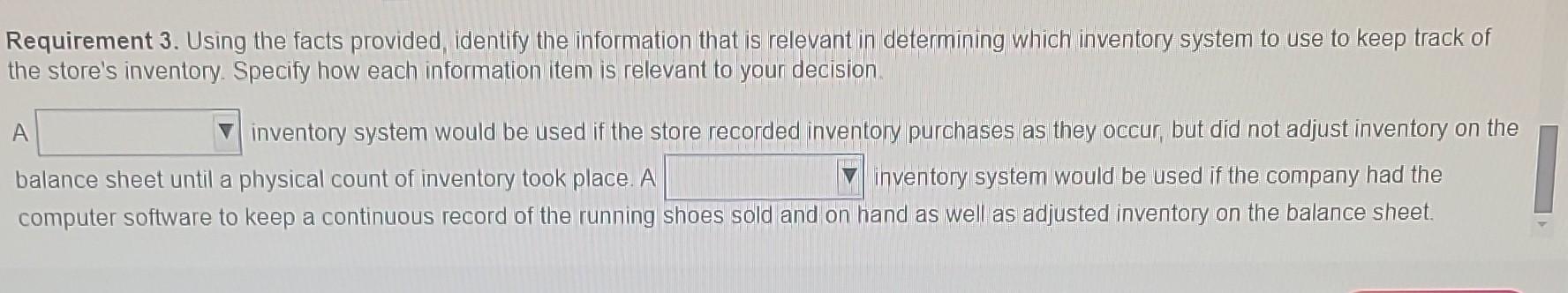

Assume an outlet of The Swoosh's Store began August 2020 with 40 pairs of running shoes that cost the store $32 each. The sale price of these shoes was 963 . During August, the store completed these inventory transactions: (Click the icon to view the inventory transactions.) Required 1. Determine the store's cost of goods sold, gross profit, and ending inventory using (a) FIFO and (b) weighted-average assuming the perpetual system is used. 2. How would your answer change under (a) FIFO and (b) weighted-average cost if the periodic system was used? 3. Using the facts provided, identify the information that is relevant in determining which inventory system to use to keep track of the store's inventory. Specify how each information item is relevant to your decision. \begin{tabular}{|c|c|c|c|c|} \hline Date & Transaction & Units & Unit Cost & Unit Sale Price \\ \hline Aug. 3 & Sale & 18 & & 63 \\ \hline Aug. 8 & Purchase & 76 & 33 & \\ \hline Aug. 11 & Sale & 22 & & 63 \\ \hline Aug. 19 & Sale & 12 & & 65 \\ \hline Aug. 24 & Sale & 29 & & 65 \\ \hline Aug. 30 & Purchase & 19 & 34 & \\ \hline \end{tabular} Requirement 1a. Determine the store's cost of goods sold, gross profit, and ending inventory using FIFO assuming the perpetual system is used. Begin by calculating the cost of goods sold using the FIFO method. (Round your answers to the nearest whole dollar.) The cost of goods sold is $ Now, calculate the gross profit using the FIFO method. (Round your answers to the nearest whole dollar.) The gross profit for FIFO is $ Calculate the ending inventory using the FIFO method. (Round your answers to the nearest whole dollar.) The ending inventory at August is $ Requirement 3. Using the facts provided, identify the information that is relevant in determining which inventory system to use to keep track of the store's inventory. Specify how each information item is relevant to your decision. A inventory system would be used if the store recorded inventory purchases as they occur, but did not adjust inventory on the balance sheet until a physical count of inventory took place. A inventory system would be used if the company had the computer software to keep a continuous record of the running shoes sold and on hand as well as adjusted inventory on the balance sheet. Requirement 2a. How would your answer change under FIFO if the periodic system was used? Begin by calculating the cost of goods sold using the FIFO method. (Round your answers to the nearest whole dollar.) The cost of goods sold is \$ Now, calculate the gross profit using the FIFO method under the periodic system. (Round your answers to the nearest whole dollar.) The gross profit is \$ Calculate the ending inventory using the FIFO method under the periodic system. (Round your answers to the nearest whole dollar.) The ending inventory at August is $ Requirement 2b.. How would your answer change under weighted-average cost if the periodic system was used? Calculate the cost of goods sold using the weighted-average-cost method if the periodic system was used. (Round interim calculations to the nearest cent and your final answer to the nearest whole dollar.) The cost of goods sold is $ Calculate the gross profit using the weighted-average-cost method under the periodic system. (Round your answers to the nearest whole dollar.) The gross profit is Calculate the ending inventory using the weighted-average-cost method under the periodic system. (Round your answers to the nearest whole dollar.) The endinn inventory at Alnst is $ Requirement 1b. Uetermine the store's cost of goods sold, gross protit, and ending inventory using weighted-average assuming the perpetual system is used. Calculate the cost of goods sold using the weighted-average-cost method. (Round interim calculations to the nearest cent and your final answer to the nearest whole dollar.) The cost of goods sold is $ Calculate the gross profit using the weighted-average-cost method using the weighted-average-cost method. (Round your answers to the nearest whole dollar.) The gross profit is Calculate the ending inventory using the weighted-average-cost method. (Round your answers to the nearest whole dollar.) The endina inventorv at Auqust is $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started